Posts Tagged ‘DOW’

Managing a Small Loser in the S&P 500 Futures

We’ve had a nice winning streak with our futures trading over the past few weeks, which ended today with a small loser in the S&P 500 Futures. We also discuss a couple trade setups in COST and KR.

Our Trade Plan is designed with a set of rules in mind to keep us out of trouble, more times than not. In the case of the /ES futures, our rules did just that. We had an opportunity to short the S&P 500 as the markets slammed into our Volatility Box levels in the 10-11 am PT hour.

However, we did n

Read MoreDay Trading the Russell and Copper Futures +$1,580

The Russell Futures (/RTY) has been more volatile than its index peers as of recently, which has also led to us finding some really nice Volatility Box fades.

We had a nice winner earlier in the week, and that same trend continued today. In the Russell futures, we had two trade setups that triggered, both of which were winners. One was via our new Scalper Volatility Box, while the other was via the Conservative Volatility Box.

The first day trade in the RTY futures was good for +5.6 points, w

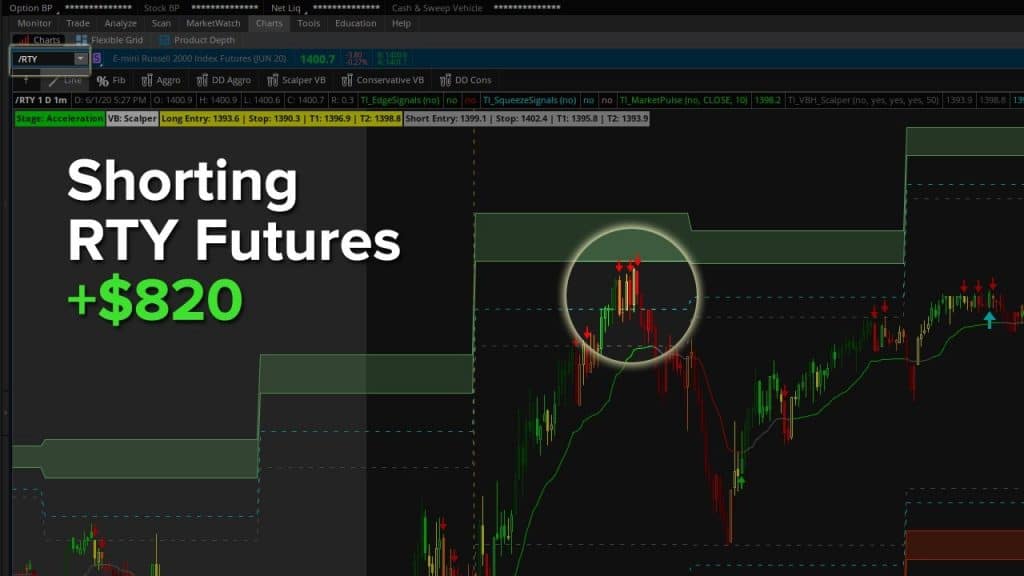

Read MoreShort Entry in the Russell Futures +$820

We had one entry in the Russell 2K (/RTY) futures today, at 7:40 AM PT, which led to a nice winner of +$820 across both contracts.

The short came in the RTY as price slammed into our Volatility Box, levels giving us an opportunity to try and scalp the markets. Our risk was 4.8 points, to try and make 4.8 points on the first contract, and 11.6 points on the second contract (with a break-even stop).

Once we got our Edge Signal confirmation, that was the green light to enter the trade, with a s

Read More