Posts Tagged ‘bond’

Nasdaq, Russell and 30-YR Bond Volatility

We had the 30-Year Bond futures giving us an early heads up of increasing volatility in the indices. In this video, we’ll evaluate whether that information proved to be useful in trading volatility on the indices.

Read MoreTLT Fibonacci Trade Idea (50% Retracement Pullback)

With a rather peculiar year, we’ve seen markets like TLT have a greater than average percentage gain, so far into 2020.

In today’s video, we’ll discuss a trade idea setting up in TLT, as a result of the recent gap lower. Price action is currently hovering around the 50% retracement mark, using the swing high to swing low in TLT.

Additionally, if we use a previous swing high to swing low Fibonacci retracement, we’re able to create a cluster zone. So far, price action has respected this zone,

Read MoreStimulus Update Volatility – Futures & Stock Trade Setups

In today’s video we’re going to talk about the volatility we saw in the markets, as a result of Trump’s tweets, stating that stimulus negotiations were going to be pushed till post-election.

This was something the market did not expect, and we saw that reflected in the price action. Across the board, the S&P 500, Nasdaq, DOW, Russell, 30-YR Bond, Energies, you name it — almost all major markets saw a volatile reaction to this news.

This ended up becoming our catalyst for both futures and stoc

Read MoreTrading Futures in the Final Hour

The final hour of the markets today gave us multiple opportunities to buy the dip, and catch some quick reversals in the indices.

We had a breach in the S&P 500 (/ES), Nasdaq (/NQ), DOW (/YM) and the Russell 2000 (/RTY). All 4 of these breaches respected our Volatility Box models, and gave some incredible reversal opportunities.

In addition to the indices, we also had breaches in Natural Gas (/NG), which was successful, along with Gold (/GC). The only market in which we went outside of our vo

Read MoreMorning Volatility Clues for ES, YM and RTY

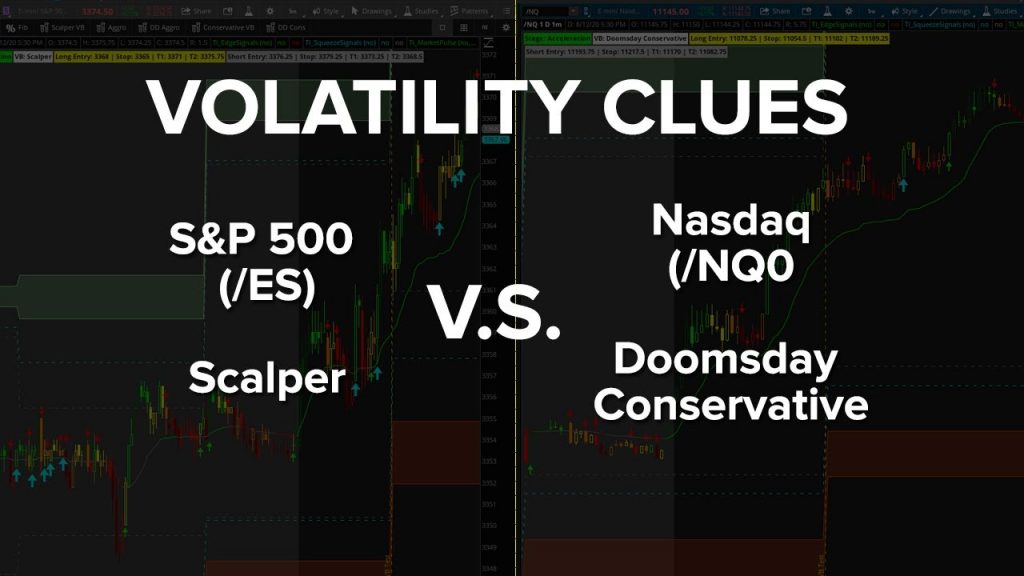

In today’s video, we’re going to use our first hour Volatility Box test to find clues around what to expect for the rest of the day.

Today, we saw that the 30-YR Bond Futures (/ZB) and the Nasdaq Futures (/NQ) both gave us clues to expect more volatility as the day progresses. We’ll review whether or not the clues were accurate, and what actually happened as the day progressed.

In the Nasdaq, we were on our Doomsday Conservative models (which are the most conservative models we have), compare

Read MoreReviewing 3 Losers in ES, NQ and ZB for Takeaways

In today’s video, we’re going to take a look at three futures trades that were losses, to see if there are any takeaways.

We had setups in the S&P 500 (/ES), Nasdaq (/NQ) and 30-YR Bond (/ZB). However, neither of these setups worked today, which was atypical. Normally, we have an opportunity to earn back some of our losses, even on our net red days. Today, we didn’t have any such cases.

We’ll do a deeper dive into each of the three markets, and review the breach, along with the subsequent pr

Read More2 Setups in the 30-YR Bond and Weekend Trade Updates

Our Trade Plan rules typically keep us on the right side of the market. In today’s case, we ended up being TOO cautious with our rules, at the expense of missing multiple setups in the 4 major indices markets, almost all of which worked.

However, our rules usually do keep us out of trouble — which was proven in our 2 setups in the 30 Year Bond futures market (/ZB). In our first setup, we hit both our first and second target, giving us a nice win.

The second setup was a little different, tho

Read MoreDay Trading the Russell and Copper Futures +$1,580

The Russell Futures (/RTY) has been more volatile than its index peers as of recently, which has also led to us finding some really nice Volatility Box fades.

We had a nice winner earlier in the week, and that same trend continued today. In the Russell futures, we had two trade setups that triggered, both of which were winners. One was via our new Scalper Volatility Box, while the other was via the Conservative Volatility Box.

The first day trade in the RTY futures was good for +5.6 points, w

Read More