Futures

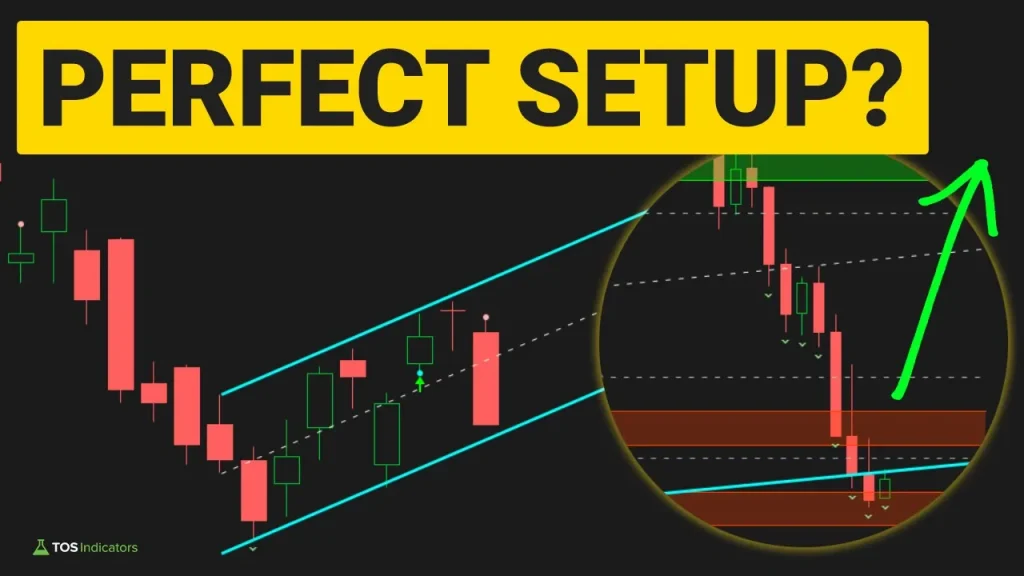

Instantly Reduce Risk and Increase Reward

A quick way to DRAMATICALLY skew the Risk/Reward ratio in your favor.

Read MoreS&P 500, Nasdaq and DOW – Major Levels (September 2024)

These are the major levels to pay attention to in the S&P 500, Nasdaq, and DOW Jones as the markets flirt with a new all time high.

Read MoreIntraday NASDAQ Bounces

Here’s an example of how to take advantage of volatility inside of the major index markets — S&P 500, Nasdaq and DOW.

Read MoreS&P 500 and Nasdaq – Fibonacci Levels (August 2024)

The S&P 500 stock is giving you a RARE opportunity to buy the dip, after a steep sell-off. Profit from this volatility with the exact Fibonacci extensions levels.

Read MoreTake Advantage of FOMC Volatility in SPY

Here is a simple way to take advantage of FOMC related volatility in the S&P 500, using SPY.

Read MoreBuy the Dip in SPY at $500?

Is the S&P 500 a buy at these key levels? Here’s a simple way to use volatility and price channels for a comprehensive look.

Read MoreCompare Stock and Futures Market Volatility

A step-by-step guide comparing the volatility between major stocks and futures markets.

Read MoreNASDAQ – Three Key Levels to Watch in 2024

Keep track of these 3 key levels in the Nasdaq in 2024.

Read MoreDay Trading – Nasdaq vs. S&P 500 – Volatility Comparison

Compare and contrast the different volatility in the Nasdaq and S&P 500 futures markets, with specific clues.

Read MoreES Futures vs. Micro ES Futures vs. SPX Volatility

Compare and contrast the volatility in the S&P 500 across 3 different asset classes: /ES, /MES, and SPX.

Read More