Posts Tagged ‘election trades’

Post-Election Volatility Trading

With the election being a close race, we had a good deal of uncertainty that translated into volatility for our 4 major index markets.

During the after hours activity as the election results were slowly trickling out, we saw the S&P, Nasdaq, DOW and Russell futures all moving wildly (with the NQ up 3.5%+ in after hours). This same volatility continued into the market place today.

As a result of this volatility, we had a variety of different trading opportunities set up, which we’ll discuss in

Read MorePre-Election Volatility in the S&P 500

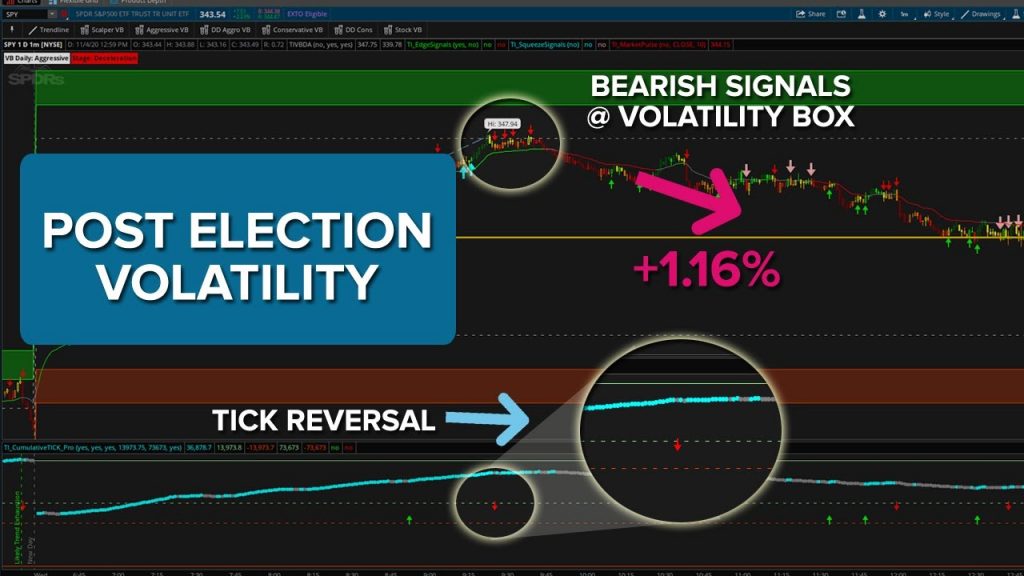

With the election tomorrow night, we’re starting to see some of the “funkiness” that we would expect from pre-election night volatility in the S&P 500.

Specifically today, we had the market internals suggest to us to expect more buying pressure as the day progressed. We also saw a steady rise in the Cumulative TICK indicator, suggesting more buying than selling pressure.

However, when you contrast that with what price action actually did, we’ll see a much different story. Instead of price go

Read MorePre-Election Volatility in Index Markets

With the election right around the corner, we’ve had a good amount of volatility enter our 4 major index markets.

In today’s video, we’ll break down the trade setups that we had in the S&P, Nasdaq, DOW and Russell futures markets. If you don’t trade the full size futures, you can also use the micro-futures equivalents, or even the ETF options.

With today’s chop, we had the S&P and DOW really chopping back and forth in between our Futures Volatility Box entry lines.

We triggered both long an

Read MoreBuying the Dip in ES, YM and NQ Futures

The election volatility in the S&P 500, DOW, Nasdaq and Russell markets continue, with day trading opportunities setting up.

Today, we had an opportunity to buy the dip in the ES, YM and NQ futures. Similar to yesterday, there were 2 winners and 1 loser.

P/L (2 contracts):

1. S&P 500 (/ES) Futures: +24 points, +$1,200

2. Nasdaq (/NQ) Futures: -50 points, -$1,000

3. DOW (/YM) Futures: +190 points, +$950

Well discuss all 3 trades that setup today, including the winners and losers.

For those

Read More