How to Trade Earnings

Learn how to trade earnings with 3 simple strategies, and tools that make earnings season your best friend.

Pre-Earnings

Identify patterns leading into earnings for quick gains

Day of Earnings

Ready-to-go cheat sheet for earnings day volatility

Post-Earnings

Post-earnings price and volatility analysis in seconds

VOLATILITY BOX MODELS

Profit From Earnings Volatility

Join the Stock Volatility Box membership for instant access to the pre-earnings and post-earnings analysis indicators for ThinkOrSwim.

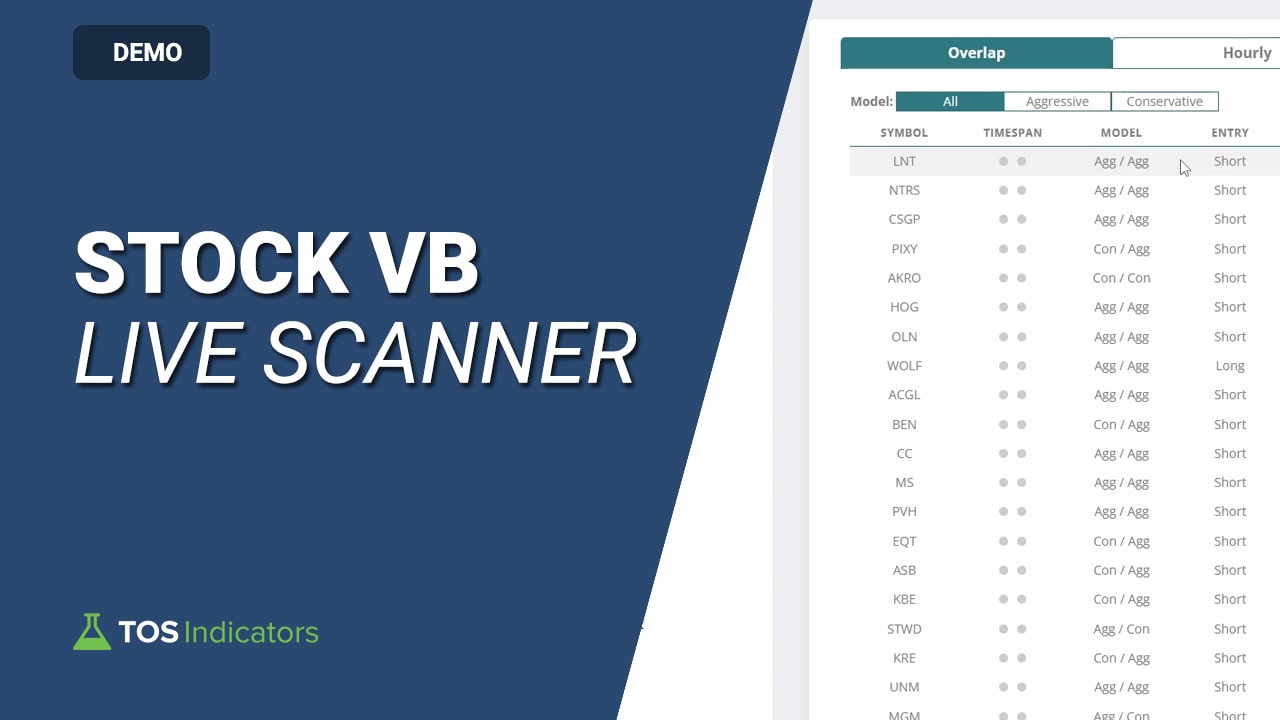

You can also use the Live Scanner inside of the Stock Volatility Box platform to find earnings volatility setups, that are breaching our Conservative VB volatility models.

Frequently Asked Questions

Commonly Asked Questions About Our Earnings Course

This course will teach you how to trade earnings using options strategies. You'll learn how to use three specific tools to trade Pre-Earnings, Post-Earnings, and the Day of Earnings successfully.

Yes, this course is designed for both beginners and experienced traders. I'm hoping you walk away with learning at least one new strategy or tool available to analyze how to trade earnings in ThinkOrSwim efficiently.

You will learn pre-earnings strategies, day-of-earnings strategies, and post-earnings strategies, including how to use specific option strategies to take advantage of theta decay, IV crush, and maximize profits.

The Smarter Earnings indicator is available for free to everyone. The Pre-Earnings and Post-Earnings Analysis indicators are included for free with a Volatility Box membership.

The How to Trade Earnings course is completely free. There are no upsells or hidden fees - you just need a free account to watch the modules.

The course is 1-hour long, broken down into three modules focusing on pre-earnings, day-of-earnings, and post-earnings strategies.

Yes - I'll walk through real examples of how to use the Pre-Earnings Analysis, Post-Earnings Analysis, and Smarter Earnings indicators to find high-probability earnings trades. We'll also take a look at the options chain to evaluate which strategy is worth deploying, based on the implied volatility and options pricing.

The course covers how to use implied volatility as a key factor in your trading strategies. For example, you'll learn how implied volatility tends to rise in stocks like Microsoft leading up to earnings, which can help you decide when to buy options to capitalize on this increase.

You will learn advanced options strategies such as iron condors, calendar spreads, and straddles, along with when to simply buy premium, specifically tailored for pre-earnings, day-of-earnings, and post-earnings trading.

The course teaches you how to interpret market reactions to earnings reports, including how to use gap fill and gap and go strategies to trade based on the direction and strength of post-earnings price movements.

High-Probability Strategies That Are Easy to Follow

Man this was good. Thanks so much!!!!

Brian F.

Earnings

Excellent. One of the best "how to plays earnings" videos on YT. Well-defined repeatable process. Thanks.

Jonathan L.

Earnings

Great free alternative to the CML trade machine to see this directly inside of ThinkOrSwim.

Brett P.

Earnings