Posts Tagged ‘fomc’

Take Advantage of FOMC Volatility in SPY

Here is a simple way to take advantage of FOMC related volatility in the S&P 500, using SPY.

Read MoreWhich Sector Did FOMC Affect Most Today?

Review the 4 major index ETFs, along with all 11 SPY sector ETFs, to compare and contrast volatility across the board. There were a handful of sectors that exhibited more optimism and buying pressure, compared to the rest of the bunch.

Read MoreThe 4 Stages of FOMC Volatility for Day Trading

A complete breakdown of the 4 different stages of FOMC volatility, including examples and common characteristics.

Read MoreFOMC Trading – S&P 500 (Fed Raises Rates – July 2022)

The Fed raised rates, which led to an increase in volatility in the markets. We’ll take a look at how the “FOMC Model” played out today, with volatility trading in the S&P 500.

Read MoreFOMC Volatility – S&P 500 (July 2022)

We’ll compare and contrast July 2022’s FOMC volatility to that of past FOMC Meeting Minutes.

Read MoreFOMC Volatility – S&P 500 (June 2022)

In today’s video, we’ll compare and contrast June 2022’s FOMC volatility to that of past FOMC Meeting Minutes.

Read MoreFOMC Volatility – S&P 500 (May 2022)

In this video, we’ll see how the markets moved, once Fed chair Powell took the stand and gave his statement.

Read MoreFutures Scalping – S&P, Nasdaq and DOW

We’ll focus on the S&P 500, Nasdaq and DOW futures markets in today’s video, discussing the scalp trade opportunities that setup using our volatility models.

Read MoreFOMC Volatility – S&P 500 and Nasdaq (Jan. 2022)

In today’s video, I’ll share a candle-by-candle walkthrough of the FOMC volatility we saw, after the announcement today at 11am ET.

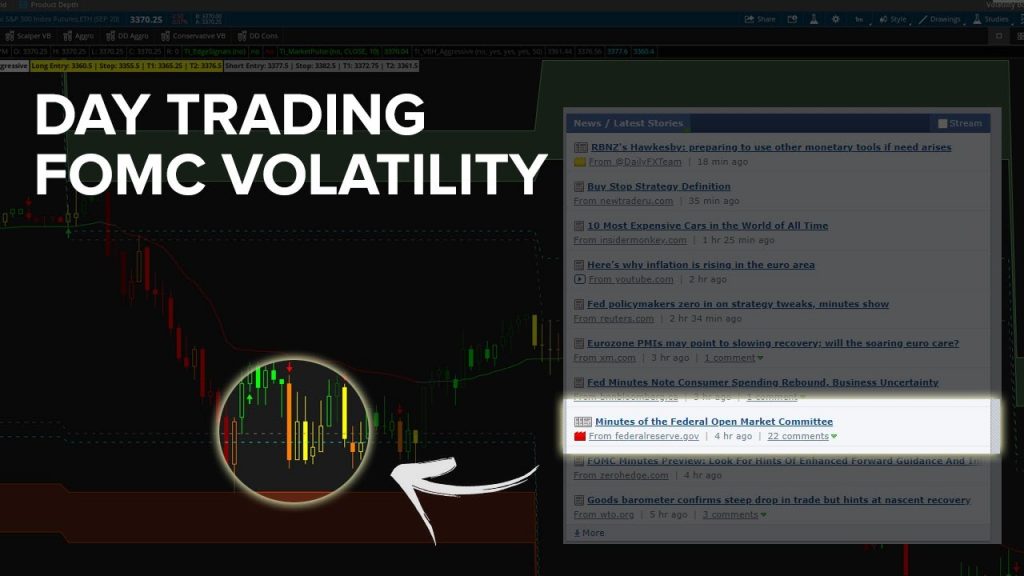

Read MoreDay Trading Futures Through FOMC Minutes Volatility

The release of the FOMC Minutes served as our catalyst for volatility in the futures market place today, leading to 7 futures day trades.

In today’s video, we’ll discuss all 7 of those trades, walking through all of the breaches and setups. Most of our trades today came in the 11-12p PT hour (when the FOMC minutes were released), which led to a burst of volatility in the marketplace.

Outside of the indices and 30-YR bond, we also had futures volatility trades that set up in markets like Crud

Read More