Posts Tagged ‘day trades’

SPY Gap Fill With Cumulative TICK Data (OTM Put Debit Spread)

Similar to last week, we’re going to continue using the Cumulative TICKs to find clues around what to expect in the S&P 500 for tomorrow.

With the close today, we had our Cumulative TICK Pro indicator suggesting that we had a likely bullish trend exhaustion. Typically, this is met with a reversal the next day. We had something similar set up last Thursday, with a bearish trend exhaustion signal, and saw a nice rally to close on Friday.

We’ll use this data and observation to build a trade in S

Read MoreSPY Bullish Reversal Trade Results (100%+ Winner)

We set up a game plan for trades in SPY, along with the futures and stock markets via our Volatility Box in yesterday’s video. Today, we’ll take a look at the results to see what happened.

We expected for the markets to open down lower, and then start to trend bullishly for the rest of the day. This was based off of our backtesting of the Cumulative TICK data, that we did in our pro version of the tutorial (free for Volatility Box members, available here: https://www.tosindicators.com/indicato

Read MoreBullish Reversal Trade Idea in SPY – Market Internals Data

The Cumulative TICK Pro signaled to us to expect a likely bearish trend exhaustion with today’s activity. We’ll use this information to create a game plan for tomorrow’s trading.

Specifically, I’m looking for the bearish trend that we had into the final hours of the market to halt, and reverse into tomorrow. Below, you’ll find a brief game plan that is expanded upon more in tonight’s video.

➡️ WHAT WE’RE EXPECTING:

A bullish reversal, after a morning decline. The Cumulative TICKs suggested t

Trading Futures in the Final Hour

The final hour of the markets today gave us multiple opportunities to buy the dip, and catch some quick reversals in the indices.

We had a breach in the S&P 500 (/ES), Nasdaq (/NQ), DOW (/YM) and the Russell 2000 (/RTY). All 4 of these breaches respected our Volatility Box models, and gave some incredible reversal opportunities.

In addition to the indices, we also had breaches in Natural Gas (/NG), which was successful, along with Gold (/GC). The only market in which we went outside of our vo

Read MoreCumulative TICK Indicator with Volatility Ranges

Over the weekend, we released our 21st episode of the “How to thinkScript” series, which includes both a free and pro version (which is available for Volatility Box members).

In today’s video, we’re going to use the Cumulative TICK Pro indicator, alongside our updated Volatility Box models to take a look at price action in the indices.

Across the board in the ES, YM, and NQ, we had breaches of our Volatility Box in the 10-11AM PT hour that hit our Volatility Box zones, almost to perfection.

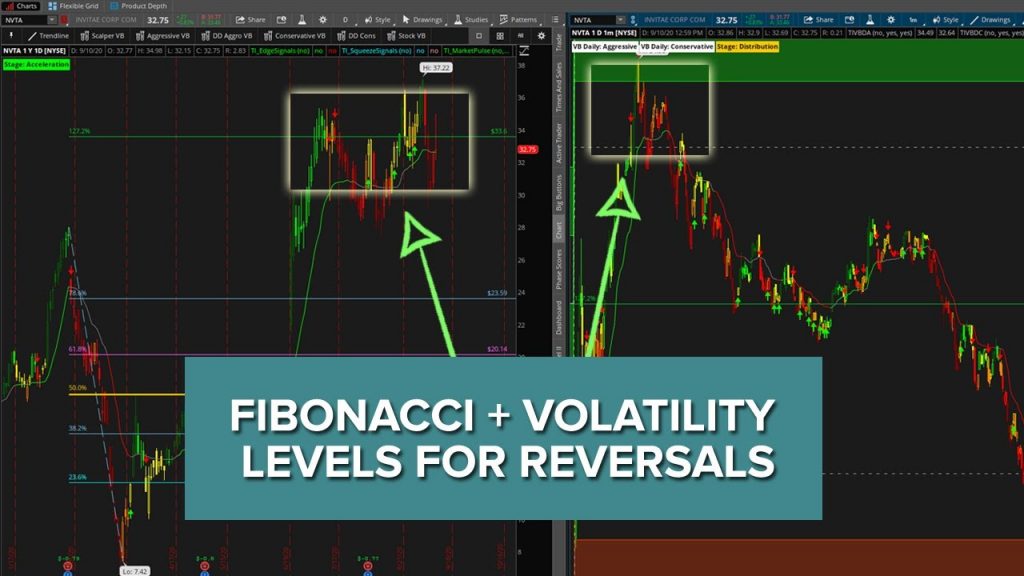

Read MoreStock Volatility Trades in NVTA, SPY and QQQ

In this video, we’ll review the Stock Volatility Box’s performance for today, as well as dive deeper into the charts of NVTA, SPY and QQQ to look at 3 specific setups.

With the recent burst of volatility, we’ve seen more stocks hit our Live Scanner compared to usual. The Live Scanner is a “machine” that we’ve built, whose job is to update every 15 seconds with new trades that breach our Volatility Box edges.

Today, we had more than 229 trades that hit our Live Scanner over the course of the

Read MoreTrading Daily and Hourly Volatility Levels on Indices

After 3 days of breaking outside of our most conservative models, we saw price action start to stabilize just a bit.

In today’s video, we’ll layer on both our hourly and daily volatility ranges to look and trade the indices. We sent out the daily volatility ranges, part of the Stock Volatility Box platform, to all of our Futures VB members as well, which ended up triggering for some nice trades across the board.

Via our Futures VB levels, we had a total of 7 trades, with a net P/L of +$1,410,

Read MoreVolatility Trades in Tech Stocks and Futures (Sept. 2, 2020)

We had the Nasdaq futures break outside of our Doomsday Conservative (our most conservative) volatility models within the first 30 minute after market open. With that same downfall, we had a group of tech stocks all hit our Stock Volatility Box Live Scanner, giving us plenty of opportunities to look for fade trade setups.

In today’s video, we’ll discuss both stock and futures trades, along with ways to overlap the Stock and Futures Volatility Boxes to work in congruence. With Nasdaq breaking ou

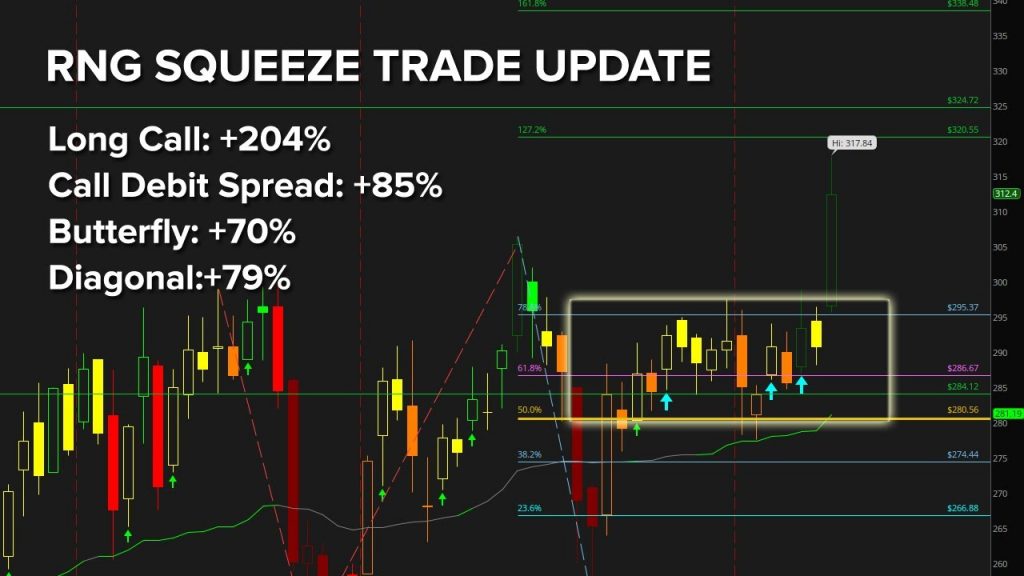

Read MoreRNG Options Trades Winner Follow Up (Stock Up +9%)

On August 30, 2020, we set up 4 different options trades in Ring Central (RNG), looking for a bullish move to $320.

We were looking at the September series options with 19 DTE, but got the move much sooner in less than 2 days. In today’s video, we’ll do a follow up on picking smart targets, along with an update to the option’s pricing to gauge which strategy was most effective.

The 4 trades that we had set up were:

1 – Long Call ($4.90 now worth $14.90)

2 – Long Call Debit Spread ($3.00 now w

Stocks Likely to Trend Tomorrow

In today’s video, we’ll walk you through the Nightly Trending List, which contains stocks we think are likely to trend for tomorrow.

This list contains a group of stocks, usually 3-6, that our models suggest are likely to trend for the next day. These are stocks that have closed within our Volatility Box zones, and we expect either the buying or selling pressure to continue the next day.

Tonight, we’ll also layer on a high-level option’s chain analysis, using Open Interest and Probability of

Read More