Posts Tagged ‘fibonacci trades’

High Short Interest and Bullish Squeeze in Lumentum (LITE)

In less than 5 minutes, we’re going to scan through 60 stocks to find high short interest trade opportunities (using the weekly time frame).

The scan that we use in today’s video is our Edge Signals scan, looking to find places where we had the signal print bullish with last week’s close. We also overlaid a squeeze condition on top, looking for a squeeze likely to fire long.

Using that list, we have these 4 stocks, that looked interesting and had relatively high short interest:

IFF,

VCTY,

T

SPY, QQQ, DIA and IWM Buy Zones and Triggers

We saw a broader sell off in the indices with Friday’s trading, leading many top weighted holdings to start to pull back to entry zones.

In this video, we’re going to use a few different perspectives (and indicators) to create a game plan, with specific levels that I’m interested in buying as support on the SPY, QQQ, DIA, and IWM.

We’re going to use the following tools for the analysis:

1. Put Call Ratio in the Utility Labels

2. Market Pulse Line

3. Fibonacci Retracements and Extensions

4.

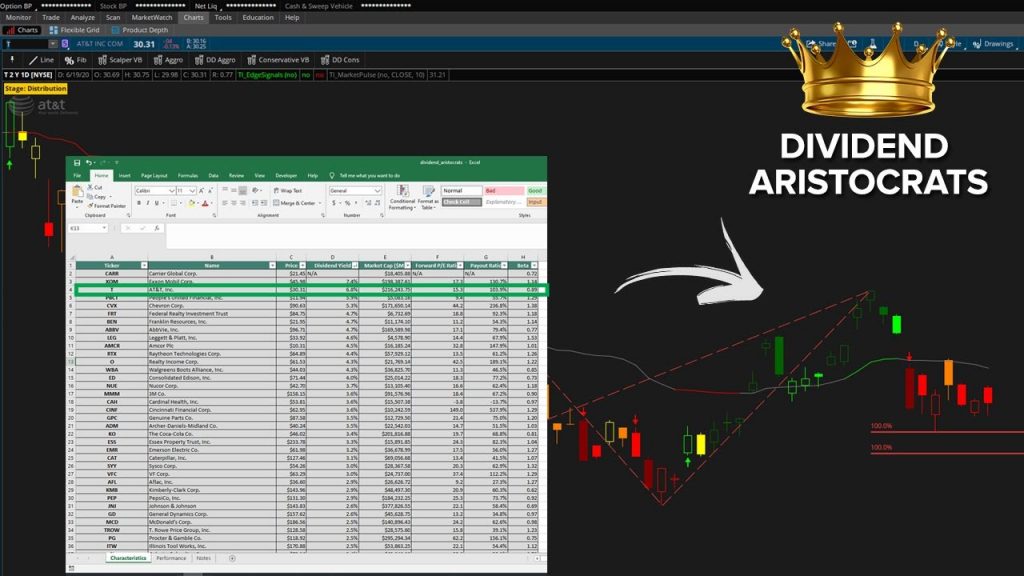

Finding Trade Opportunities in the Dividend Aristocrats

The Dividend Aristocrats is a list of S&P 500 stocks, that have been increasing their dividends for 25+ consecutive years.

The full list is available for free download: https://www.suredividend.com/dividend-aristocrats-list/

This gives us an instant list of high quality stocks, where we can start to look, to find opportunity when most everything else in the marketplace feels extended. There are currently 66 stocks on the Dividend Aristocrats list (June 2020), and we’ll be focusing on one in p

Read More