Futures

PEP Stock vs. NASDAQ Futures

Compare and contrast the volatility in the Nasdaq futures market, with the volatility inside of two large cap stocks (INTC and PEP).

Read MoreFutures vs. Stock Volatility Models (NQ vs. QQQ)

I’ll show you the differences between the Futures Volatility Box and Stock Volatility Box models and levels.

Read MoreNASDAQ’s Unique Volatility Edge

We’ll review all 4 index markets, and walk through the unique volatility edge that the NASDAQ provided for day trading.

Read MoreVolatility Day Trading – S&P 500, NASDAQ, DOW, and Russell 2K

A step-by-step process you can follow to understand and profit from volatility in the 4 major index markets.

Read MoreVolatility Breakdown: Gold vs. Silver

Let’s compare volatility in Gold (GC) and Silver (SI) to find any clues we can spot to use for day trading. The same techniques can be used on the micro-futures equivalent as well.

Read MoreS&P 500 – Fibonacci Levels Update

A quick update on the S&P 500 Fibonacci Levels that we have been tracking in this most recent sell-off, along with a game plan of what we need to see for our bias to reverse.

Read MoreHow Low Can the S&P 500 Fall?

We’ll use Fibonacci extensions in our current bear market to project downside levels, if the S&P 500 continues to keep falling.

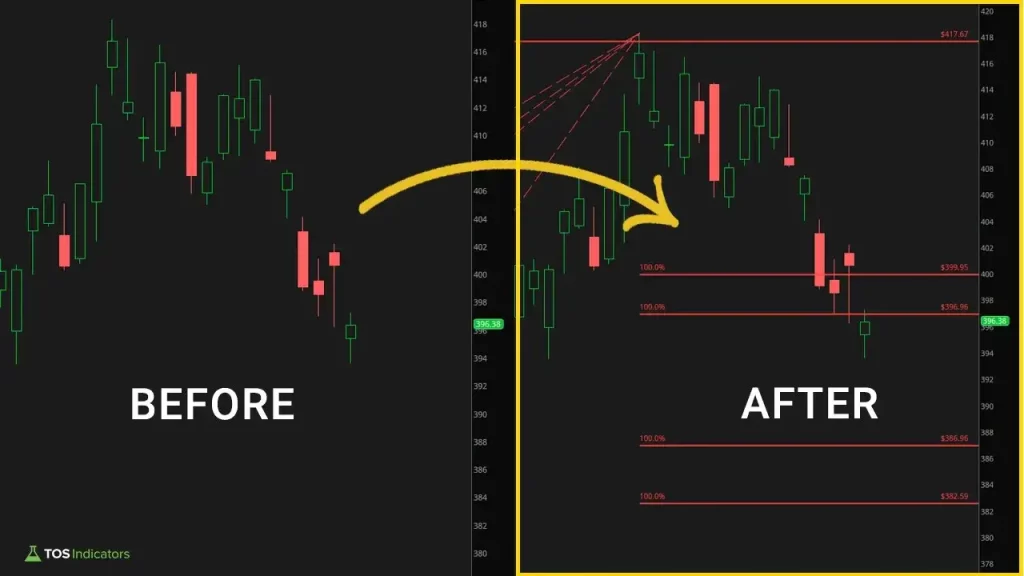

Read MoreS&P 500 Fibonacci Retracement Levels (Feb. 2023)

Start with a blank chart of the S&P 500, and learn how to mark it up from scratch using a Fibonacci Retracements and price channels.

Read MoreSPY Lotto Butterfly Idea

In today’s video, I’ll share a lotto trade idea in SPY, which is targeting a move to the Market Pulse line, and a bounce from the shorter term trend channel.

Read MoreMarket Volatility and Impact on Individual Index Markets

We’ll review the overall market’s volatility from this morning, when we had the S&P 500, DOW, Nasdaq, and Russell all break key volatility zones.

Read More