Research

Anchored VWAP – March 2020 vs. June 2022

We’ll use the Anchored VWAP to compare how price action has evolved from March 2020 lows to June 2022’s volatility.

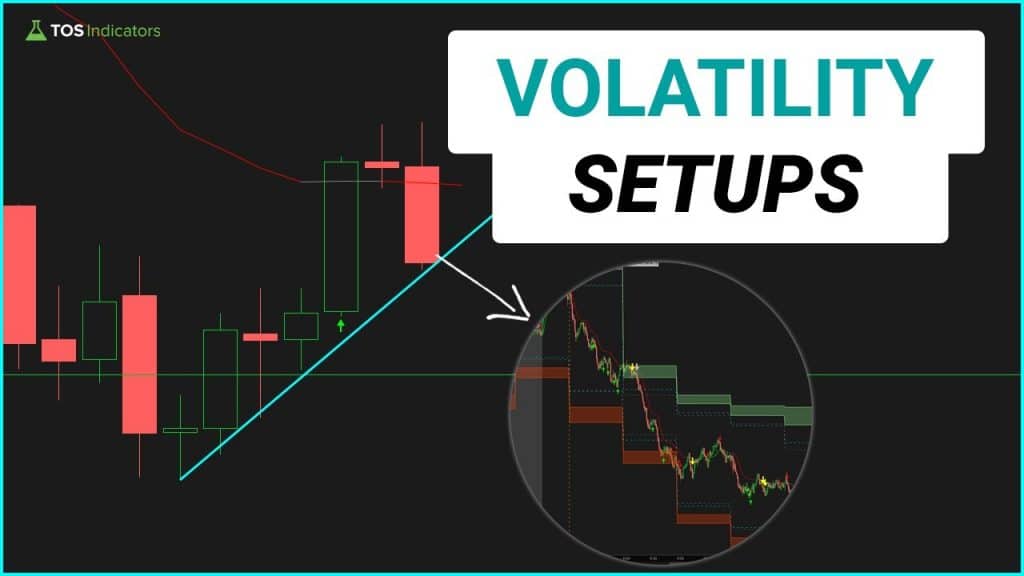

Read MoreDay Trade Volatility With These 3 Setups

I’ll share the 3 setups that I’m focusing on trading, to profit from this current increase in volatility.

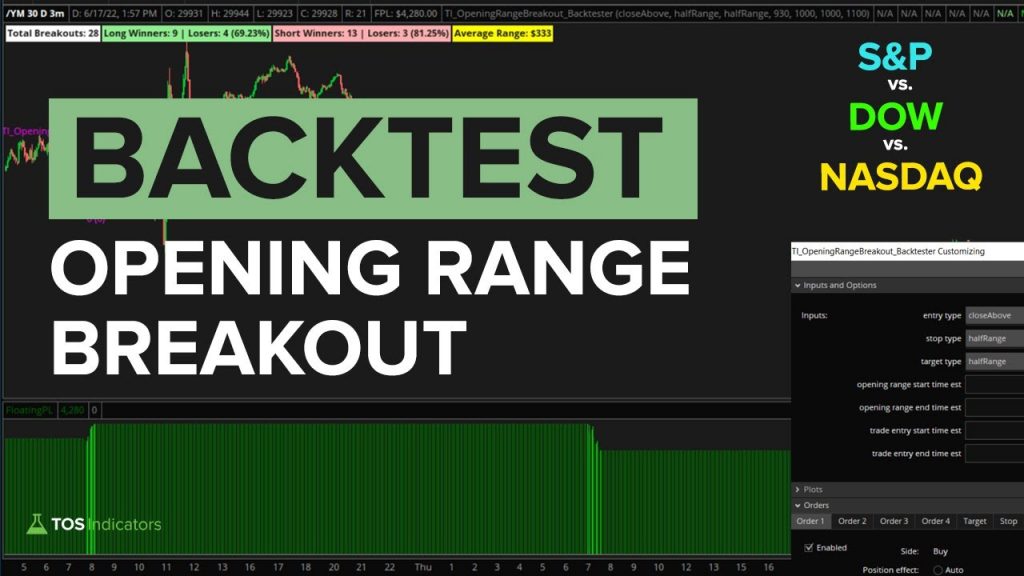

Read MoreOpening Range Breakout Strategy Success Rate on Indices

I’ll show you how to use the Opening Range Breakout Backtester to discover if the ORB strategy is profitable on any of the 4 major index markets.

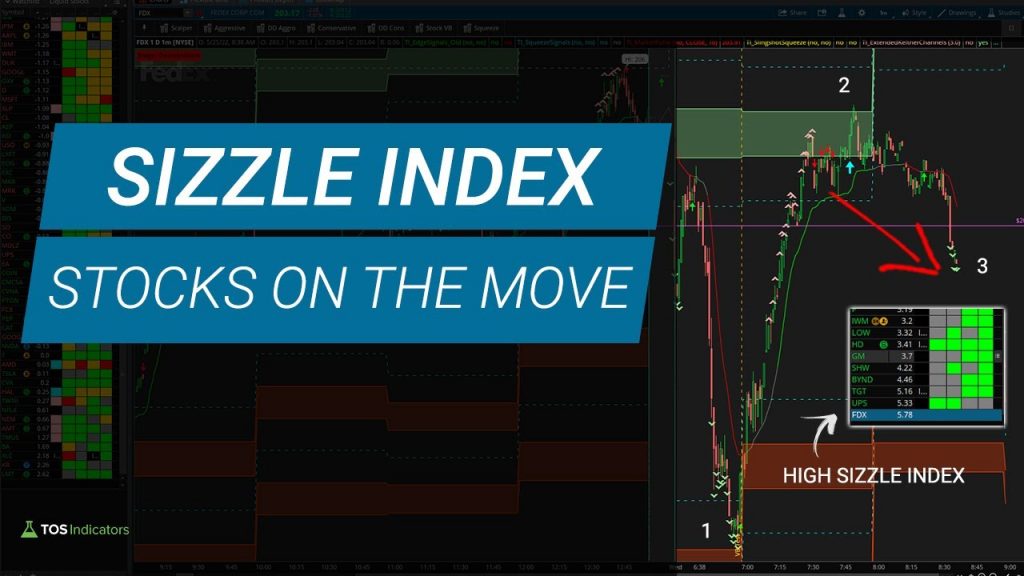

Read MoreHourly Volatility Models for Stocks – Demo on FDX and UPS

FDX and UPS were two stocks that stood out on our hourly Sizzle Index indicator, for leading the charge when the markets were chopping around sideways.

Read MoreTrend Trading – Early Trend Signs

Discover hidden price and volatility clues in the market every morning, to find early trend signs. Learn how to recognize these patterns, and profit from them.

Read MoreBear Market Relief Rally – A Deep Dive in SPY, QQQ, DIA, and IWM

A deep dive into a bear market relief rally, and sharing research for previous relief rallies in the S&P 500, DOW, NASDAQ and Russell 2000 indices.

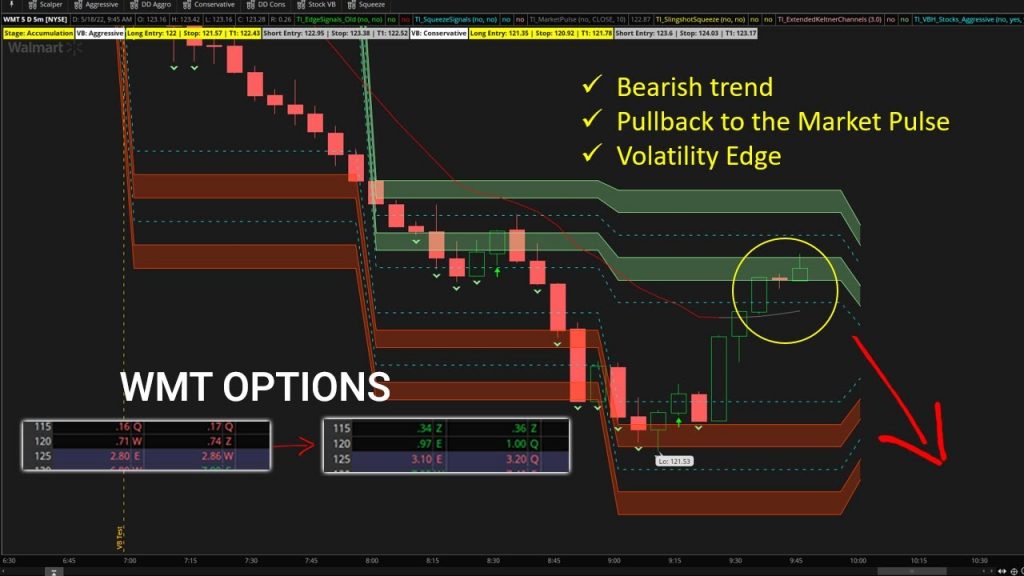

Read MoreHourly Volatility Models for Stocks – Demo on WMT

Walmart, along with a majority of retail stocks, faced a great deal of volatility today. That volatility is our opportunity, to take advantage of price/volatility edges in the marketplace.

Read MoreHourly Volatility Models for Stocks – Demo on ETFs

I’ll show you the models being applied for the SPY sector ETFs, contrasting markets like XLV vs. XLF, XLP vs. XLY, etc. to show you what different volatility regimes looked like.

Read MoreHourly Volatility Models for Stocks – Demo on AAPL

I’ll give you a demo of our new HOURLY volatility models, to help you find intraday reversals in your favorite stocks and ETFs.

Read MoreWhat Moving Average Pullback is Best for Trend Days?

Backtest which moving average is best-suited for moving average pullback setups on TREND days.

Read More