Posts Tagged ‘DOW’

/ES and /YM Volatility – Live Commentary

Live commentary, walking through two different volatility trade setups in the /ES and /YM futures markets.

Read MoreVolatility Reversal Setup Walkthrough

This is a longer form, detailed walkthrough for Futures Volatility Box members, recapping all fade setups from May 10, 2021’s trading activity.

Read MoreChop vs. Trend Trades in ES, YM, NQ and RTY

Let’s look at visual examples of chop vs. trend trade setups, using the Volatility Box.

Read MoreS&P, DOW and Nasdaq After the First Week of Trading in 2021

With the first full week of trading completed in 2021, we’ll review where the major markets ended in relation to technical levels.

Specifically, we’ll focus in on 6 markets:

1. S&P 500

2. DOW

3. Nasdaq

4. Russell 2K

5. Gold

6. Bonds

In the 4 major indices, we’ve tagged major Fibonacci extensions. While the S&P and Russell has hit its 1.272% extension, the Nasdaq has tagged its 2.00% extension. The DOW, on the other hand, has yet to hit any major extension from the Feb-March 2020 swing.

For

Read MoreEnd of the Year Volatility – S&P, DOW, Nasdaq and Russell

In this video, we’ll take a look at the end of year volatility that we’re seeing in the S&P, DOW, Nasdaq and Russell.

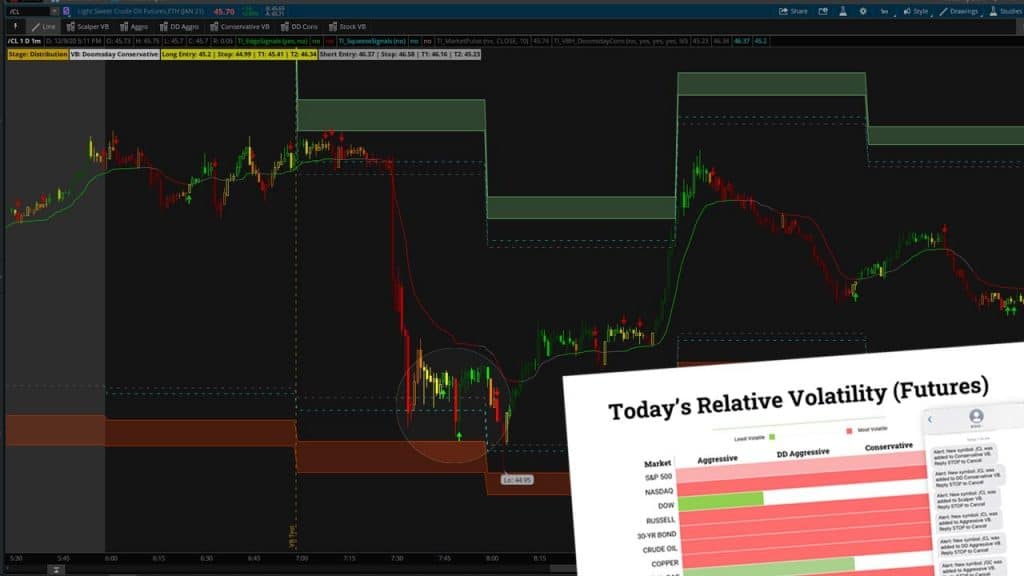

Read MoreComparing Volatility in 10 Futures Markets Post-Selloff

We’ll use the Volatility Box models as a structure, to easily rank the markets.

Read MoreDIA and JNJ Trade Triggers (and DDOG/TSLA recap)

We’ll do a review of the swing trades in DDOG and TSLA which have hit their first set of targets, along with set up a new trade in DIA.

A reminder as to the idea behind DDOG: https://youtu.be/ZStu8iHr46E

-We had a pullback on the weekly time frame chart to DDOG’s Market Pulse line.

-We also had a bullish Edge Signal (oversold) confirmation signal on the daily time frame chart.

ENTRY: $91.04 (Filled)

TARGET 1: $94.62 (Hit T1)

TARGET 2: $100 (Open)

TARGET 3: $115.30 (Open)

TARGET 4: $125-$1

TSLA, RTY and YM Trades

We’ll do a quick update to our TSLA Broken Wing Butterfly trade, along with discuss two futures trades in the Russell and DOW markets.

Starting off with the TSLA broken wing butterfly, we were looking for a pin near the $550 price point, and had built a 530/550/560 broken wing butterfly for $1.55. Today, that same butterfly is currently selling for ~$3.90.

To manage the trade, I’d be looking at a pullback here in TSLA, which would actually be healthy, and help erode some of the theta premium

Read MorePre-Election Volatility in Index Markets

With the election right around the corner, we’ve had a good amount of volatility enter our 4 major index markets.

In today’s video, we’ll break down the trade setups that we had in the S&P, Nasdaq, DOW and Russell futures markets. If you don’t trade the full size futures, you can also use the micro-futures equivalents, or even the ETF options.

With today’s chop, we had the S&P and DOW really chopping back and forth in between our Futures Volatility Box entry lines.

We triggered both long an

Read MoreHourly and Daily Volatility Levels – SPY, QQQ, DIA, IWM

As volatility traders, the 2020 election has led to an increase in not only volatility, but also trade opportunities in many of the major markets.

In today’s video, we’ll contrast our Hourly Volatility Box levels with the Daily Volatility Box levels in the 4 major indices. We’ll take a look at ES vs. SPY, NQ vs. QQQ, DIA vs. YM, and IWM vs. RTY.

We’ll also highlight the “Likely Trending Down” heads up that we received with the Cumulative TICK Pro indicator, and how to trade using market inte

Read More