Posts Tagged ‘DOW’

Volatility Trades in Tech Stocks and Futures (Sept. 2, 2020)

We had the Nasdaq futures break outside of our Doomsday Conservative (our most conservative) volatility models within the first 30 minute after market open. With that same downfall, we had a group of tech stocks all hit our Stock Volatility Box Live Scanner, giving us plenty of opportunities to look for fade trade setups.

In today’s video, we’ll discuss both stock and futures trades, along with ways to overlap the Stock and Futures Volatility Boxes to work in congruence. With Nasdaq breaking ou

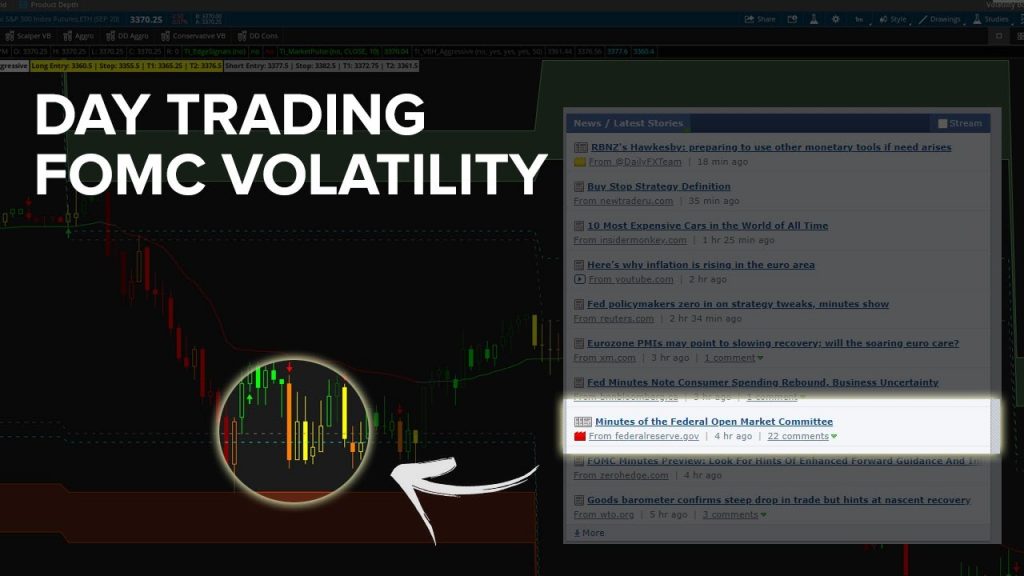

Read MoreDay Trading Futures Through FOMC Minutes Volatility

The release of the FOMC Minutes served as our catalyst for volatility in the futures market place today, leading to 7 futures day trades.

In today’s video, we’ll discuss all 7 of those trades, walking through all of the breaches and setups. Most of our trades today came in the 11-12p PT hour (when the FOMC minutes were released), which led to a burst of volatility in the marketplace.

Outside of the indices and 30-YR bond, we also had futures volatility trades that set up in markets like Crud

Read MoreMorning Volatility Clues for ES, YM and RTY

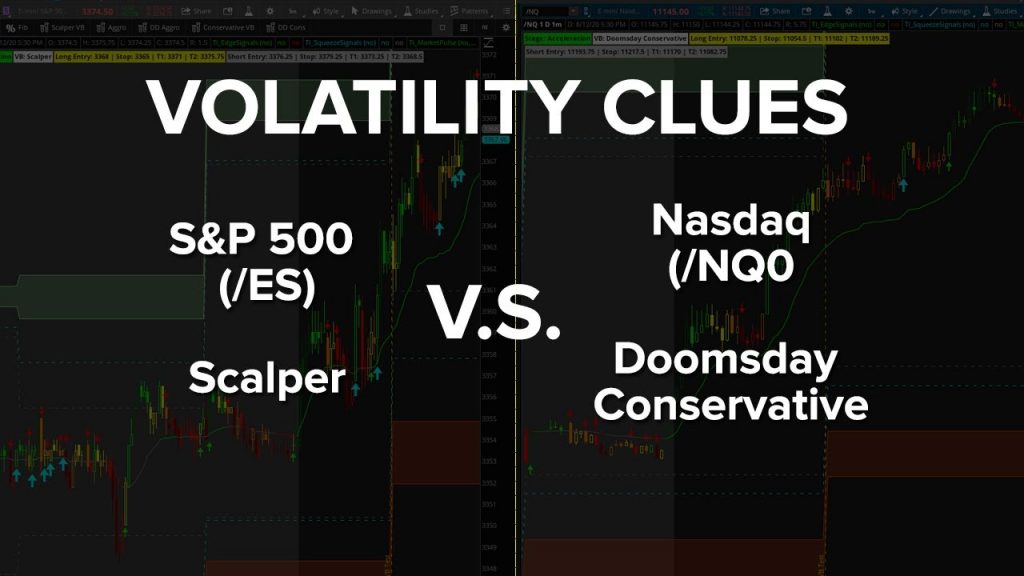

In today’s video, we’re going to use our first hour Volatility Box test to find clues around what to expect for the rest of the day.

Today, we saw that the 30-YR Bond Futures (/ZB) and the Nasdaq Futures (/NQ) both gave us clues to expect more volatility as the day progresses. We’ll review whether or not the clues were accurate, and what actually happened as the day progressed.

In the Nasdaq, we were on our Doomsday Conservative models (which are the most conservative models we have), compare

Read MoreWalking Through 10 Volatility Breaches in Futures Markets

We had more Volatility Box breaches today, than we’re typically used to seeing. Today, we had 8 out of the 10 markets we look at breach, giving us a total of 10 trade setups.

In today’s video, we’ll go through each of those 10 trade setups in slightly greater detail. While the indices all presented us with losing trades, we had other markets like Gold and Silver help make up for some of those losses.

If we had to extract 2 “takeaways” from today’s trading, those would be:

1. If you have to

Fibonacci Levels – SPY, QQQ, IWM, DIA, MSFT, NFLX and CSCO

Once again, we have a nice pullback setting up in the markets, giving us some new opportunities to enter on a trend pullback.

In this video, we’re going to start by reviewing what the SPY, QQQ, DIA AND IWM are telling us, by using price action, volume and Fibs. While QQQ currently offers us the most Fibonacci-support, it’s also the most extended (duh), having reached its 1.272% extension of the Feb-March swing high to low.

We’re going to use that to dive deeper into some stocks in the Nasdaq,

Read MoreAdapting to Changing Volatility Conditions

If you’re looking to trade volatility, it’s critical to have tools to very easily, but reliably measure and rank the volatility across markets, and adapt.

Today, with the Volatility Box, we had the luxury of adapting to each index market’s respective volatility — and we saw that differ across the 4 major markets.

For example, today, here were the rankings of the 9 futures markets that we look at, with their respective Volatility Box models:

ES, RTY – Scalper

NQ – Aggressive

YM – Doomsda

Fades in the YM, RTY and NG Futures

We had three markets in which we had Volatility Box breaches today – the DOW, Natural Gas and Russell futures markets.

In the morning, we sent out a note to all of our members with a list of all 9 futures markets we look at, along with the Volatility Box models we were using for the day. These models are selected based on the First Hour test, and we let price action dictate to us if and when we should switch.

We had a total of four trades that set up today:

1. A long fade in Natural Gas (win

SPY, QQQ, DIA and IWM Buy Zones and Triggers

We saw a broader sell off in the indices with Friday’s trading, leading many top weighted holdings to start to pull back to entry zones.

In this video, we’re going to use a few different perspectives (and indicators) to create a game plan, with specific levels that I’m interested in buying as support on the SPY, QQQ, DIA, and IWM.

We’re going to use the following tools for the analysis:

1. Put Call Ratio in the Utility Labels

2. Market Pulse Line

3. Fibonacci Retracements and Extensions

4.

2 Setups in the 30-YR Bond and Weekend Trade Updates

Our Trade Plan rules typically keep us on the right side of the market. In today’s case, we ended up being TOO cautious with our rules, at the expense of missing multiple setups in the 4 major indices markets, almost all of which worked.

However, our rules usually do keep us out of trouble — which was proven in our 2 setups in the 30 Year Bond futures market (/ZB). In our first setup, we hit both our first and second target, giving us a nice win.

The second setup was a little different, tho

Read MoreRanking Volatility in ES, YM, NQ and RTY Futures

We show you how to rank the 4 major index markets and their respective volatility, in just a few minutes.

As part of our Volatility Box Trade Plan, we have our first hour test, which helps us determine and adapt to the day’s volatility. In today’s case, what we noticed was the DOW and Russell futures giving us signs of being the more volatile markets, while the Nasdaq was on the opposite end of that spectrum.

We perform the First Hour Test for our indices at 7 AM PT, less than 30 minutes into

Read More