Posts Tagged ‘earnings trades’

How to Trade Earnings Volatility

We’ll walk through a simple process that you can use to take advantage of earnings related volatility.

Read MoreALLY Earnings Volatility

In this video, we’ll walk through a simple process to trade earnings volatility with an edge.

Read MoreCorsair Earnings (CRSR) Volatility

In this video, we’ll focus in on the earnings volatility we saw in Corsair Gaming (CRSR), along with do a follow up on our swing trades in Oracle (ORCL) and Opendoor (OPEN).

Read MoreMicrosoft Post-Earnings Trades

Microsoft reported an earnings beat after the close, which gives us opportunity to set up some new trades to play post-earnings moves.

Read MoreFTCH, DIS, AMAT and CSCO Earnings Plays

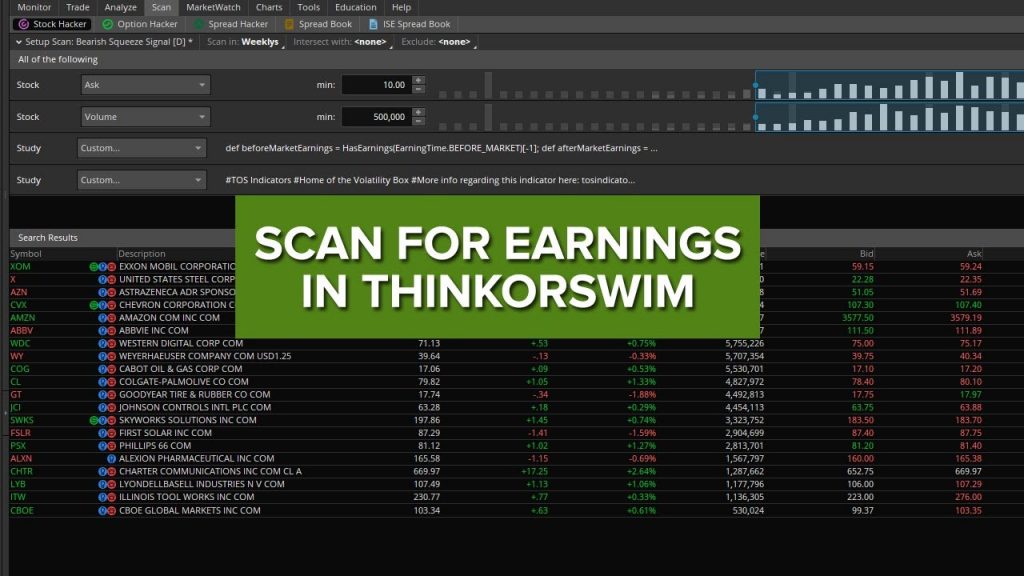

In today’s video, we’ll cycle through 9 different companies reporting earnings today after the close, to try and find trade ideas. For this exercise, we’ll use our Smarter Earnings indicator, which is available for free here: https://www.tosindicators.com/indicators/smarter-earnings

From the 9 trades, here are our final results:

FTCH – Looking for a bullish gap n go, avg bullish move is $1.69, lowest move is $0.24

DIS – Looking for a bullish gap n go, avg bullish move $3.48, lowest move is $0

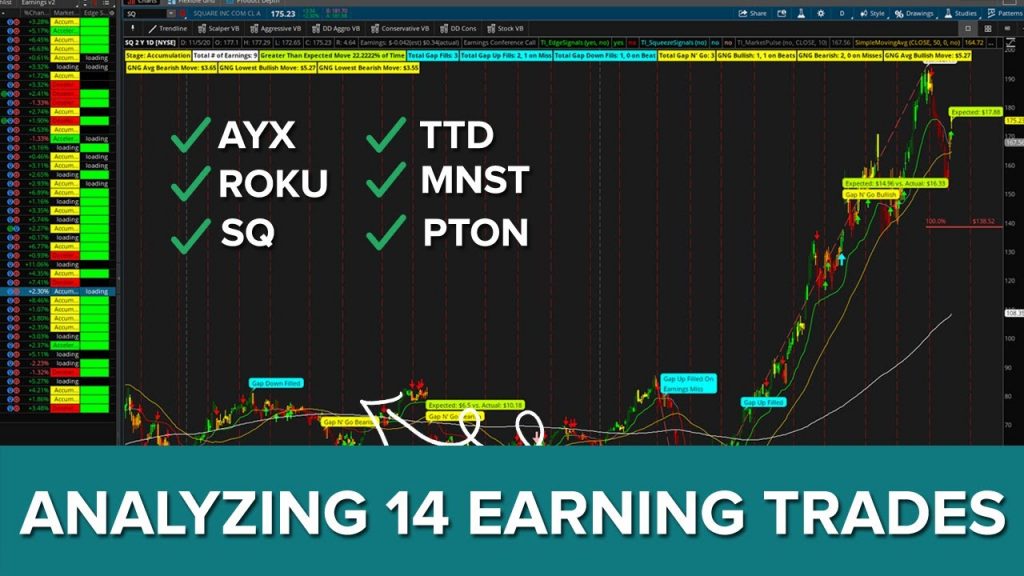

Read More14 Earning Trade Ideas (incl. AYX, TTD, ROKU, SQ)

In today’s video, we’ll cycle through 14 different earnings charts to try and find trade ideas. For this exercise, we’ll use our Smarter Earnings indicator, which is available for free here: https://www.tosindicators.com/indicators/smarter-earnings

From the 14 trades, here are our final results:

AYX- looking for a gap down, and a fill of that gap off of a beat

MNST – looking for a potential gap n go, avg move $2.33, lowest is $1.21

ROKU – looking for a bullish move — either gap fill or gap n

Preparing for MSFT and TSLA Post-Earnings Moves

With earnings season started, we’re going to use the free Smarter Earnings indicator to show you how you can plan and prepare for likely post-earnings moves.

Download Smarter Earnings indicator (free): https://www.tosindicators.com/indicators/smarter-earnings

Starting with the Futures Volatility Box, we had two trade setups today in Gold. The first setup was a stop-out, which cost us 4.5 points per contract, and had us switch from our Aggressive Volatility Box models to our Doomsday Aggres

Read MorePost-Earnings Volatility Box Setup

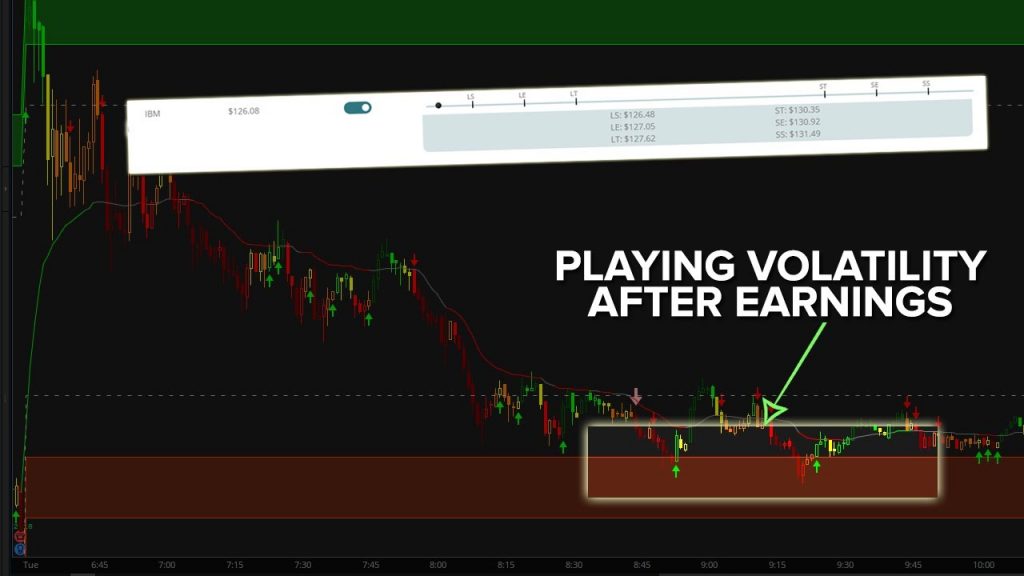

With earnings activity starting to pick back up, we’ll talk about a fairly simple, yet effective setup to play post-earnings moves in your favorite stocks.

For today’s example, we’re going to use IBM, which reported before the market open (and had an earnings beat). On the beat, IBM gapped up higher, but then continued to fill its gap and trend lower for the rest of the day.

The setup comes in looking to “buy the dip” or “fade the rip” and using earnings as a catalyst for a high volatility ev

Read More