Fibonacci ThinkOrSwim

A complete guide on how to use the Fibonacci Retracement and Fibonacci Extensions tools in ThinkOrSwim.

Fibonacci Retracements

How to draw Fibonacci Retracements correctly, and set up the tool so it is easy to use

Fibonacci Extensions

How to pick the correct swings to use with the Fibonacci Extensions tool

Best Settings

Some hidden ThinkOrSwim settings that help you maximize trading with Fibonacci

Fibonacci Modules

Module 1: Fibonacci Sequence and Trading

Learn about the origins of the Fibonacci Sequence, and how it connects to the Fibonacci Ratios we use in trading.

Module 2: Fibonacci Retracements Tool

Learn how to use the Fibonacci Retracements Tool to create a useful roadmap with support and resistance zones, using just 2 inputs - a swing high and swing low.

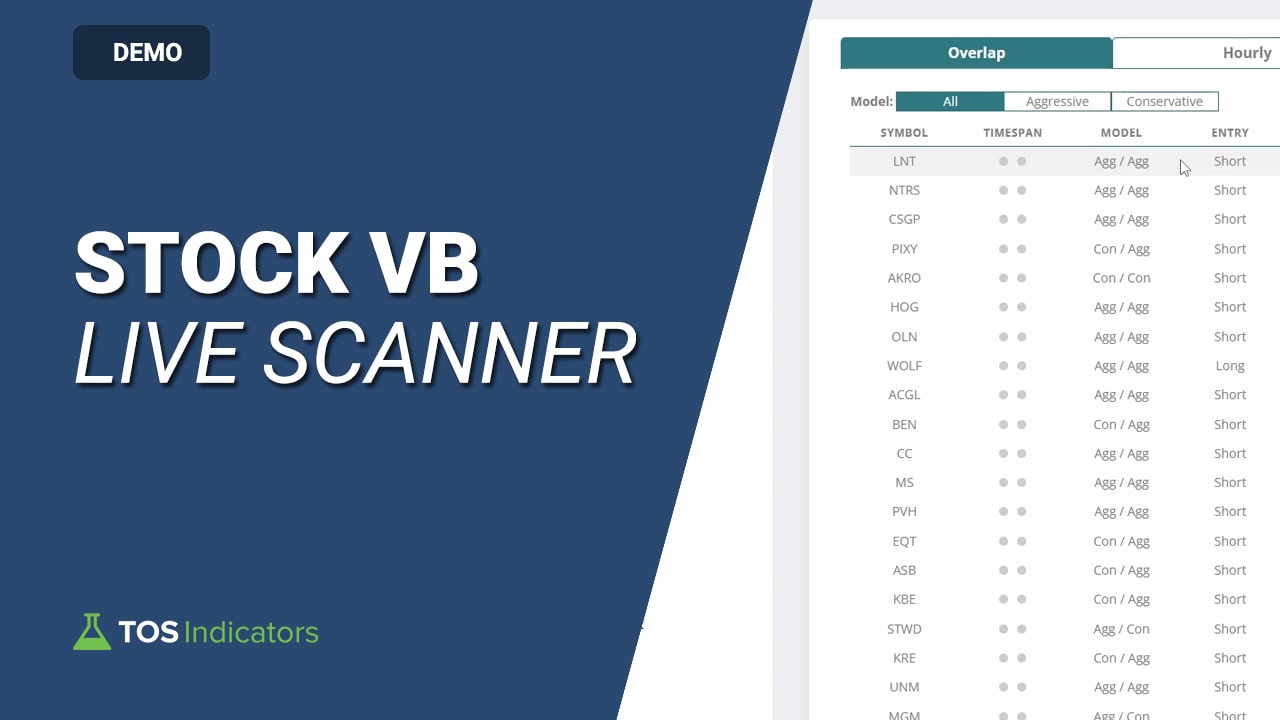

PAIRS WELL WITH FIBONACCI

Combine Fibonacci x Volatility

Join the Stock Volatility Box membership for instant access to our Live Scanner, which pairs with day trading Fibonacci ThinkOrSwim levels.

Pro Tip: Look for overlaps with stocks tagging key Fibonacci levels, while also breaching Volatility Box models.

Frequently Asked Questions

Answers to commonly asked questions about Fibonacci Trading

Fibonacci Retracements and Extensions are tools used in technical analysis to predict potential support and resistance levels in trading. The Fibonacci Retracements are useful in providing a roadmap for price action, while the Fibonacci Extensions tool is useful in comparing previous swings. Both tools are based on key numbers identified by mathematician Leonardo Fibonacci.

To add Fibonacci tools in ThinkOrSwim, go to the Drawings menu in ThinkOrSwim, select Drawing Tools, and choose either Fibonacci Retracements or Fibonacci Extensions. I'll show you how to do this step-by-step in Modules 2 and 3 of our Fibonacci Trading course.

Yes, Fibonacci tools can be used for both day trading and swing trading to identify potential entry and exit points based on price retracements and extensions. Module 1 covers how Fibonacci levels can enhance your trading strategy.

Common Fibonacci retracement levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Extension levels often include 127.2%, 161.8%, and 200%. I'll show you how to set up these ratios in your Fibonacci Retracements tool in Module 2.

Not at the moment - we do not have an auto-fib indicator available for free download.

Select significant recent swing highs and lows that represent clear price movements. These points help ensure the Fibonacci levels are meaningful and relevant to the current market trend. Module 1 will help you understand how to identify these swings.

Fibonacci clusters combine multiple Fibonacci retracement and extension levels to identify stronger potential support and resistance zones, enhancing the reliability of trading signals. You'll learn how to build these clusters in Module 4.

Yes, Fibonacci tools can be effective on all timeframes, from intraday charts to weekly charts, depending on your trading strategy and objectives. Module 2 will show you examples across different timeframes.

Customize the colors and line weights for clarity, and include key retracement levels such as 0.236, 0.382, 0.50, 0.618, and 0.786, along with extension levels like 1.272, 1.618, and 2.0. Module 2 includes a section on the best settings to use.

Yes, combining Fibonacci levels with other technical indicators, like the Volatility Box, Edge Signals indicator, or even simple moving averages, can provide more robust trading signals and improve decision-making. Module 3 demonstrates how to integrate these tools for a comprehensive trading strategy, and you can find more examples of Fibonacci Trading videos in our Trade Reports.

Why Take Our Fibonacci ThinkOrswim Course

WOW!! The clearest explanation of the Fibonacci Retracements tool in ThinkOrSwim. Too bad they don't have you make their tutorials!

Walter E.

Fibonacci ThinkOrSwim Course

I caught a nice bounce using the fib extensions levels from last week's video. Waited for an entry to the support zone near the Market Pulse, took the trade off at the 1.618.

Paloma G.

Fibonacci ThinkOrSwim Course

I miss having Fib Queen and her regular updates, but your Fibonacci videos have been helpful in learning how to draw my own fib levels.

Joanne K.

Fibonacci ThinkOrSwim Course