Posts Tagged ‘options’

6 Options Trade Ideas for the Daily Squeeze in Activision (ATVI)

A step-by-step guide on playing the daily time frame squeeze in Activision, which is building momentum.

Read MoreMind Medicine Stock (MNMD) – Wheel Options Strategy

Mind Medicine (MNMD) is a new stock on the Nasdaq exchange, with options that became available this past week. We’ll focus on finding the ideal strikes to run the wheel options strategy in MNMD stock.

Read More2 Option Trade Ideas in HOME and HLT

We’ll set up 2 different options trades in HOME and HLT, using the Slingshot Squeeze as our trigger.

Read MoreSnowflake (SNOW) – Trade Setup & Option Strategies

Snowflake looks like it’s getting ready to start trending on the bullish side, and we’ll dive a bit deeper into the setup.

Read MoreTSLA Broken Wing Butterfly Trade Idea

With the news of Tesla (TSLA) being added to the S&P 500, we have a catalyst to support a bullish trade idea looking for a move to the 1.272% Fibonacci extension.

We have a squeeze that has been gaining momentum, leading to the idea that it will fire long. To play this move in a relatively “expensive” ticker, we’re going to build a broken wing butterfly.

The broken wing butterfly gives us 2 inherent benefits:

1. No upside risk

2. Reduced cost compared to owning the shares outright, or buyi

SPY Gap Fill With Cumulative TICK Data (OTM Put Debit Spread)

Similar to last week, we’re going to continue using the Cumulative TICKs to find clues around what to expect in the S&P 500 for tomorrow.

With the close today, we had our Cumulative TICK Pro indicator suggesting that we had a likely bullish trend exhaustion. Typically, this is met with a reversal the next day. We had something similar set up last Thursday, with a bearish trend exhaustion signal, and saw a nice rally to close on Friday.

We’ll use this data and observation to build a trade in S

Read MoreSPY Bullish Reversal Trade Results (100%+ Winner)

We set up a game plan for trades in SPY, along with the futures and stock markets via our Volatility Box in yesterday’s video. Today, we’ll take a look at the results to see what happened.

We expected for the markets to open down lower, and then start to trend bullishly for the rest of the day. This was based off of our backtesting of the Cumulative TICK data, that we did in our pro version of the tutorial (free for Volatility Box members, available here: https://www.tosindicators.com/indicato

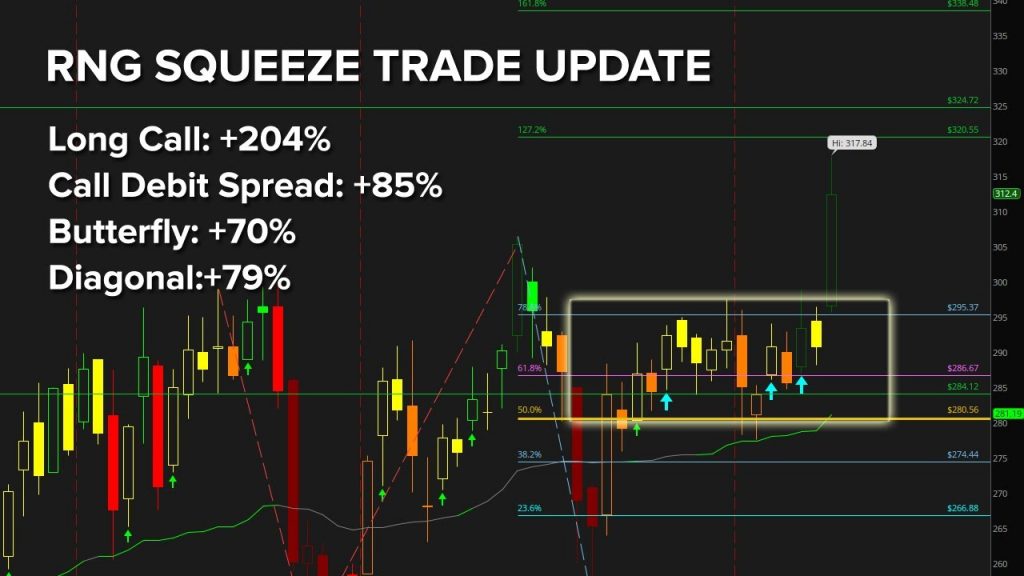

Read MoreRNG Options Trades Winner Follow Up (Stock Up +9%)

On August 30, 2020, we set up 4 different options trades in Ring Central (RNG), looking for a bullish move to $320.

We were looking at the September series options with 19 DTE, but got the move much sooner in less than 2 days. In today’s video, we’ll do a follow up on picking smart targets, along with an update to the option’s pricing to gauge which strategy was most effective.

The 4 trades that we had set up were:

1 – Long Call ($4.90 now worth $14.90)

2 – Long Call Debit Spread ($3.00 now w

4 Options Trade Ideas in Ring Central (RNG)

In today’s video, I’d like to focus on one stock, which I think has some trade opportunities setting up. We’ll spend some time evaluating the stock chart on a daily time frame, along with its option’s chain.

The stock that we’ll be taking a look at is Ring Central — they started by making the video doorbell, and have expanded their line of offering to a suite of security, and some even non-security applications now.

That’s to say – their product line has been gradually expanding, and I woul

Read MoreHow to Use Shorter Dated Options to Skew R/R in Your Favor

We’re going to compare 1 vs. 8 days to expiration (DTE) options, to see what the delta looks like, in terms of the returns of each strategy.

We had over 90 setups that hit our Live Scanner today, with a focus on “Buying the Dip” — this means Aggressive VB Long and Conservative VB Long setups.

Of those 90, we’re going to focus on 6 in particular that met the following conditions:

1. Hit the Volatility Box edge

2. Got an Edge Signal

3. Opportunity to enter at the VB clouds or better, before