Posts Tagged ‘natural gas’

CREE Stock – Covered Call Trade Idea (Daily and Weekly Swing Trade Setup)

In today’s video, I’ll break down a bullish setup in CREE stock, which has 5 different longer time frame squeezes, a bullish Market Pulse line, and a bounce from key moving averages.

Read MoreEnergy Stocks – When and Where to Buy the Dip for Day Trading

We will walk through an example of using the (free) VScore Upper study’s scans, to narrow down a list of 20 stocks to the top 3.

Read MoreTrading Futures in the Final Hour

The final hour of the markets today gave us multiple opportunities to buy the dip, and catch some quick reversals in the indices.

We had a breach in the S&P 500 (/ES), Nasdaq (/NQ), DOW (/YM) and the Russell 2000 (/RTY). All 4 of these breaches respected our Volatility Box models, and gave some incredible reversal opportunities.

In addition to the indices, we also had breaches in Natural Gas (/NG), which was successful, along with Gold (/GC). The only market in which we went outside of our vo

Read MoreCumulative TICK Indicator with Volatility Ranges

Over the weekend, we released our 21st episode of the “How to thinkScript” series, which includes both a free and pro version (which is available for Volatility Box members).

In today’s video, we’re going to use the Cumulative TICK Pro indicator, alongside our updated Volatility Box models to take a look at price action in the indices.

Across the board in the ES, YM, and NQ, we had breaches of our Volatility Box in the 10-11AM PT hour that hit our Volatility Box zones, almost to perfection.

Read MoreTrading Daily and Hourly Volatility Levels on Indices

After 3 days of breaking outside of our most conservative models, we saw price action start to stabilize just a bit.

In today’s video, we’ll layer on both our hourly and daily volatility ranges to look and trade the indices. We sent out the daily volatility ranges, part of the Stock Volatility Box platform, to all of our Futures VB members as well, which ended up triggering for some nice trades across the board.

Via our Futures VB levels, we had a total of 7 trades, with a net P/L of +$1,410,

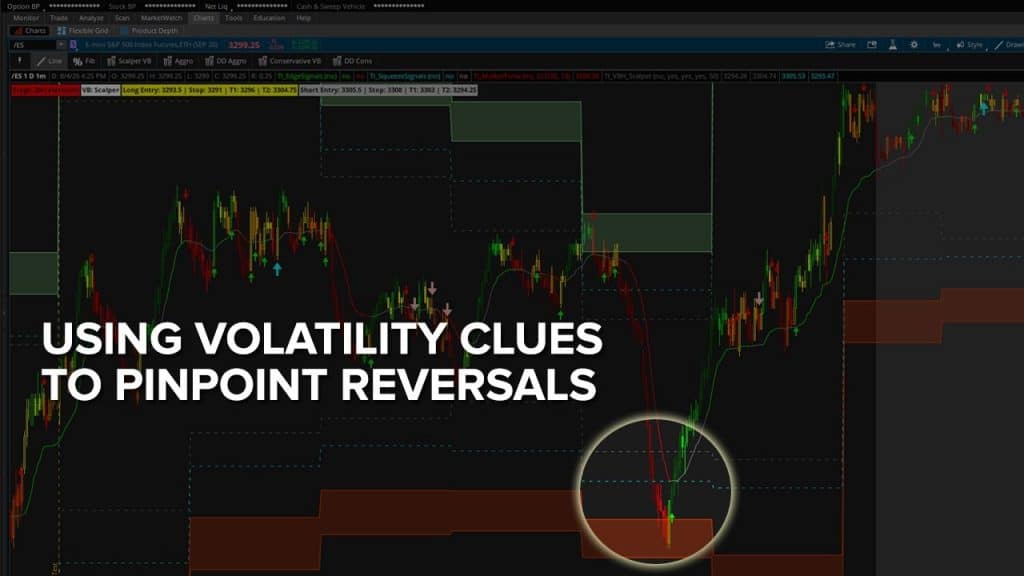

Read MoreUsing Volatility Clues to Day Trade Futures

We had our early morning volatility test give us some clues as to what to “expect” for the rest of the day.

Using our Volatility Box models, we had the 30-YR Bond (/ZB) signal to us that we should be using the Doomsday Aggressive models, while our indices all signaled that we could continue to scalp via the Scalper Volatility Box.

That was a clue – with the bonds giving us an early heads up to expect some sort of volatility in the broader markets (which we saw, in the 11-12 PM PT hour in the

Read MoreFades in the YM, RTY and NG Futures

We had three markets in which we had Volatility Box breaches today – the DOW, Natural Gas and Russell futures markets.

In the morning, we sent out a note to all of our members with a list of all 9 futures markets we look at, along with the Volatility Box models we were using for the day. These models are selected based on the First Hour test, and we let price action dictate to us if and when we should switch.

We had a total of four trades that set up today:

1. A long fade in Natural Gas (win

NG Futures and Swing Trade in Cloudflare

Start trading with an edge, at the edge, and sign up for the Volatility Box today

Read More