Posts Tagged ‘msft’

MSFT, SPY, DIA, QQQ, IWM – Volatility Update

In today’s video, I’ll follow-up on the downside targets (some of which have been hit) in MSFT, SPY, DIA, QQQ, and IWM.

Read MoreMSFT and LRCX Squeeze Trade Update – First Targets Hit

In March, we set up 2 different squeeze trade ideas in Microsoft (MSFT) and Lam Research (LRCX). Both have now hit their first target, and in this video, we’ll review the setup and talk next steps.

Read MoreMicrosoft Squeeze Trade Fires Again – 12 Winners, 0 Losers (Past 5 Yrs)

The Slingshot Squeeze has triggered AGAIN in Microsoft, which has historically been a consistent winner. Let’s build a trade.

Read MoreMicrosoft Post-Earnings Trades

Microsoft reported an earnings beat after the close, which gives us opportunity to set up some new trades to play post-earnings moves.

Read MoreSell Off in the Markets – Trigger Zones to Monitor

We had a relatively sharp sell off in the markets today, with many markets breaking outside of even our most conservative volatility models in the 7-8am PT and the subsequent hour.

We had all of our major indices markets break outside of our Doomsday Conservative Volatility Box clouds (ES, YM, NQ, and RTY), along with markets such as the 30-YR Bond, Gold, and Silver (ZB, GC, and SI). While that led to a challenging day in day trading the futures, it’s important to also take a step back and asse

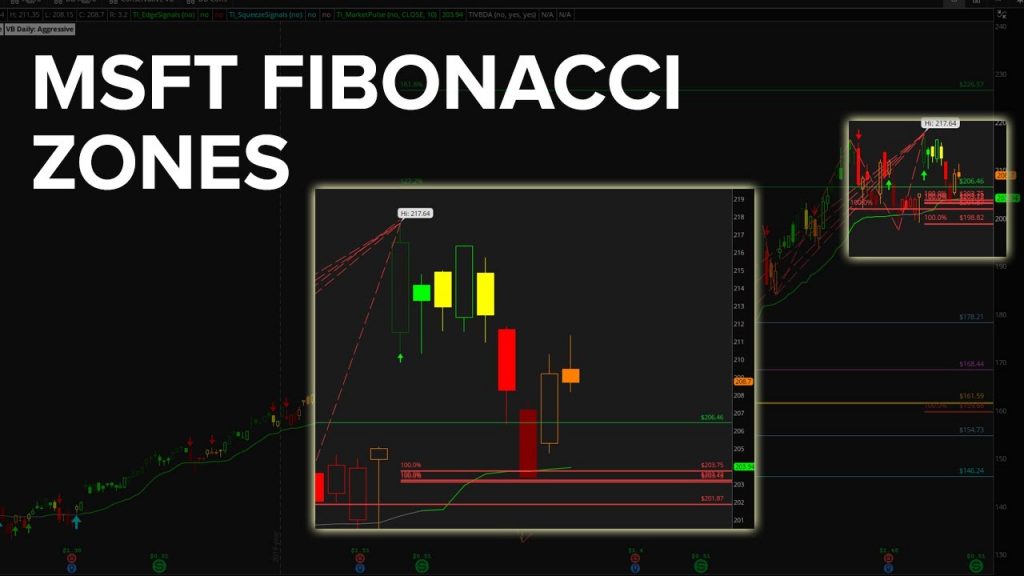

Read MoreMSFT Fibonacci Levels and Stock Volatility Trades

We’re going to talk about 3 different stock topics in this video:

1 – Microsoft (MSFT) fib zones update, with new levels for entry, along with potential target zones

2 – Bullish short squeeze trade opportunity in PAGS

3 – Review of 3 Stock Volatility Box trades in ADSK, DDOG and GMAB

With MSFT, we’ve seen a pullback into the Fibonacci levels on this entire recovery move up, and we’re looking for a similar continuation of trend to the 1.618% extension.

In PAGS, we have a squeeze that looks l

Read MorePreparing for MSFT and TSLA Post-Earnings Moves

With earnings season started, we’re going to use the free Smarter Earnings indicator to show you how you can plan and prepare for likely post-earnings moves.

Download Smarter Earnings indicator (free): https://www.tosindicators.com/indicators/smarter-earnings

Starting with the Futures Volatility Box, we had two trade setups today in Gold. The first setup was a stop-out, which cost us 4.5 points per contract, and had us switch from our Aggressive Volatility Box models to our Doomsday Aggres

Read More