Posts Tagged ‘silver’

Day Trading Fade Setup – Silver Trade Walkthrough

In today’s video, I’ll share a step-by-step breakdown of a day trading fade setup, using the Futures Volatility Box.

Read MoreGold and Silver Futures Day Trading (Live Commentary)

In today’s video, I’ll share some live commentary on volatility trade setups in Gold and Silver futures.

Read MoreTrading Daily and Hourly Volatility Levels on Indices

After 3 days of breaking outside of our most conservative models, we saw price action start to stabilize just a bit.

In today’s video, we’ll layer on both our hourly and daily volatility ranges to look and trade the indices. We sent out the daily volatility ranges, part of the Stock Volatility Box platform, to all of our Futures VB members as well, which ended up triggering for some nice trades across the board.

Via our Futures VB levels, we had a total of 7 trades, with a net P/L of +$1,410,

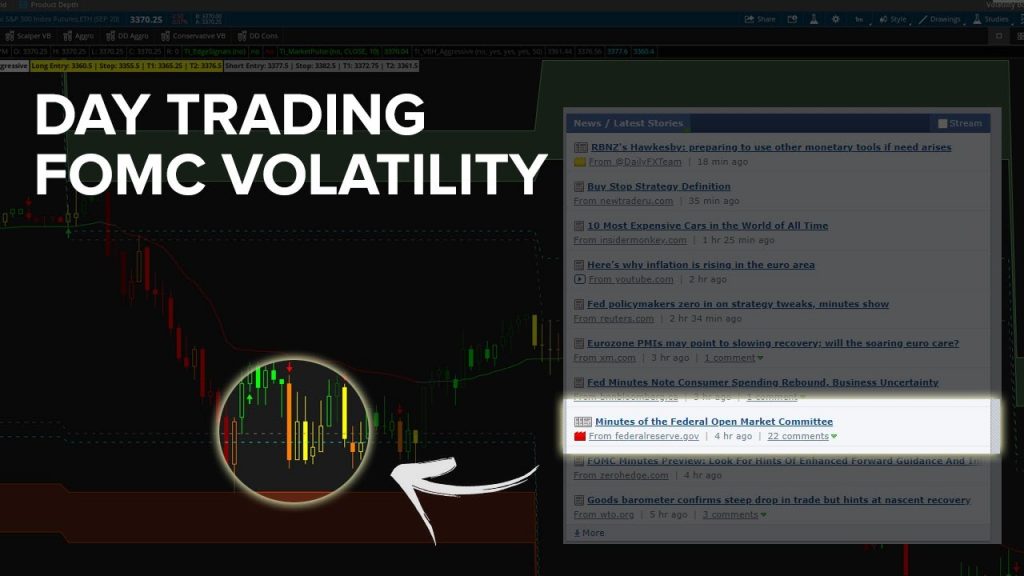

Read MoreDay Trading Futures Through FOMC Minutes Volatility

The release of the FOMC Minutes served as our catalyst for volatility in the futures market place today, leading to 7 futures day trades.

In today’s video, we’ll discuss all 7 of those trades, walking through all of the breaches and setups. Most of our trades today came in the 11-12p PT hour (when the FOMC minutes were released), which led to a burst of volatility in the marketplace.

Outside of the indices and 30-YR bond, we also had futures volatility trades that set up in markets like Crud

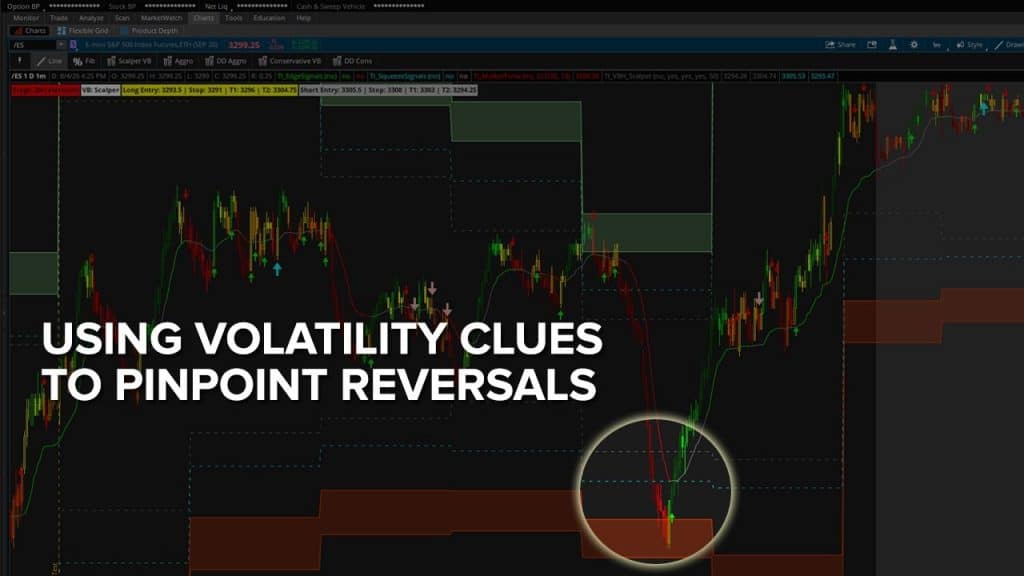

Read MoreUsing Volatility Clues to Day Trade Futures

We had our early morning volatility test give us some clues as to what to “expect” for the rest of the day.

Using our Volatility Box models, we had the 30-YR Bond (/ZB) signal to us that we should be using the Doomsday Aggressive models, while our indices all signaled that we could continue to scalp via the Scalper Volatility Box.

That was a clue – with the bonds giving us an early heads up to expect some sort of volatility in the broader markets (which we saw, in the 11-12 PM PT hour in the

Read MoreDay Trading Silver Futures (/SI) and AMD

In today’s video, we’ll break down day trades in the Silver Futures market (/SI), along with AMD.

Both Silver and AMD have been on the radars of a lot of traders, especially with their recent volatility. We’ve seen momentum kick into full gear in Silver, while related markets like Gold make all time high’s.

This increased volatility is opportunity for us, as volatility traders. In Silver, we had a total of 4 trades, 3 of which were winners for a net P/L of +$3,680.l We also had 1 trade in Natu

Read MoreWalking Through 10 Volatility Breaches in Futures Markets

We had more Volatility Box breaches today, than we’re typically used to seeing. Today, we had 8 out of the 10 markets we look at breach, giving us a total of 10 trade setups.

In today’s video, we’ll go through each of those 10 trade setups in slightly greater detail. While the indices all presented us with losing trades, we had other markets like Gold and Silver help make up for some of those losses.

If we had to extract 2 “takeaways” from today’s trading, those would be:

1. If you have to