Posts Tagged ‘day trades’

Hourly Volatility Models for Stocks – Demo on AAPL

I’ll give you a demo of our new HOURLY volatility models, to help you find intraday reversals in your favorite stocks and ETFs.

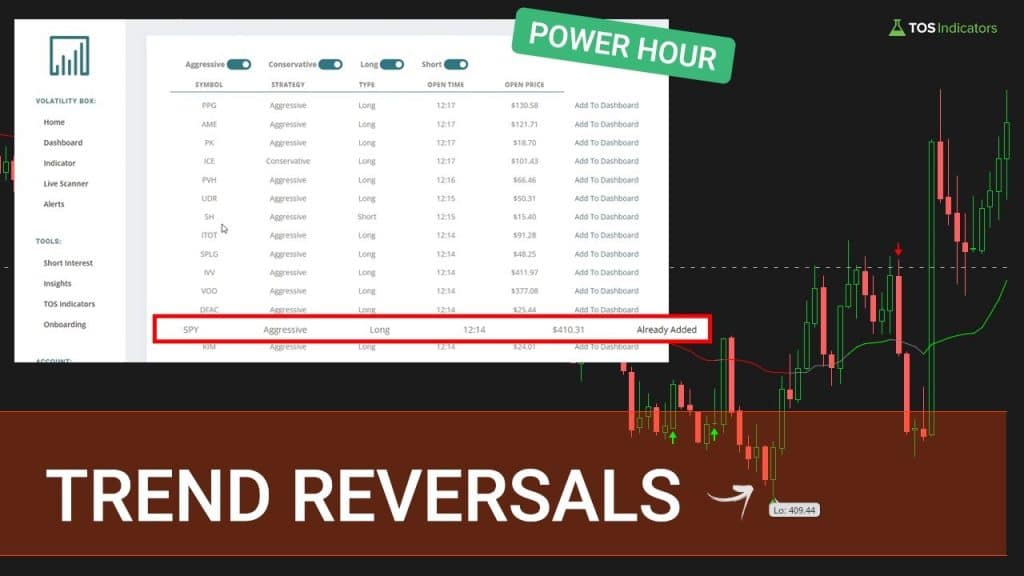

Read MorePower Hour Volatility – SPY, SBUX, COST, CSCO

In today’s video, we’ll take a look at leveraging the volatility in the final hour of the market, after a volatile day in which the S&P 500 was down nearly -3.5%.

Read MoreKey Resistance Level on S&P 500

A step-by-step guide on how to find key resistance levels inside of the S&P 500, by yourself.

Read MoreFade Setup Examples – Index Futures (ES, YM, NQ, RTY)

Study the many examples in this video to master the popular Fade Setup, and use it to consistently profit from the markets.

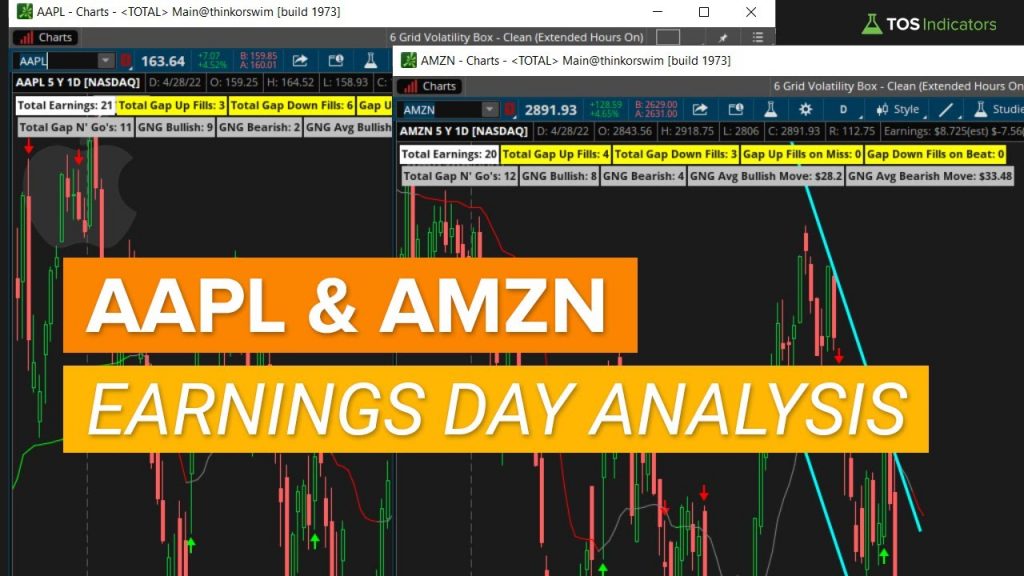

Read MoreAAPL and AMZN – Earnings Day Analysis

In today’s video, I’ll use our free Smarter Earnings indicator to analyze price behavior in both AAPL and AMZN, after reporting earnings.

Read MoreVolatility Fade Setup – Rules and Examples

A detailed, step-by-step guide on the Fade Setup, and using it to consistently profit from the markets.

Read MoreWhat Moving Average Pullback is Best for Trend Days?

Backtest which moving average is best-suited for moving average pullback setups on TREND days.

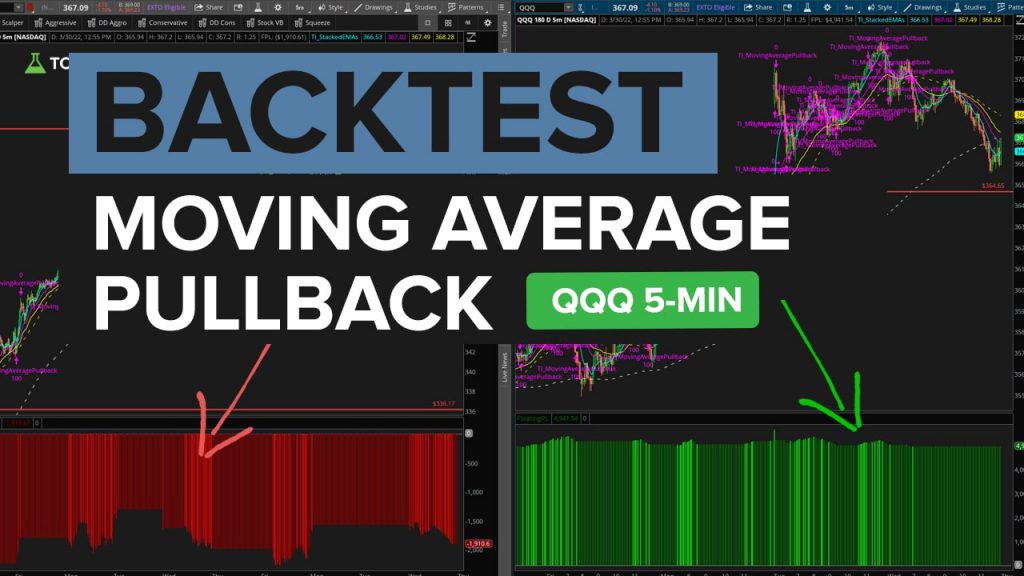

Read MoreWhat Moving Average Pullback is Best for QQQ 5-MIN Chart?

Find out which moving average pullback leads to the greatest P/L, inside of the NASDAQ (QQQ), on a 5-minute timeframe chart.

Read MoreTSLA: Price Action Review (15-Minute Bar by Bar)

Inspired by Al Brooks, in today’s video, I’ll walk through the entire day’s price action, bar-by-bar on a 15-minute chart in TSLA. We’ll compare bulls vs. bears, trends vs. chop, and scalps vs. longer trends.

Read MoreFOMC Volatility – S&P 500 (Mar. 2022)

In today’s video, we’ll compare and contrast March 2022’s FOMC volatility to that of January 2022. We’ll discuss both similarities and differences between the reaction to the FOMC event, along with the volatility regime for each one.

Read More