Squeeze Course

The ultimate TTM Squeeze toolkit to scan, backtest, and trade your own squeeze setups.

"A masterclass in thinkScript"

"Disneyland for squeeze traders"

"The backtester increased my confidence"

6 Indicators

Find hidden squeezes with the Triple Pro Squeeze, and analyze multiple time frames quickly

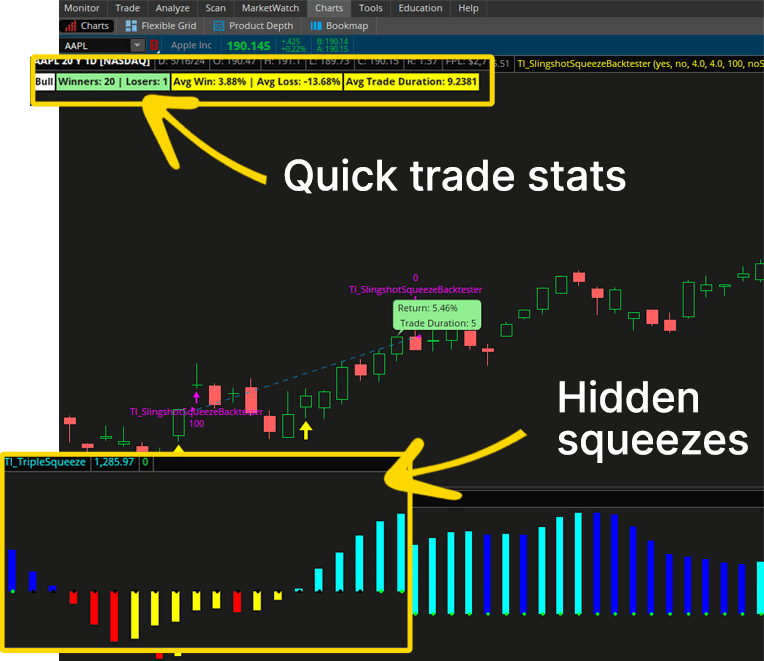

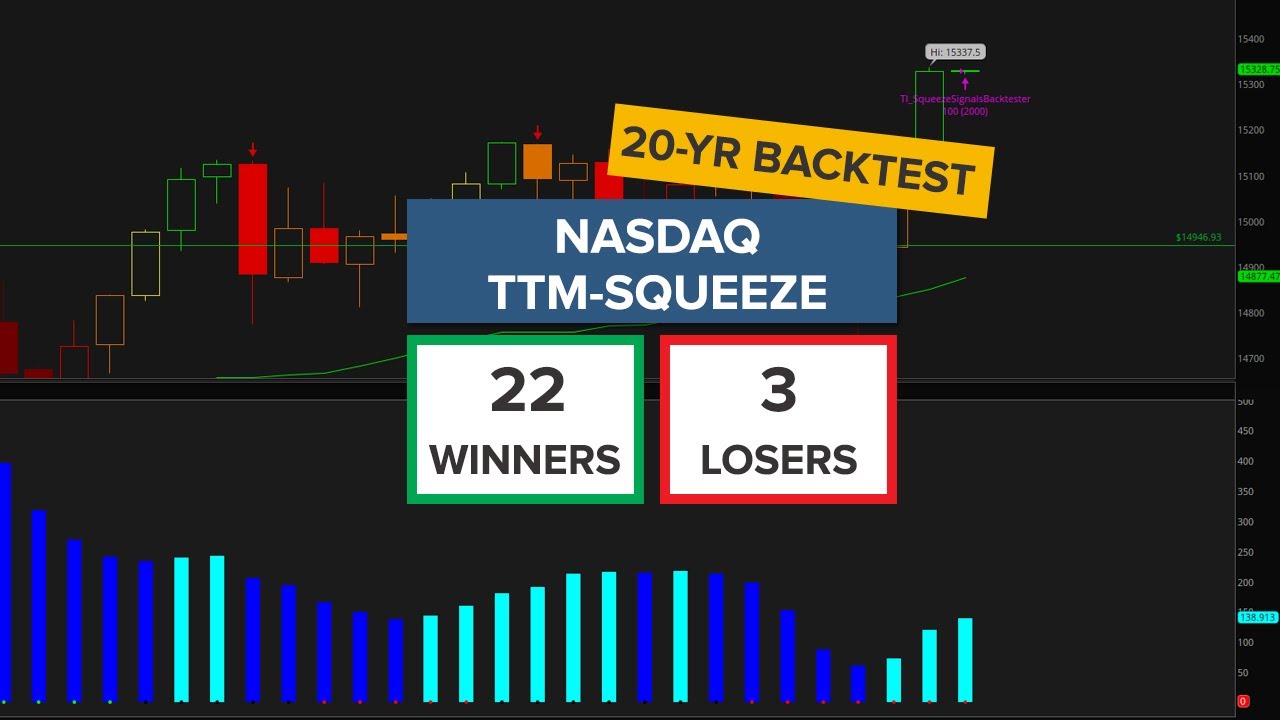

4 Backtesters

Backtest more than 20+ years worth of data, with the built-in win/loss stats in our backtesters

3 Scans (and Bonus!)

Find the best setups triggering with our custom TTM Squeeze scans for ThinkOrSwim.

Squeeze Course Modules

Module 1: TTM Squeeze Basics

Understand the TTM Squeeze, its calculation, and what's going on under the hood. Grasping these basics will lay the foundation for the rest of the course.

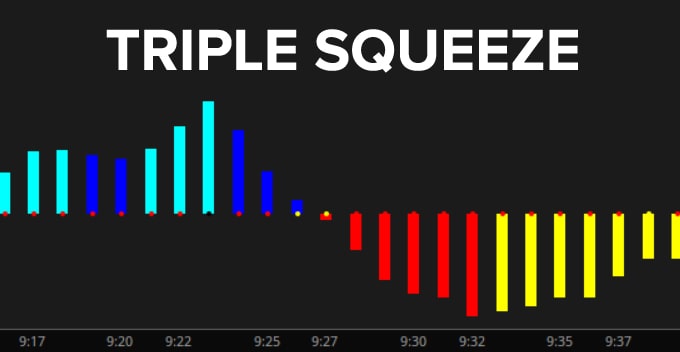

Module 2: Triple Pro Squeeze

Build your first squeeze indicator, the Triple Pro Squeeze. This indicator helps you find hidden squeezes, and adds on the black and yellow dot squeezes to the classic red dot squeeze.

Module 3: Triple Pro Squeeze Backtester

Build your first backtester to test different squeeze patterns and ideas. This tool enables you to test different squeeze patterns and refine our squeeze strategies to maximize P/L.

Module 4: Triple Pro Squeeze Scans

Create your first set of scans for the Triple Pro Squeeze using patterns from the backtester. You'll learn how to take an indicator and turn it into a scan in ThinkOrSwim.

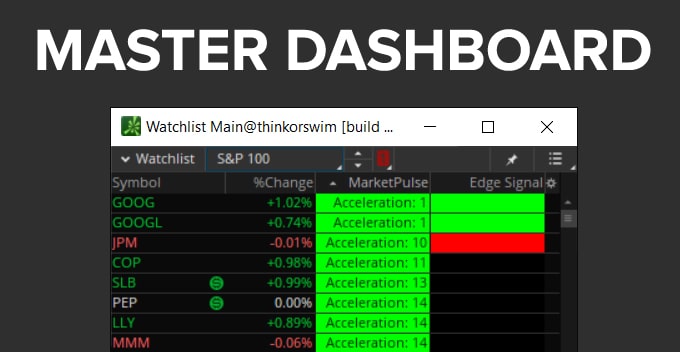

Module 5: Triple Pro Squeeze Dashboard

Build a visual dashboard to monitor trades using Edge Signals and Market Pulse indicators. This helps you stay organized and know where the best squeezes are setting up.

Module 6: Squeeze Signals Indicator

Build the Squeeze Signals indicator, which takes our secret sauce pattern and turns it into exact entry points in squeezes that are gaining momentum and likely to fire soon.

Module 7: Bringing It All Together

Recap the journey from understanding the squeeze to building powerful signals. Solidify your knowledge one last time, before moving on to advanced modules.

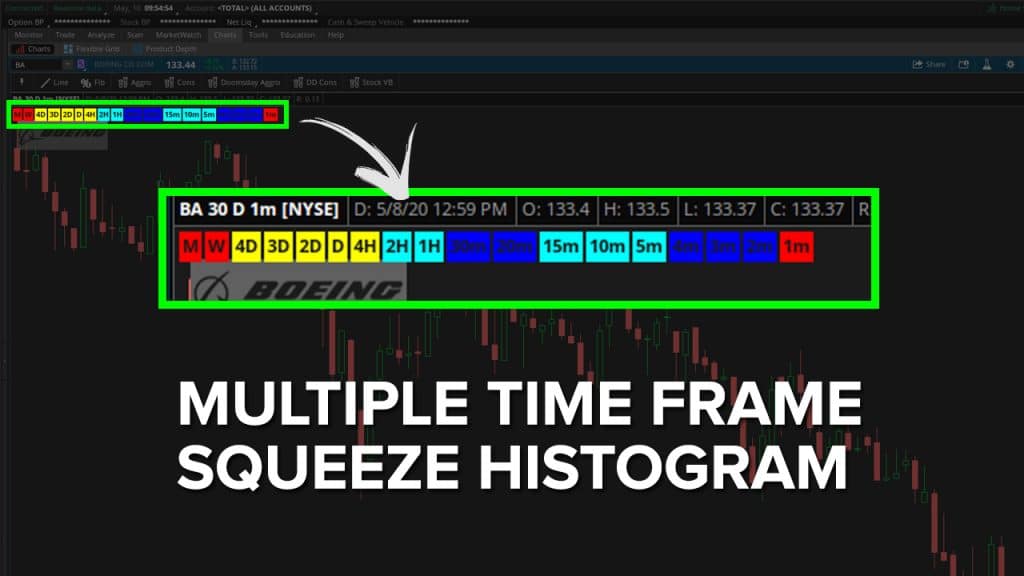

Module 8: MTF Squeeze Histogram

Build a MTF Squeeze Histogram indicator to monitor multiple time frame squeeze histograms. You'll be able to see what the squeeze histogram looks like on 17 different time frames, in one click.

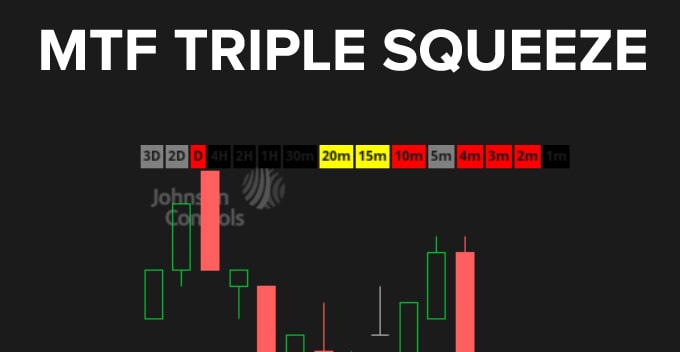

Module 9: MTF Triple Squeeze

Complete the set with a MTF Triple Squeeze indicator, to show you which of the 17 time frames have any of the 3 different squeezes forming. Combine this with the MTF Squeeze Histogram for a complete picture of trend, squeezes, and where there are opportunities.

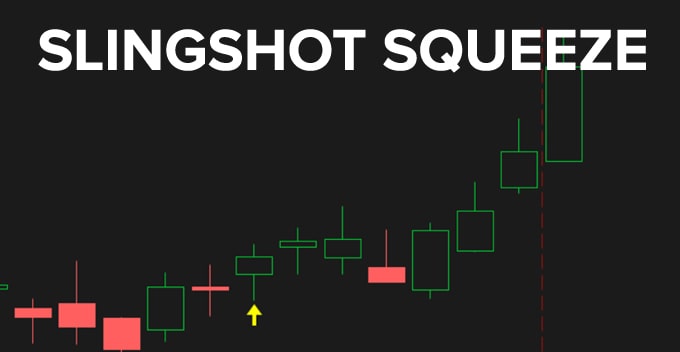

Module 10: Slingshot Squeeze

Build the Slingshot Squeeze indicator, which is a powerful tool to help you identify early squeeze entries. You'll be able to use the Slingshot Squeeze to better time your squeeze entries, and improve your risk/reward ratio.

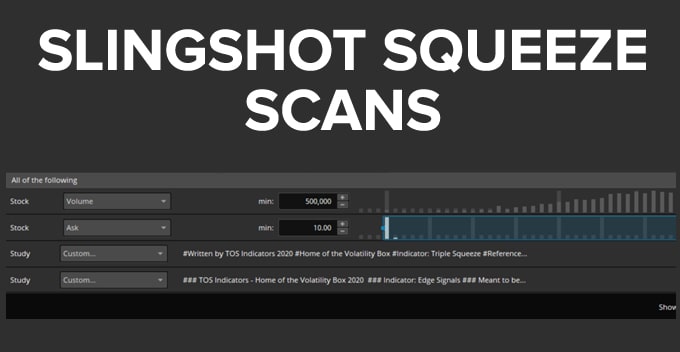

Module 11: Slingshot Squeeze Scans

Build scans to let ThinkOrSwim do the heavy lifting of finding Slingshot Squeezes setting up. You'll learn how to bypass some ThinkOrSwim limitations, and tap into the full potential of the scan tab.

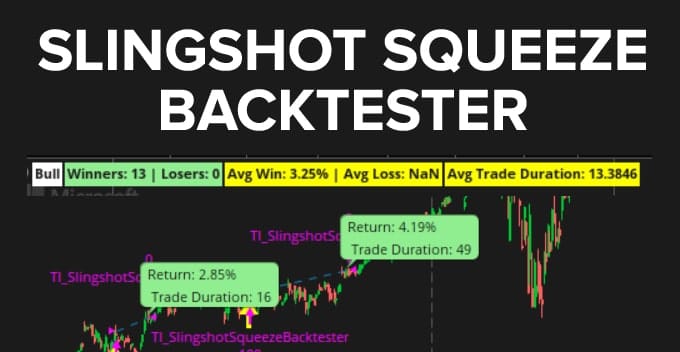

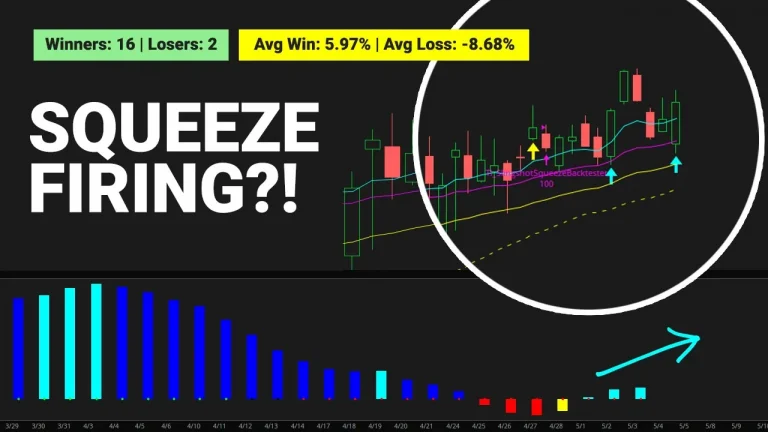

Module 12: Slingshot Squeeze Backtester

Build the first part of our Slingshot Squeeze backtester, which allows you to test how effective the strategy has been over the past 20 years. You can test different exits to maximize your P/L, and trade the best squeezes.

Module 13: Slingshot Squeeze Backtester Stats

Add trade statistics to the Slingshot Squeeze backtester, including win/loss breakdowns and trade durations. These insights help you understand the performance of the Slingshot Squeeze, and make smarter, data-driven decisions.

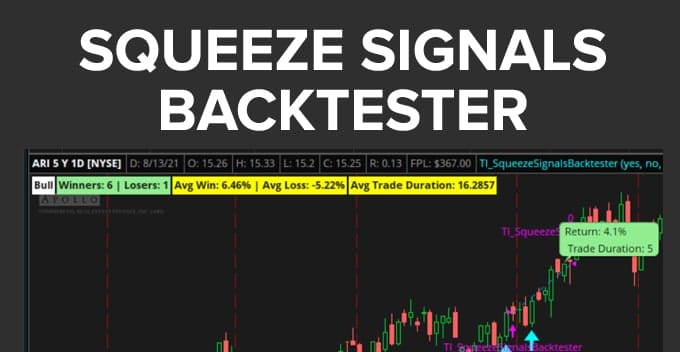

Module 14: Squeeze Signals Backtester

Build the Squeeze Signals backtester, to test how effective the momentum entry signals have been over the past 20 years. Combine the Squeeze Signals and Slingshot Squeeze backtesters to find and trade only the best squeeze setups.

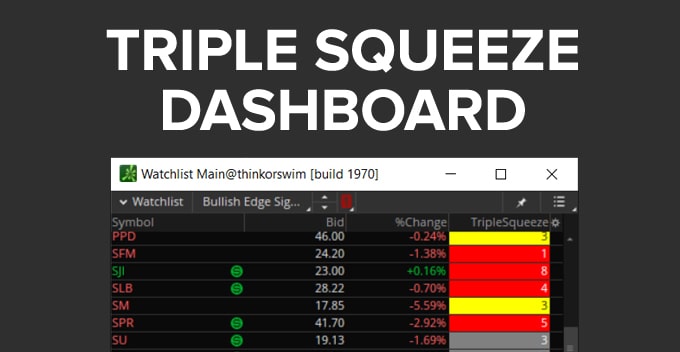

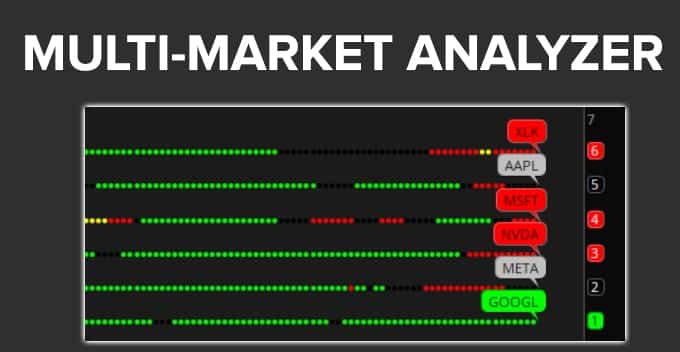

Module 15: Triple Squeeze Dashboard

Build a beautiful dashboard to monitor black, red, or yellow dot squeezes. This dashboard script lets you find hidden squeezes in your favorite markets, across multiple time frames.

Module 16: TTM Squeeze Histogram Pro Backtester

Create a backtester to evaluate the squeeze histogram's effectiveness in timing momentum shifts. Understanding these shifts can enhance your ability to predict market moves and time your squeeze trades better.

Module 17: Five Triple Pro Squeeze Dots in a Row Scan

Create a scan to find five consecutive Triple Pro Squeeze dots (red, black, yellow) across any time frame. The bullish and bearish scans let you quickly find squeezes that have been building up for some time, and have stacked moving averages.

INTRADAY TARGETS

Use the Volatility Box for Squeeze Target Levels

Join the Volatility Box for instant access to proprietary hourly and daily volatility models that let you know exact levels to take entries and targets in your squeeze trades.

Frequently Asked Questions

Commonly asked questions around the Squeeze Course tools

The Squeeze Course is included for free with a Volatility Box membership. It is currently not available for purchase separately.

The Squeeze Course includes 19 in-depth modules, with more than 4.5 hours of thinkScript tutorials. The Squeeze Course also includes access to download all 15 of the indicators, backtesters, scans, and dashboards that we will build.

The built-in TTM Squeeze indicator uses a single compression to find squeezes that are forming. The Triple Pro Squeeze indicator extends this capability to 3 different compressions, and allows you to find hidden squeezes for earlier entries.

The TTM Squeeze has simply the red dot squeeze and the green dot squeeze.

The Triple Pro Squeeze has the red dot squeeze, the black dot squeeze, the yellow dot squeeze, and the green dot squeeze.

A red dot squeeze implies that we are in a period of consolidation, waiting for a breakout. This is a normal squeeze.

A black dot squeeze implies that we are starting to enter consolidation. This is considered an aggressive squeeze, and often times gives early entries.

A yellow dot squeeze implies that we are in a long period of consolidation. This is the slowest of the three squeezes, and often takes time for the squeeze to fire, also leading in slow, but powerful moves.

A green dot squeeze implies that we don't have a squeeze setting up currently. This will occur when the Bollinger Bands are outside of the Keltner Channel Bands.

We will build these squeeze backtesters in the course:

- Slingshot Squeeze Backtester

- Squeeze Signals Backtester

- Squeeze Histogram Backtester

- Triple Squeeze Backtester

Yes!

Yes! The Squeeze Course is updated throughout the year with new content and tools. We are selective in the modules we release, and typically spend 3-4 months researching and testing new ideas in live market conditions.

The TTM Squeeze method relies on using the relationship between the Bollinger Bands and Keltner Channels to identify periods of consolidation, before a breakout occurs.

If the Bollinger Bands cross inside of the Keltner Channels, we are in a squeeze.

If the Bollinger Bands cross back outside of the Keltner Channels, the squeeze is firing.

Most of Module 1 is spent looking under the hood of the TTM Squeeze indicator, to help you gain a good fundamental understanding of how the squeeze works.

We will build these squeeze indicators in the course:

- Triple Pro Squeeze

- Slingshot Squeeze

- Squeeze Signals

- MTF Triple Squeeze

- MTF Squeeze Histogram

- Multi-Market Analyzer

We will build these squeeze scans in the course:

- Slingshot Squeeze Scans

- Squeeze Signals Scans

- Triple Squeeze Dots Scans

Become a Smarter TTM Squeeze Trader

I've been using the squeeze backtester for a few months now, and it has completely changed the way I find and trade squeezes.

Mark W.

This is by far the best tool I have used so far.

Alex M.

As a non-programmer, I appreciate how you started with the basics, without assuming coding knowledge.

Jonathan R.

I like using the Slingshot Squeeze scans and backtester to find squeeze setups on the daily and weekly time frame. Appreciate you sharing this tool with us!

Rohan A.

This is Excellent!! Just what I was looking for.. Thank You.

Bill B.

A gold mine of information for all squeeze traders. Worth the cost of the tools alone.

Ken N.

This is the best thinkScript course I've come across.

Max L.

Built a few of my own scans over the weekend using the course and caught a nice bounce in NVDA today.

Dan V.

See the Tools in Action

Real trade examples of squeeze setups using the tools built in this course

This TTM Squeeze Setup Has a 41-2 Win Rate Over 30 Years

Over the past 30 years, this squeeze setup has won 41 times, and lost only twice. This same setup is triggering again today! I’ll share the specific squeeze strategy in this video, along with the backtest stats.

This TTM Squeeze Setup Has a 88% Win Rate Over 20 Years

Over the past 20 years, this squeeze setup has won 16/18 times, and is triggering a third entry today. I’ll share the specific squeeze strategy in this video, along with the backtest stats.

UNH Squeeze – Is This Our Entry?

Let’s revisit the active UNH squeeze setup, and evaluate if today’s pullback is the type of entry that we’re looking to trade.

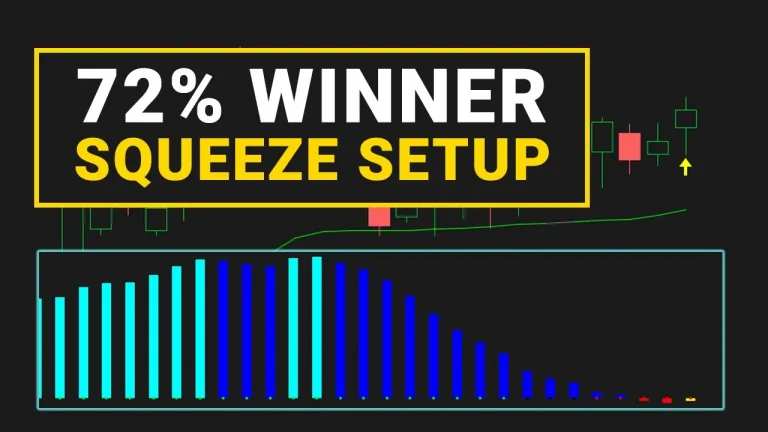

This Squeeze Has a 72% Win Rate Over 30 Years

This TTM Squeeze setup has more than 27 winners over the past 30 years, and November is the strongest performing month. BUT, there’s one big red flag.

This TTM Squeeze Has a 75% Win Rate Over 20 Years

Let’s take a look at a TTM Squeeze setup that has triggered today. It has a 75% win rate over the past 20 years, and there’s a better way to play this squeeze.

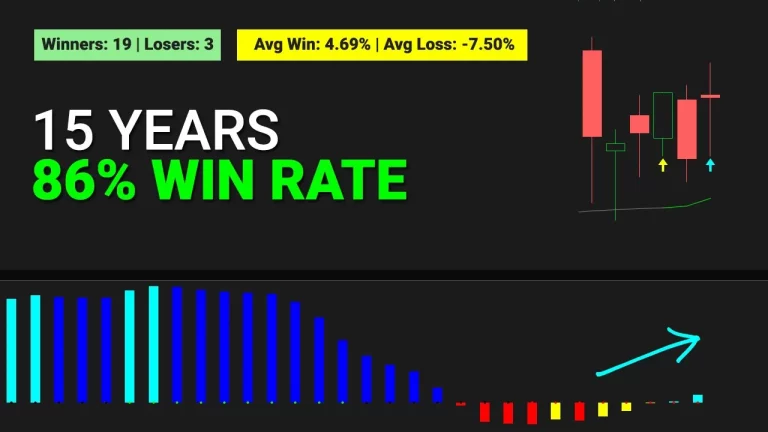

TTM Squeeze Setup With a 86% Win Rate Over 15 Years

I’ll share two TTM Squeeze setups that triggered recently and run 5 and 15 year backtests in each setup.

TTM Squeeze Setup That Hasn’t Lost in 5 Years

I’ll share a TTM Squeeze setup that is currently triggering, and has been a consistent winner every single time it has triggered over the past 5 years.

TTM Squeezes in SPY Sectors

I’ll share two sectors which have weekly TTM Squeezes setting up, with a momentum signal to the downside. Both have a Squeeze Signal that is plotting, along with bearish momentum.

One Stock With Multiple TTM Squeezes and Earnings Beat

One stock which has TTM Squeezes on multiple time frames, and just reported earnings with a nice beat. Let’s build a trade, with entries and targets.

Better Entries on 3 Squeezes

In this video, I’ll review all 4 squeezes from the previous video, 3 of which are currently giving us better entries (after already seeing a move in our anticipated direction).

2 Bullish and 2 Bearish TTM Squeeze Setups

In this video, I’ll share 2 bullish and 2 bearish TTM Squeeze setups, supported by backtests over a 5-year period.

TTM Squeeze Trade Setup in AMAT That Hasn’t Lost in 20 Years

In this video, I’ll discuss a daily and weekly timeframe setup in AMAT that has won all 6 of the times it has triggered in the past.

CrowdStrike (CRWD) – Pre Earnings Volatility and Multiple Squeezes

Let’s break down a trifecta of setups inside of CrowdStrike (CRWD), where we have pre-earnings volatility, multiple squeezes forming, and intraday reversal opportunities.

TTM Squeeze Trade Setup in AMZN That Hasn’t Lost in 20 Years

In this video, I’ll discuss a weekly timeframe setup in Amazon that has triggered 8 times in the last 20 years, and has been a winner all 8 of those times.

Leverage Intraday Volatility in MNST for Weekly Swing Trade (20-YR Backtest)

In this video, I’ll discuss a live setup in Monster Beverage (MNST), which has multiple WEEKLY signals, a bounce off of the DAILY 200-SMA, and a volatility reversal trade off of the 1-MIN time frame.

Stocks With Positive Backtest to Trade Next Leg Higher

In this video, I’ll discuss squeeze setups that are triggering across the board, focusing on using backtests and statistics for our analysis.

High Short Interest Stocks With TTM Squeeze and Stacked EMAs

In this video, I’ll walk through how to find a list of stocks with high short interest, that also have a TTM Squeeze that is forming, alongside stacked moving averages.

TTM Squeeze Across 13 Different Timeframes in DHI

There are 13 different timeframes that currently have squeezes setting up inside of DHI. Let’s take a look at the squeeze to craft a trade idea.

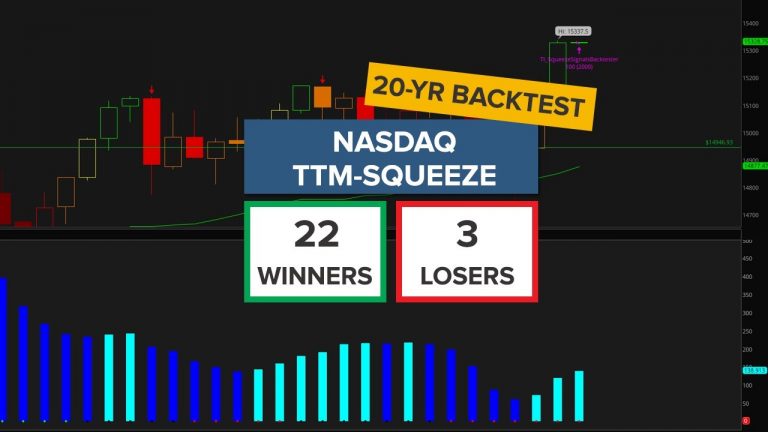

TTM Squeeze Trade Setup in Nasdaq (with 20 Year Backtest)

Over the past 20 years, we’ve had the Nasdaq trigger 25 times using our bullish Squeeze Signals indicator. The signal has been a winner 22 out of those 22 times.