Research

Opening Range Breakout Strategy Success Rate on SPY Sectors

I’ll show you how to use the Opening Range Breakout Backtester to discover if the ORB strategy is profitable on any of the 11 major SPY sectors.

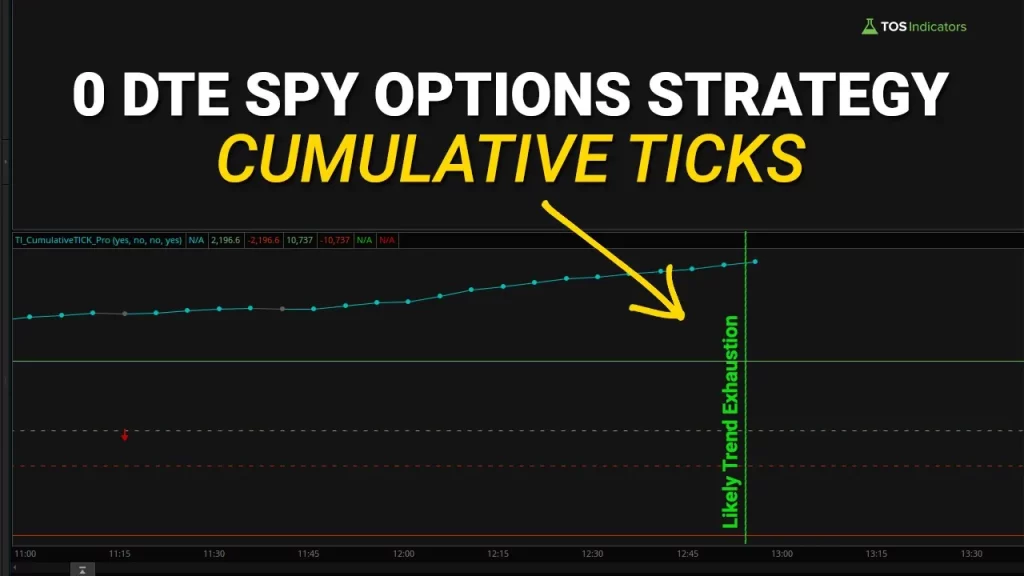

Read MoreWhat Market Internals are Telling Us About Tomorrow

With today’s rally, the Cumulative TICKs are telling us to expect a likely trend exhaustion tomorrow. I’ll share the exact day trading and swing trading triggers that I’m waiting for, in order to take advantage of this setup.

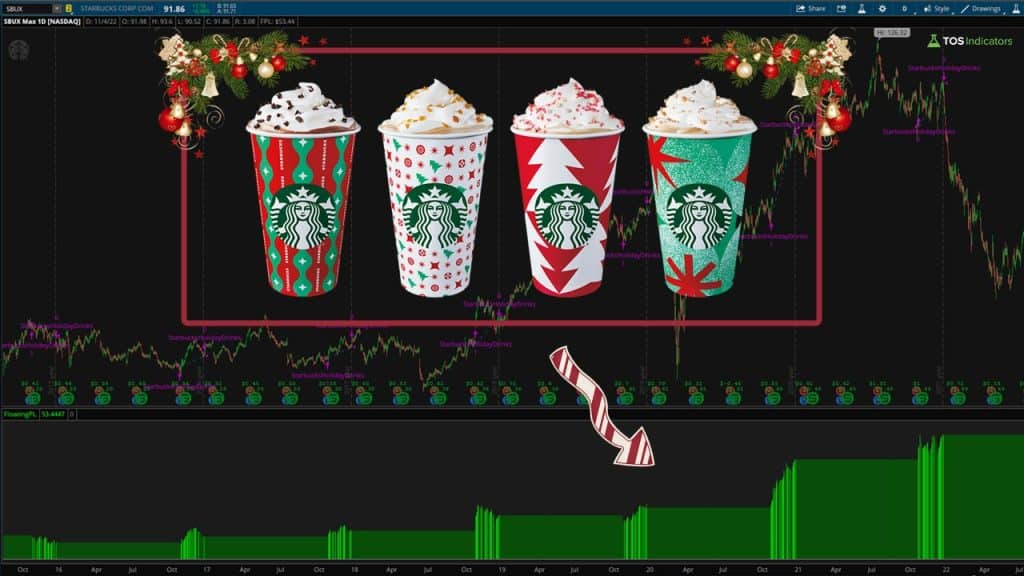

Read MoreDo Starbucks Holiday Drinks Increase The Stock Price?

Build a simple backtester to test whether Starbuck’s holiday drink season is correlated with a rise in SBUX stock price.

Read MoreThe 4 Stages of FOMC Volatility for Day Trading

A complete breakdown of the 4 different stages of FOMC volatility, including examples and common characteristics.

Read MoreS&P 500 November Seasonality Patterns in Bear Markets

Explore the seasonality tendencies in SPY for the month of November, focusing on Bear Markets.

Read MoreNYSE TICK Divergences – Price and Market Internals Clues

We’ll focus on identifying NYSE $TICK divergences with price action. We have 3 tools to help us identify divergences in the S&P 500 (SPY) alongside the $TICK.

Read MoreShould You Trade During the Lunch Time Hour?

Let’s dive deeper into the lunch time hour, and determine if the hour is worth trading using 3 factors – volume, price action, and volatility.

Read MoreHow To Identify Intraday Reversals (5-Step Process)

Let’s break down the anatomy of an intraday volatility reversal, with a simple 5-step process.

Read MoreOpening Range Breakout Strategy Success Rate on NFLX

Let’s use the Opening Range Breakout Backtester to test the P/L of the strategy on NFLX stock over the past 30 vs. 90 days.

Read MoreDo Larger Time Frames Reduce False Signals?

Let’s explore the concept of different 5 different time frames for day trading, and compare the accuracy of signals on each time frame.

Read More