Posts Tagged ‘copper’

Day Trading Futures Through FOMC Minutes Volatility

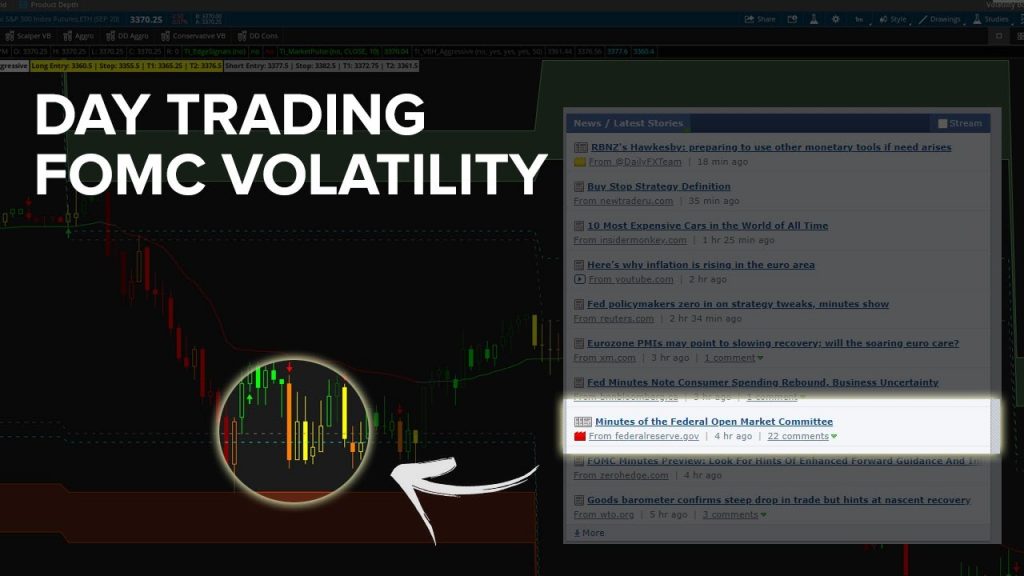

The release of the FOMC Minutes served as our catalyst for volatility in the futures market place today, leading to 7 futures day trades.

In today’s video, we’ll discuss all 7 of those trades, walking through all of the breaches and setups. Most of our trades today came in the 11-12p PT hour (when the FOMC minutes were released), which led to a burst of volatility in the marketplace.

Outside of the indices and 30-YR bond, we also had futures volatility trades that set up in markets like Crud

Read MoreTrading FOMC Volatility – Futures & Stock Setups

With the FOMC event today, we saw a burst of volatility in our futures markets leading to a series of breaches in /ES, /NQ, /GC and /HG.

The S&P 500, Nasdaq and Copper futures trades were all winners, while the Gold trade was a loser. In today’s video, we’ll do a recap of all 5 of the trade setups that we had today, for a net P/L of +$805.

Outside of that, we’ll also talk about some swing trade setups that are still active and valid. With Powell’s remarks, we can look to take advantage of ar

Read MoreDay Trading the Nasdaq Futures

We have a systematic process that we follow every single day, for day trading with the Volatility Box.

Using the note we sent out at 7:30 am PT to all of our members, we’ll cover the Nasdaq and Copper futures markets, where we had trade opportunities set up today.

Specifically on the Nasdaq futures (NQ), we had 3 different setups that met our Trade Plan rules, and triggered. All 3 of these were winners, for a net P/L of +$1,560.

On the Copper futures (HG), we had one trade setup which took

Read MoreExpecting a Trending Down Day in Nasdaq 30 Mins After the Open

We had an early heads up to expect a trending day in the Nasdaq (/NQ), Copper (/HG) and Crude Oil (/CL) futures markets.

The Nasdaq was the clear winner for the day, but all 3 markets made moves in their respective trending directions. We had our notification at 7am PT that we should expect a likely trending day in the NQ futures.

At that point, the Nasdaq was trading closer to 10,100. By the end of the day, the Nasdaq had traded down to 9,927.25. That’s a move of ~1.7%+, which had significa

Read MoreDay Trading the Russell and Copper Futures +$1,580

The Russell Futures (/RTY) has been more volatile than its index peers as of recently, which has also led to us finding some really nice Volatility Box fades.

We had a nice winner earlier in the week, and that same trend continued today. In the Russell futures, we had two trade setups that triggered, both of which were winners. One was via our new Scalper Volatility Box, while the other was via the Conservative Volatility Box.

The first day trade in the RTY futures was good for +5.6 points, w

Read More