Research

Using the VVIX to Trade SPY

Here’s a simple clue to look for in the VVIX, when trading the S&P 500. We’ll take a look at three market internals, and what each was telling us.

Read MoreCan’t Trade the Market Open or Close? Try This Hour Instead

This consistently volatile often leads to some incredible setups for day traders, who cannot trade the first or last hour of the markets.

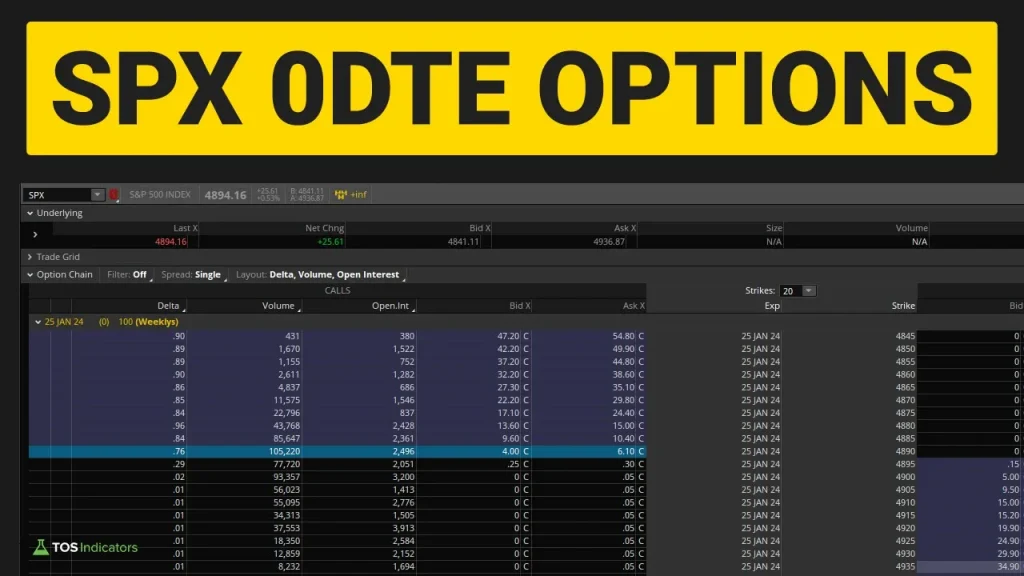

Read MoreSPX 0DTE Options – Data Breakdown

A step-by-step guide on how to trade SPX 0DTE options, with an edge. Data breakdown included.

Read MoreHow to Spot Sector Rotations

A step-by-step guide on how to recognize and profit from sector rotations.

Read MoreStock Market Seasonality Patterns

Your secret cheat sheet to seasonality patterns in the S&P 500, Nasdaq, and DOW Jones.

Read MoreHow To Analyze Volatility Every Morning

A simple 10 minute process to follow every morning, to day trade volatility like a pro. Major index markets, energies, and metals supported!

Read MoreIs The Put Call Ratio Warning Us?

The Put-Call Ratio ($PCALL) dipped below a key threshold, giving us our first warning signal. Let’s study what has happened in the past 10 years, when the $PCALL ratio has fallen below this key level.

Read MoreThe Hidden Starbucks Holiday Setup

This setup has been a 70% winner over the past 30 years inside of Starbucks, and triggers only during the holiday period.

Read MoreWill S&P 500’s November Seasonality Kick In?

Combine seasonal and sector analysis to create a game plan around how to trade the S&P 500 into the end of the year.

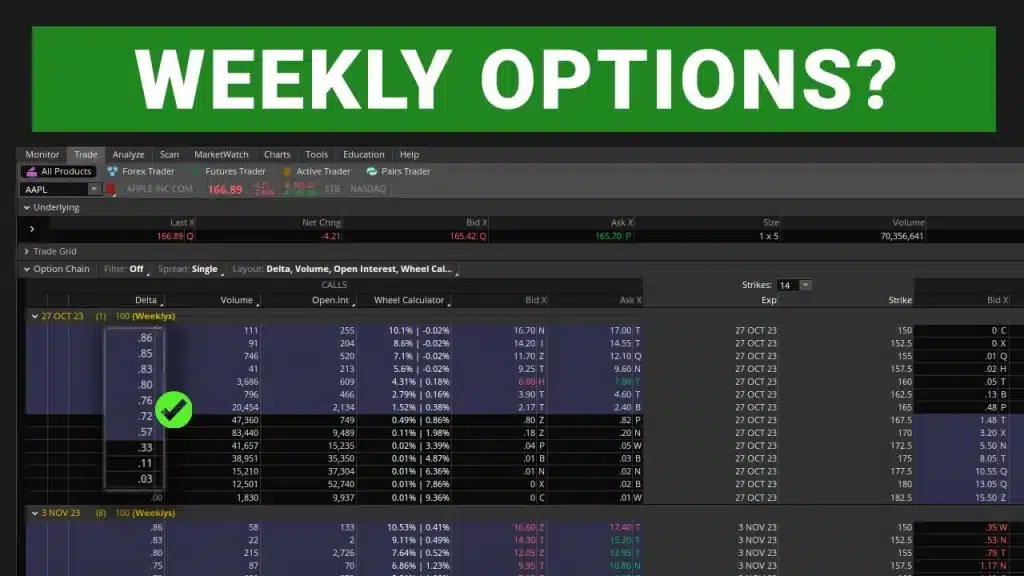

Read MoreAre Shorter Dated Options Better for Day Trading?

A data-driven comparison between 6 different options, to study pricing and understand how pricing fluctuates between different deltas and expiration cycles.

Read More