Stock Trade Reports

Stock and options trade ideas, recaps, and insights

cATEGORIES

Take Advantage of This V-Shaped Reversal Pattern

This simple V-Shaped Reversal pattern can help you capture some of the best reversals for day trading.

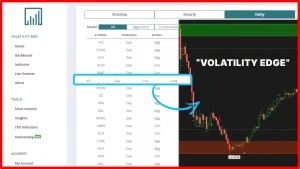

Volatility Setups in SPY Sectors

I’ll show you how to find high-probability volatility setups in S&P 500 sectors, including XLF and XLE. The setup revolves around trading only when you have a volatility edge.

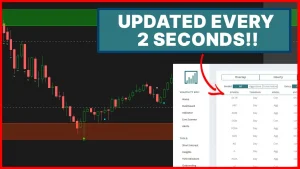

Volatility You Can Trade

Today was a good volatility trading day. I’ll show you examples of setups in both futures and stock markets, to show you the exact signs of a good volatility day, and how to take advantage of it.

S&P 500, Nasdaq and DOW – Major Levels (September 2024)

These are the major levels to pay attention to in the S&P 500, Nasdaq, and DOW Jones as the markets flirt with a new all time high.

NKE Stock – Nike’s Unusual Volatility

NKE stock is giving us a volatility trade entry that it normally does not. Take advantage of this trading setup in NKE stock with options.

MPC Stock – This Energy Stock is Turning Bullish

This top holding in the energy sector is triggering a buy the dip setup. We’ll look at XLE along with this top holding for a complete trade picture.

S&P 500 and Nasdaq – Fibonacci Levels (August 2024)

The S&P 500 stock is giving you a RARE opportunity to buy the dip, after a steep sell-off. Profit from this volatility with the exact Fibonacci extensions levels.

Is Costco Stock (COST) STILL A Buy After Falling 12%?

This S&P 100 stock is giving you a RARE opportunity to buy the dip, after a nearly 12% sell-off. Profit from this volatility with the exact Fibonacci extensions levels.

S&P 500 and Nasdaq – Fibonacci Levels (July 2024)

Here’s a detailed overview of all of the key levels to look for in SPY, QQQ, VGT, and VOO.

Curevac: Why This Stock Can Earn You a 40% Return

Curevac has weekly bullish momentum signals, after building a nice base. Learn how to use covered calls to trade this idea.

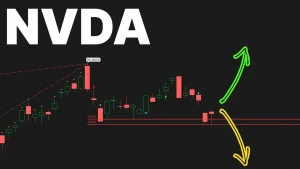

Time to Buy the Dip in NVDA?

Take advantage of the intraday volatility for this buy the dip setup in NVDA.

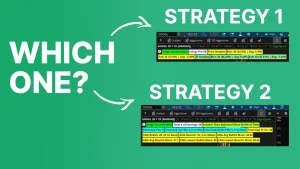

GOOGL Earnings Patterns

Here are two patterns that you can use to trade GOOGL stock into earnings, like a professional.

Why Lamb Weston Stock is a Swing Trade to Watch Right Now

Lamb Weston is triggering a buy the dip setup, and in this video I’ll share the exact zones to pay attention to.

Archer Aviation – The Company That Wants to Make Flying Cars

Archer Aviation is a stock that stands out for 3 key reasons. I’ll share those reasons in this video, along with an entry zone.

5 Reasons Why I Like This High Dividend REIT

This high dividend REIT has a 21% dividend yield, and looks attractive at its current valuation. Here are 5 key reasons why I started a position.