Research

How to Identify and Trade False Breakouts

I’ll share an easy way that you can confirm false breakouts, by using a simple (and free!) momentum indicator.

Read More4 High-Probability Day Trading Setups

4 high-probability, trade setups, with detailed rules for you to pick and choose from, based on your trading style.

Read MoreTTM Squeeze Setup in SPY on 3 Different Time Frames

Let’s break down a squeeze setup inside of the S&P 500 across 3 different intraday timeframes. We’ll look at the 5-minute, 3-minute, and 1-minute time frames, studying the same setup.

Read MoreOpening Range Breakout (ORB) Strategy Backtest – SPY vs. QQQ vs. AAPL

Is the ORB strategy working in any market consistently, during this volatility? Let’s put it to the test with our ORB backtester, comparing SPY vs. QQQ vs. AAPL.

Read MoreFirst VIX Warning Signal of 2023

The VIX printed its first Bollinger Bands Reversal signal recently, while staying below 20. In 2022, this was a solid indicator on the broader sentiments behind the market. Will it continue in 2023?

Read MoreHow to Use ChatGPT To Analyze Economic Reports

Can ChatGPT analyze key economic reports and releases, and give us the key takeaways?

Read MoreBollinger Band Reversals on VIX to Trade SPY

In this video, we’ll apply the Bollinger Bands Reversal indicator on the VIX, and use the buy and sell signals to trade the SPY.

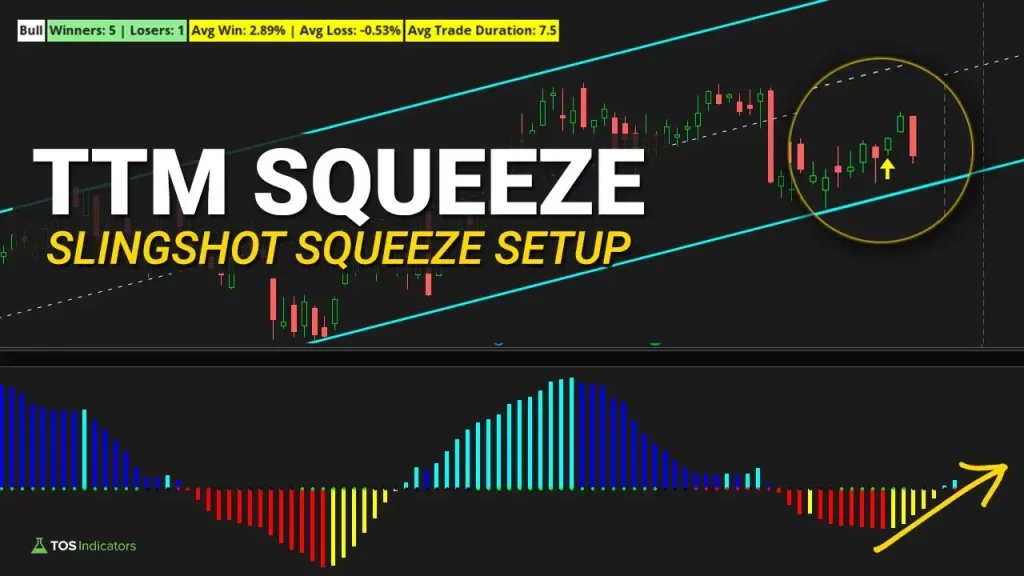

Read MoreCombining TTM SQUEEZE Signals with SEASONAL ANALYSIS for a Bullish Setup

Is the TTM Squeeze more effective when combined with Seasonal Analysis on specific markets? We’ll put the idea to the test and more in this video!

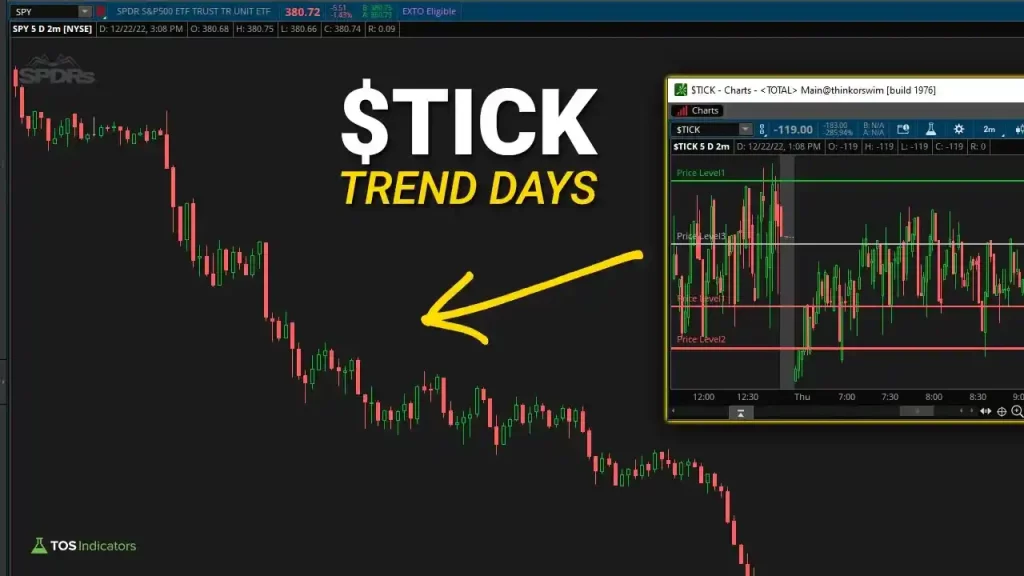

Read More2 Ways to Use NYSE $TICK to Spot Trend Days

I’ll show you two simple ways to use the NYSE $TICK and the data from the first 30 minutes after market open to spot trend days before they happen.

Read MoreSpot Trend Days Early in the Morning (Market Internal Clues)

Let’s take a closer look at trend days and how to identify them by analyzing 3 components – Market Internals, Market Structure, and Entries.

Read More