Posts Tagged ‘fibonacci trades’

Squeeze Setup in DLTR and Trade Update in AFL

We’ll setup a new squeeze trade in Dollar Tree (DLTR) which has won 4 out of 4 times, over the past 5 years.

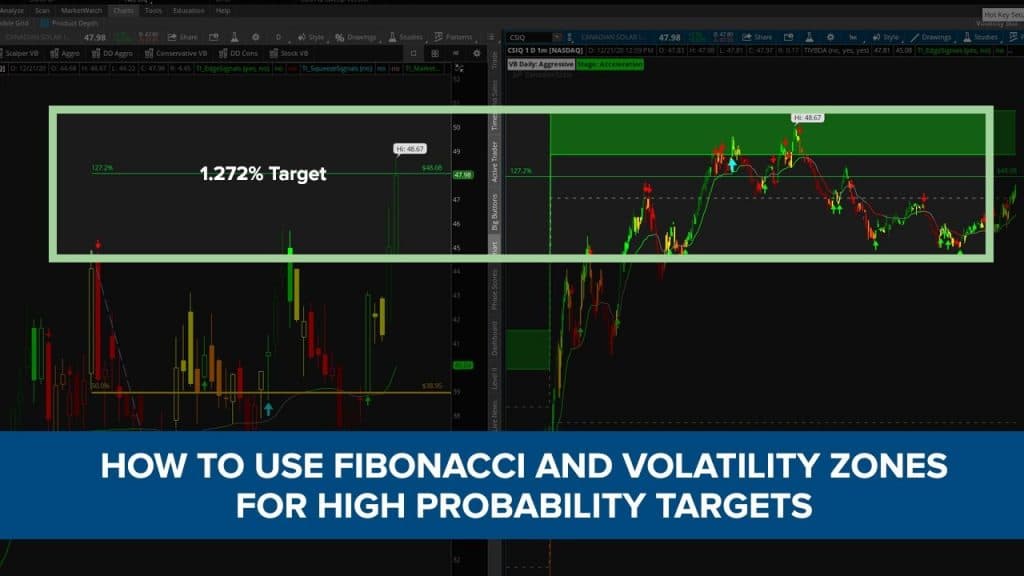

Read MoreHow to Use Fibonacci Extensions and Volatility Ranges for Trade Targets

Video Transcription Today’s video is all about how you can easily use the Fibonacci extensions tool along with our Volatility Box to get high probability target zones from which you expect price action to start to reverse. Now for today’s example, we’re going to be focusing on Canadian Solar (CSIQ) and the reason why I’m…

Read MoreTLT Fibonacci Trade Idea (50% Retracement Pullback)

With a rather peculiar year, we’ve seen markets like TLT have a greater than average percentage gain, so far into 2020.

In today’s video, we’ll discuss a trade idea setting up in TLT, as a result of the recent gap lower. Price action is currently hovering around the 50% retracement mark, using the swing high to swing low in TLT.

Additionally, if we use a previous swing high to swing low Fibonacci retracement, we’re able to create a cluster zone. So far, price action has respected this zone,

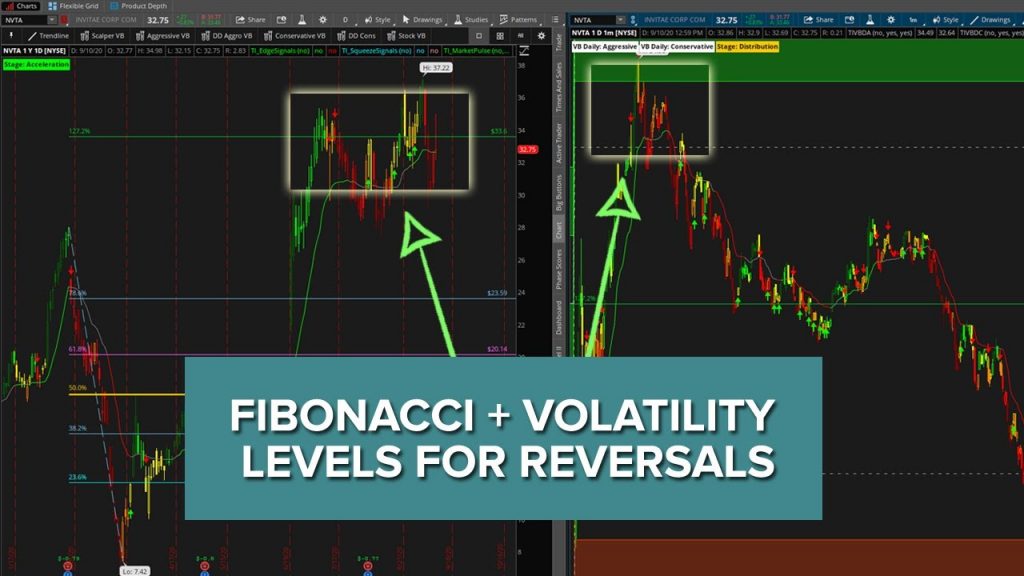

Read MoreStock Volatility Trades in NVTA, SPY and QQQ

In this video, we’ll review the Stock Volatility Box’s performance for today, as well as dive deeper into the charts of NVTA, SPY and QQQ to look at 3 specific setups.

With the recent burst of volatility, we’ve seen more stocks hit our Live Scanner compared to usual. The Live Scanner is a “machine” that we’ve built, whose job is to update every 15 seconds with new trades that breach our Volatility Box edges.

Today, we had more than 229 trades that hit our Live Scanner over the course of the

Read MoreTrading Daily and Hourly Volatility Levels on Indices

After 3 days of breaking outside of our most conservative models, we saw price action start to stabilize just a bit.

In today’s video, we’ll layer on both our hourly and daily volatility ranges to look and trade the indices. We sent out the daily volatility ranges, part of the Stock Volatility Box platform, to all of our Futures VB members as well, which ended up triggering for some nice trades across the board.

Via our Futures VB levels, we had a total of 7 trades, with a net P/L of +$1,410,

Read MoreSell Off in the Markets – Trigger Zones to Monitor

We had a relatively sharp sell off in the markets today, with many markets breaking outside of even our most conservative volatility models in the 7-8am PT and the subsequent hour.

We had all of our major indices markets break outside of our Doomsday Conservative Volatility Box clouds (ES, YM, NQ, and RTY), along with markets such as the 30-YR Bond, Gold, and Silver (ZB, GC, and SI). While that led to a challenging day in day trading the futures, it’s important to also take a step back and asse

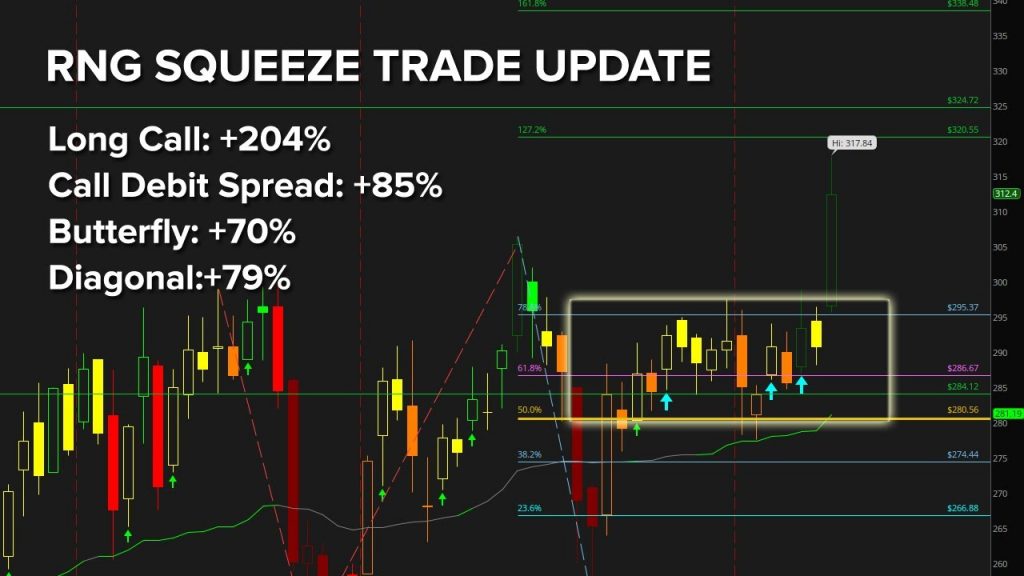

Read MoreRNG Options Trades Winner Follow Up (Stock Up +9%)

On August 30, 2020, we set up 4 different options trades in Ring Central (RNG), looking for a bullish move to $320.

We were looking at the September series options with 19 DTE, but got the move much sooner in less than 2 days. In today’s video, we’ll do a follow up on picking smart targets, along with an update to the option’s pricing to gauge which strategy was most effective.

The 4 trades that we had set up were:

1 – Long Call ($4.90 now worth $14.90)

2 – Long Call Debit Spread ($3.00 now w

4 Options Trade Ideas in Ring Central (RNG)

In today’s video, I’d like to focus on one stock, which I think has some trade opportunities setting up. We’ll spend some time evaluating the stock chart on a daily time frame, along with its option’s chain.

The stock that we’ll be taking a look at is Ring Central — they started by making the video doorbell, and have expanded their line of offering to a suite of security, and some even non-security applications now.

That’s to say – their product line has been gradually expanding, and I woul

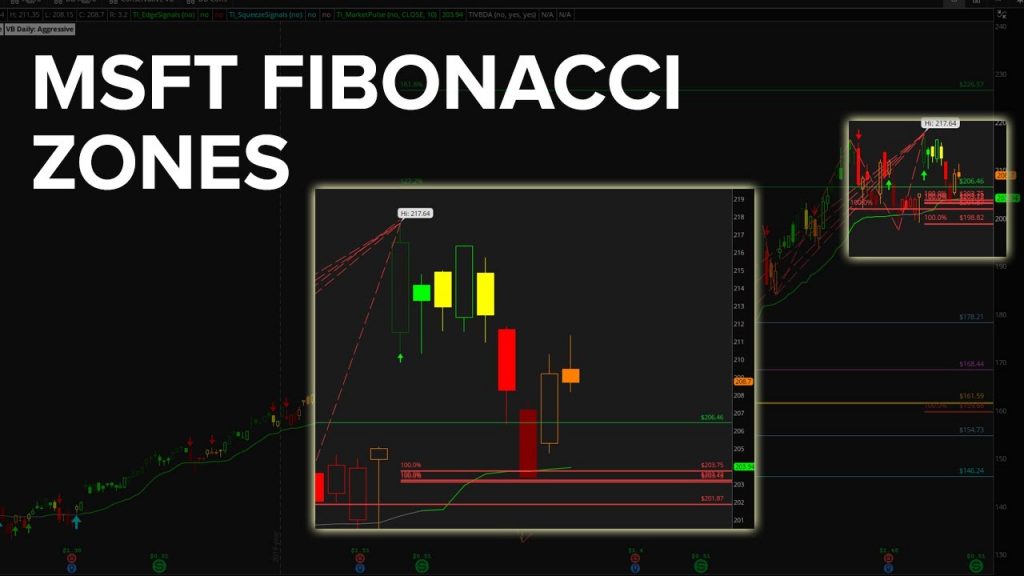

Read MoreMSFT Fibonacci Levels and Stock Volatility Trades

We’re going to talk about 3 different stock topics in this video:

1 – Microsoft (MSFT) fib zones update, with new levels for entry, along with potential target zones

2 – Bullish short squeeze trade opportunity in PAGS

3 – Review of 3 Stock Volatility Box trades in ADSK, DDOG and GMAB

With MSFT, we’ve seen a pullback into the Fibonacci levels on this entire recovery move up, and we’re looking for a similar continuation of trend to the 1.618% extension.

In PAGS, we have a squeeze that looks l

Read MoreFibonacci Levels – SPY, QQQ, IWM, DIA, MSFT, NFLX and CSCO

Once again, we have a nice pullback setting up in the markets, giving us some new opportunities to enter on a trend pullback.

In this video, we’re going to start by reviewing what the SPY, QQQ, DIA AND IWM are telling us, by using price action, volume and Fibs. While QQQ currently offers us the most Fibonacci-support, it’s also the most extended (duh), having reached its 1.272% extension of the Feb-March swing high to low.

We’re going to use that to dive deeper into some stocks in the Nasdaq,

Read More