Posts Tagged ‘day trades’

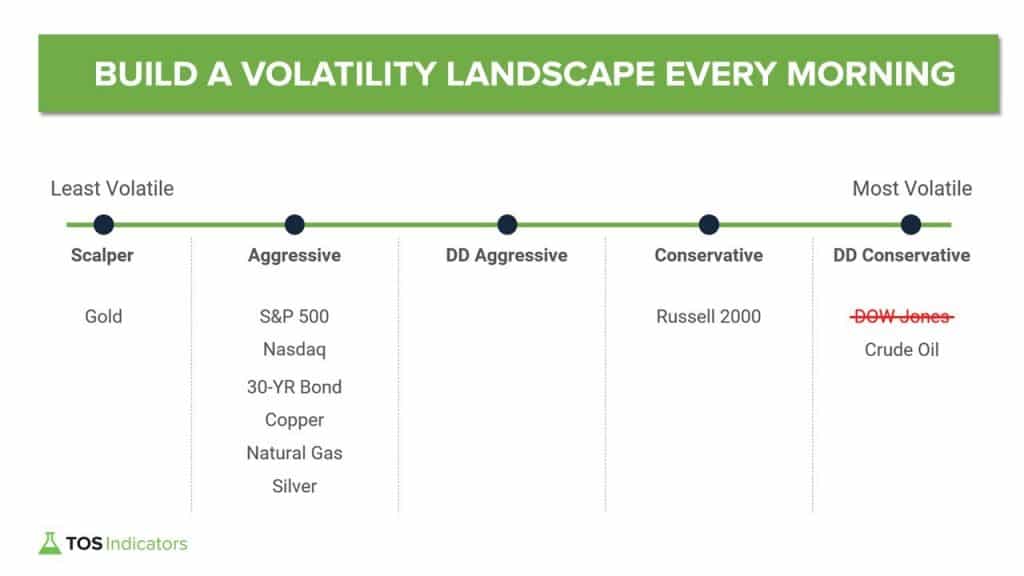

Volatility Landscape – Filter Markets to Focus on Trading

In today’s video, I’ll show you how you can build your own volatility landscape assessment every morning, to pick and choose the markets you’d like to trade.

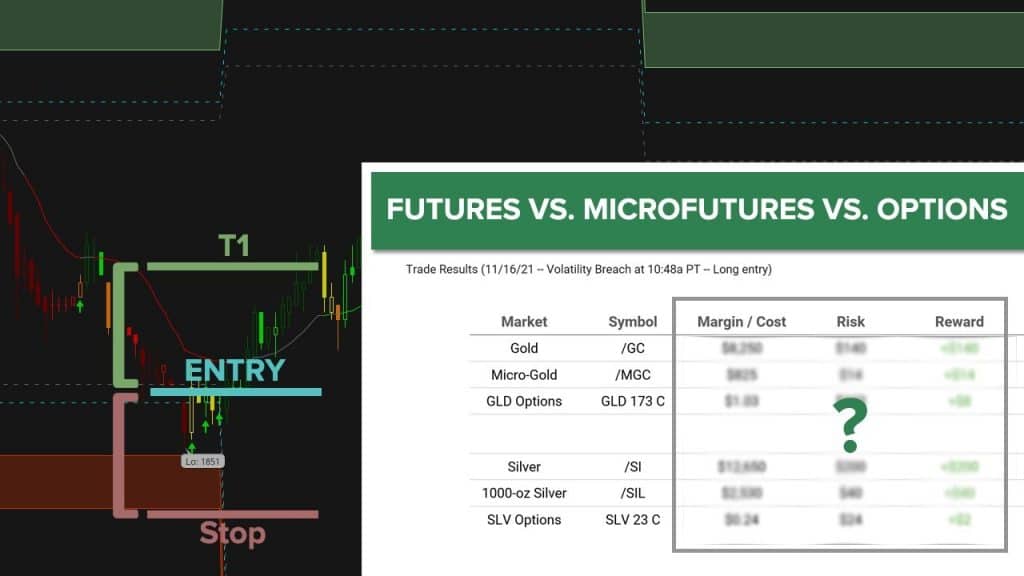

Read MoreFutures vs. Microfutures vs. ETF Options – Gold/Silver Trade Comparison

A side-by-side comparison between futures, microfutures, and ETFs for two key metals (Gold and Silver).

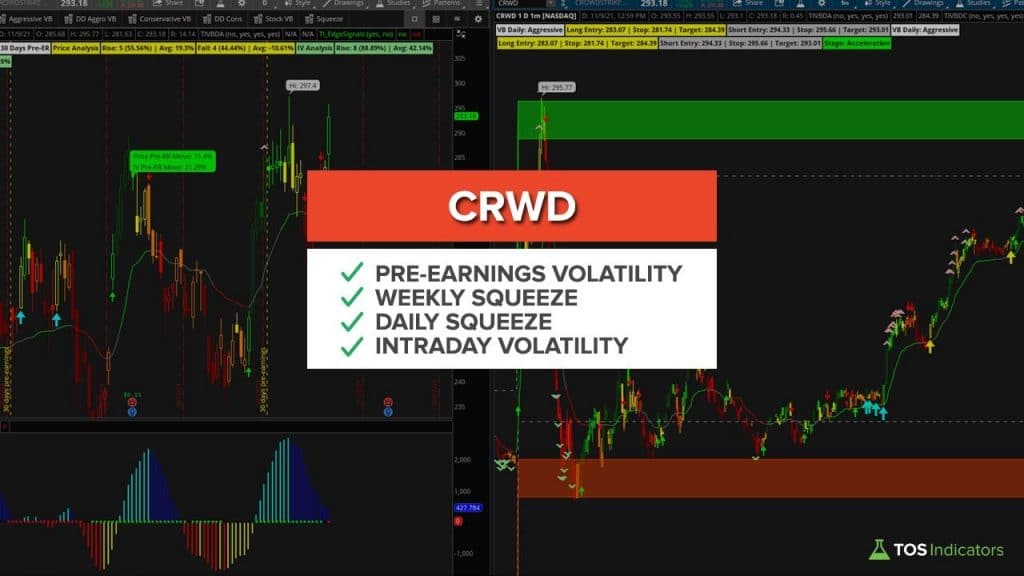

Read MoreCrowdStrike (CRWD) – Pre Earnings Volatility and Multiple Squeezes

Let’s break down a trifecta of setups inside of CrowdStrike (CRWD), where we have pre-earnings volatility, multiple squeezes forming, and intraday reversal opportunities.

Read MoreTTM Squeeze Trade Setup in AMZN That Hasn’t Lost in 20 Years

In this video, I’ll discuss a weekly timeframe setup in Amazon that has triggered 8 times in the last 20 years, and has been a winner all 8 of those times.

Read MoreAre the Markets Too Extended?

A step-by-step guide on how to determine if a market is extended, and likely to revert back to its mean.

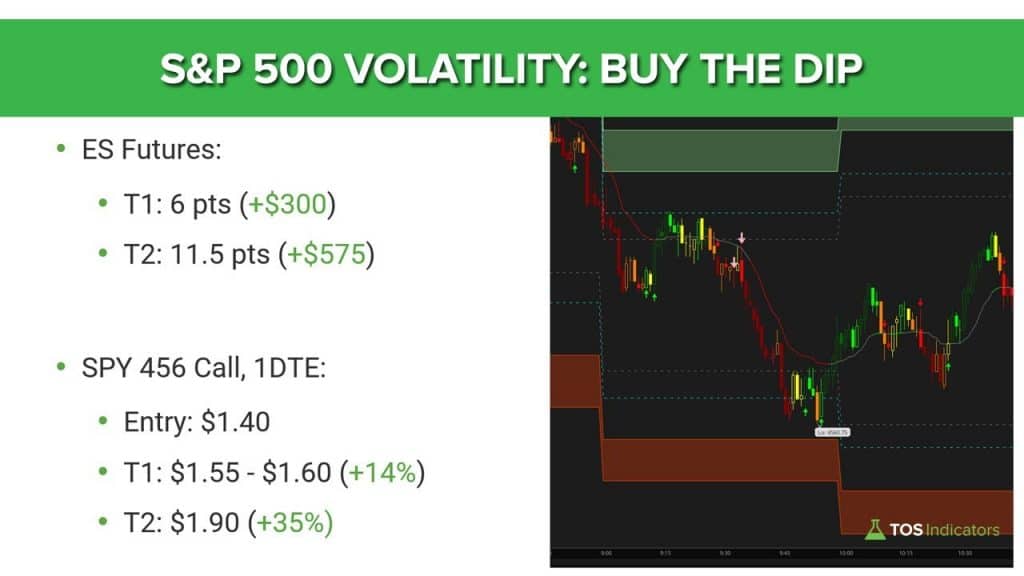

Read MoreS&P 500 Volatility – ES Futures vs. SPY Call Options

In today’s video, we’ll break down the S&P 500 in particular, focusing in on the “Buy the Dip” setup that triggered in between the 9-10am PT hour.

Read MoreCoinbase (COIN) Breakout Above Previous Resistance with High Volume

In today’s video, I’ll walk through a breakout that has triggered inside of Coinbase stock (COIN), along with break down a futures reversal trade setup inside of Gold futures (/GC).

Read MoreIs Volatility Finally Returning Back to Normal?

We’re starting to see 3 very clear signs that volatility may be starting to slowly decrease, after the September 2021 sell-off.

Read MoreWhy the Nasdaq was a Leading Volatility Indicator This Morning

I’ll walk through our 10-minute process that you can follow every morning, to find volatility clues and leading markets.

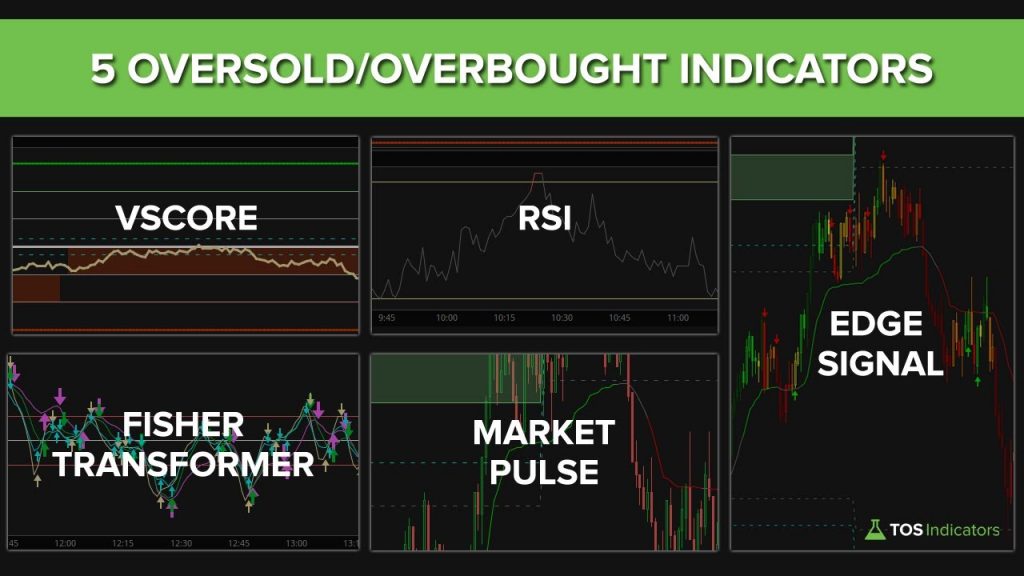

Read More5 Oversold Indicators for ThinkOrSwim

In this video, we will compare and measure 5 different overbought/oversold confirmation signals against each other, to find which is the most effective indicator.

Read More