V-Shaped Reversal

A complete breakdown of a high probability trade setup, designed to help you find the best V-Shaped Reversals.

Proven Strategy

Learn a reliable method to spot top intraday and swing trade setups with precise entry and exit guidelines

Powerful Tools

Use our Stock Volatility Box platform, trend indicators, and trade checklists to simplify your trading.

Professional Insights

Get practical advice through detailed video tutorials, real-world examples, and clear explanations to boost your trading skills.

V-Shaped Reversal Modules

Module 1: Introduction

In this module, you'll get an idea of what to expect from this course, along with where to download the workspace and indicators to follow along.

Module 2: Setup Overview

In this module, we'll break down the overall logic of the setup, and take a look at an example trade.

Module 3: Entry Criteria

In this module, I'll share my entry checklist and rules, that I use for every single trade.

Module 4: Stop Loss

In this module, I'll share the exact levels I like to place my stop loss, for day and swing trading.

Module 5: Target Zones

In this module, I'll share my favorite target zones for both first and second targets.

V-SHAPED REVERSAL WATCHLIST

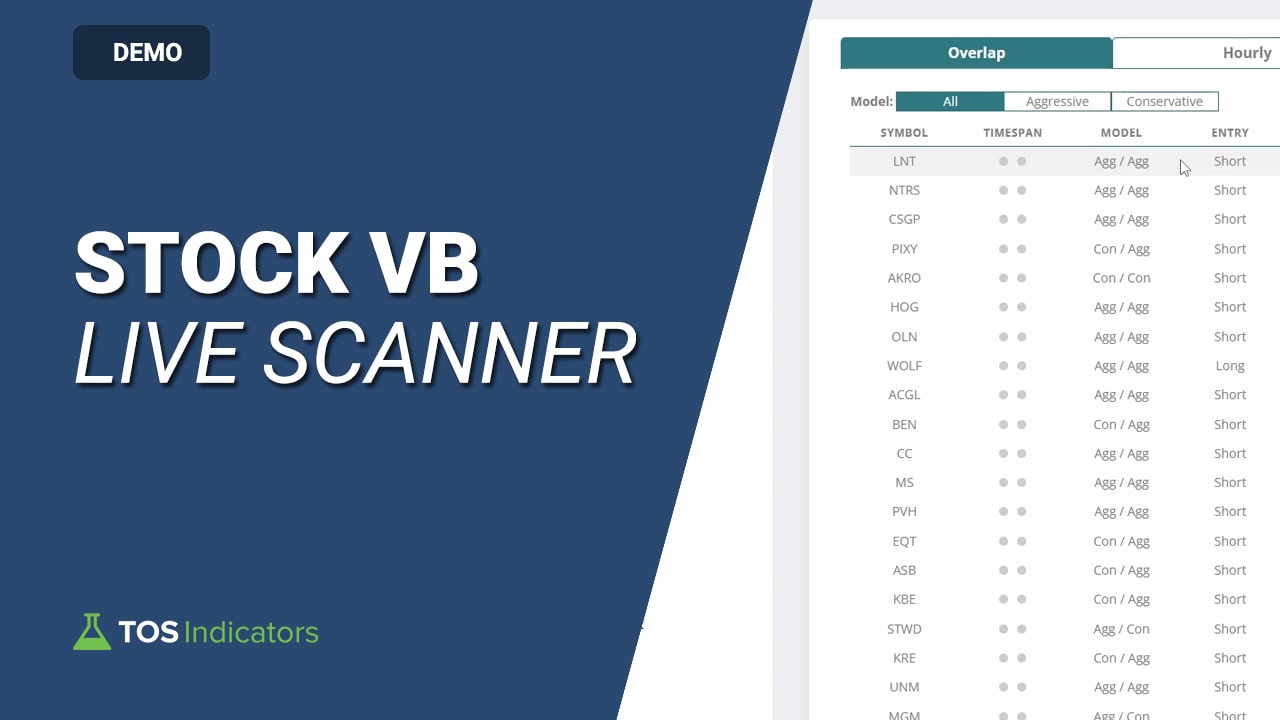

Combine the Live Scanner with the V-Shaped Reversal Setup

Join the Volatility Box membership for instant access to our Live Scanner, which updates every 2 seconds with new stocks and ETFs where you have a volatility edge.

Pair it with the V-Shaped Reversal strategy to identify key trade opportunities and automate your entries for effortless trading.

Frequently Asked Questions

Answers to Common Questions about V-Shaped Reversal Trading

The V-Shaped Reversal strategy focuses on identifying sharp intraday and swing trade reversals using multi-timeframe analysis and precise entry/exit rules. Learn how to spot these setups and execute them confidently.

The Live Scanner is available in the Stock Volatility Box platform. Join the Stock Volatility Box membership for access to the full platform, along with ALL of our members-only (PRO) indicators, scans, backtesters, and dashboards. You'll also have free access to the Squeeze Course with your Stock VB membership.

This course is best suited for intermediate traders with a basic understanding of trading concepts looking to enhance their skills with advanced strategies.

The strategy uses the Volatility Box, Keltner Channel Wedges, Trend Confirmation, and Edge Signals to identify high-probability trade setups. You can pick and choose the ones that work best for your trading style. The Volatility Box, Trend Confirmation, and Edge Signals indicators are included for free with a Volatility Box membership. The Keltner Channel Wedges are free for everyone to access.

Yes, the course includes guidance on using semi-automated trading scripts to streamline the trading process and reduce emotional bias.

The course provides detailed instructions on chart settings, including timeframes and specific indicators to use. For all Volatility Box members, you can also download our shared workspace to have the exact workspace that I use in the course.

The strategy primarily uses intraday time frame charts (ie. 1-minute, 2-minute, 3-minute, 5-minute, 15-minute, and 30-minute) for intraday setups, with higher timeframes for confirming trends.

The course includes the following downloads for all Volatility Box members:

- Trend Confirmation indicator

- My Exact Workspace

- Downloadable Trade Checklist PDF

- Downloadable Presentation Slides PDF

Absolutely, the course includes multiple real-world chart examples in Module 7 and detailed explanations to help you understand and apply the strategy effectively. You can also find recent examples of the V-Shaped Reversal setup being applied in our Trade Reports playlist.

Test this new setup, along with all automated scripts, in Paper Money first! This allows you to test and refine your skills and scripts without risking real money. The course provides step-by-step guidance on setting up the ThinkOrSwim automated trading scripts for triggers.

Why Others Like the V-Shaped Reversal Pattern

Got a lot of great insight and direction. The concepts are easy to understand, and the examples make it easier for me to see how they apply in practice.

Jason W.

V-Shaped Reversal Course

Caught the bounce in Wayfair when the cup was formed. Quick winner, in and out less than 10 minutes. This setup has been working great for me.

Sid R.

V-Shaped Reversal Course

My account has grown consistently, and I'm gaining the confidence to manage my own trades by identifying profitable setups on my own.

Ethan A.

V-Shaped Reversal Course