Research

Seasonal Crude Oil Pattern

Explore the seasonal pattern of Crude Oil, and the unique 4 month stretch when Crude Oil tends to exhibit signs of weakness. We’ll use this weakness to craft a trade setup that aligns with our longer term bias.

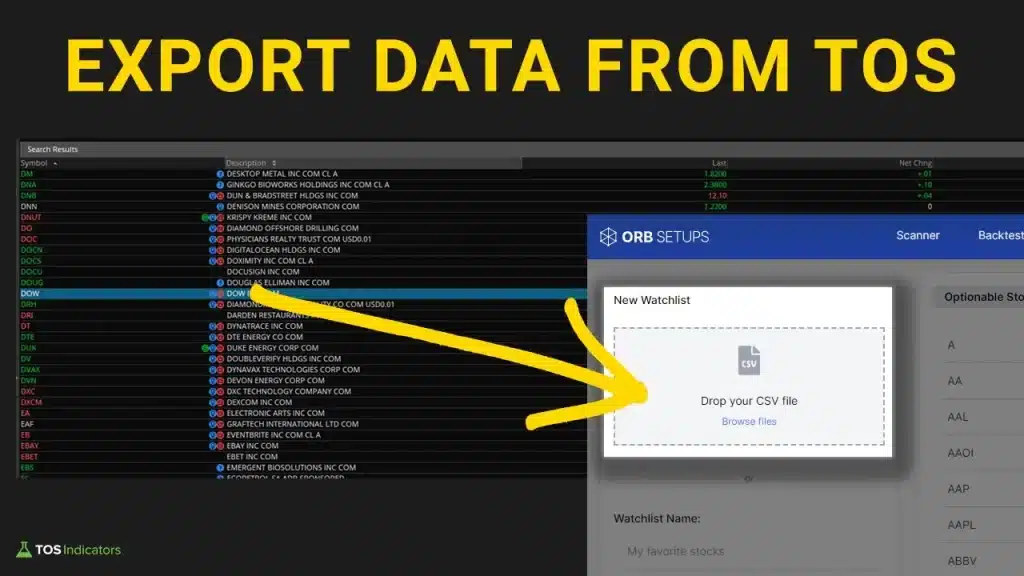

Read MoreExport ThinkOrSwim Data to a CSV

Learn how to export the large amount of data available inside of TOS. You’ll learn how to run your own queries, and export the results to a CSV.

Read MoreJuly’s Seasonal Analysis in the S&P 500

We’ll explore the unique July seasonal patterns in the S&P 500, going back more than 20 years.

Read MoreThe Secret to Confirming V-Shaped Reversals

Let’s dive deeper into the V-Shaped Reversal pattern, and explore how volume is a useful tool in identifying the best reversals.

Read MoreIs It Worth Buying 0 DTE Options?

We’ll dive deeper into the world of SPY options, measuring the 0 DTE option contracts with the 2 DTE and 5 DTE contracts.

Read MoreThe Predictive Powers of Morning Volatility

A step-by-step guide on how to leverage morning volatility in the index markets to predict the trading day.

Read MoreHow to Find Hidden Volatility When Markets Are Quiet

I’ll show you a simple way to find hidden volatility trade setups, especially when the S&P 500, DOW and Nasdaq are not moving much.

Read MoreAn Easy Way to Recognize Trend Days

A simple 3-step process to recognize trend days, using the morning’s opening range volatility.

Read MoreThe Sneaky Double Top

A step-by-step guide to recognize the sneaky double-top chart pattern, designed to stop out most traders.

Read MoreAAPL Opening Range Breakout Test

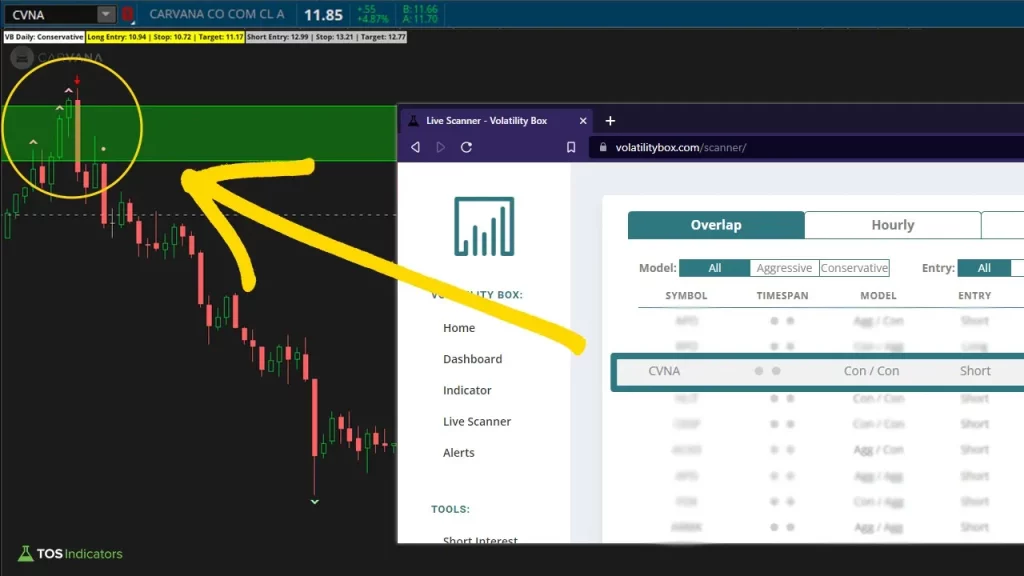

Leverage the ORB Backtester to find a specific ORB Strategy in AAPL that allows you to skew the risk/reward ratio in your favor (risk 1: reward 2), while maintaining a 70%+ win rate over the past 30 days.

Read More