Watch Trade Reports

300+ videos containing swing trade and day trade insights

cATEGORIES

Is Apple Stock a Buy Right Now?

Pay attention to these three MAJOR Fibonacci levels in Apple stock (AAPL), for high probability trades.

Three Key Levels to Trade in NVDA for 2025

Pay attention to these 3 MAJOR Fibonacci levels in Nvidia stock (NVDA).

Pay Attention to These Levels in NVDA Stock

These are 3 key levels in NVDA stock that you NEED to monitor.

Instantly Reduce Risk and Increase Reward

A quick way to DRAMATICALLY skew the Risk/Reward ratio in your favor.

Nvidia Earnings Patterns After a “Beat”

Here are two trading strategies that you can use to trade Nvidia (NVDA) stock after an Nvidia earnings beat.

The Power of Multi-Time Frame Trends

Here’s why it is important to pay attention to trends on multiple timeframes, instead of just one. Two examples provided.

Microsoft Pre-Earnings Options Strategy

Microsoft has a predictable pre-earnings pattern, and here is one options trade idea to take advantage of it.

Is This a Sign to Buy Copper Stocks?

Is this new trend your sign to buy copper stocks? Let’s backtest the setup, and see which copper stock is worth trading.

Take Advantage of This V-Shaped Reversal Pattern

This simple V-Shaped Reversal pattern can help you capture some of the best reversals for day trading.

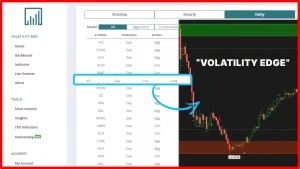

Volatility Setups in SPY Sectors

I’ll show you how to find high-probability volatility setups in S&P 500 sectors, including XLF and XLE. The setup revolves around trading only when you have a volatility edge.

Volatility You Can Trade

Today was a good volatility trading day. I’ll show you examples of setups in both futures and stock markets, to show you the exact signs of a good volatility day, and how to take advantage of it.

S&P 500, Nasdaq and DOW – Major Levels (September 2024)

These are the major levels to pay attention to in the S&P 500, Nasdaq, and DOW Jones as the markets flirt with a new all time high.

NKE Stock – Nike’s Unusual Volatility

NKE stock is giving us a volatility trade entry that it normally does not. Take advantage of this trading setup in NKE stock with options.

Intraday NASDAQ Bounces

Here’s an example of how to take advantage of volatility inside of the major index markets — S&P 500, Nasdaq and DOW.

MPC Stock – This Energy Stock is Turning Bullish

This top holding in the energy sector is triggering a buy the dip setup. We’ll look at XLE along with this top holding for a complete trade picture.