Posts Tagged ‘futures walkthrough’

S&P 500 Futures – Fed Volatility Trade Setup

A complete breakdown of a volatility setup inside of the S&P 500 futures, setting up as a result of Fed’s Waller comments earlier in the day.

Read MoreAnchored VWAP – March 2020 vs. June 2022

We’ll use the Anchored VWAP to compare how price action has evolved from March 2020 lows to June 2022’s volatility.

Read MoreDay Trade Volatility With These 3 Setups

I’ll share the 3 setups that I’m focusing on trading, to profit from this current increase in volatility.

Read MoreKey Resistance Level on S&P 500

A step-by-step guide on how to find key resistance levels inside of the S&P 500, by yourself.

Read MoreFade Setup Examples – Index Futures (ES, YM, NQ, RTY)

Study the many examples in this video to master the popular Fade Setup, and use it to consistently profit from the markets.

Read MoreVolatility Fade Setup – Rules and Examples

A detailed, step-by-step guide on the Fade Setup, and using it to consistently profit from the markets.

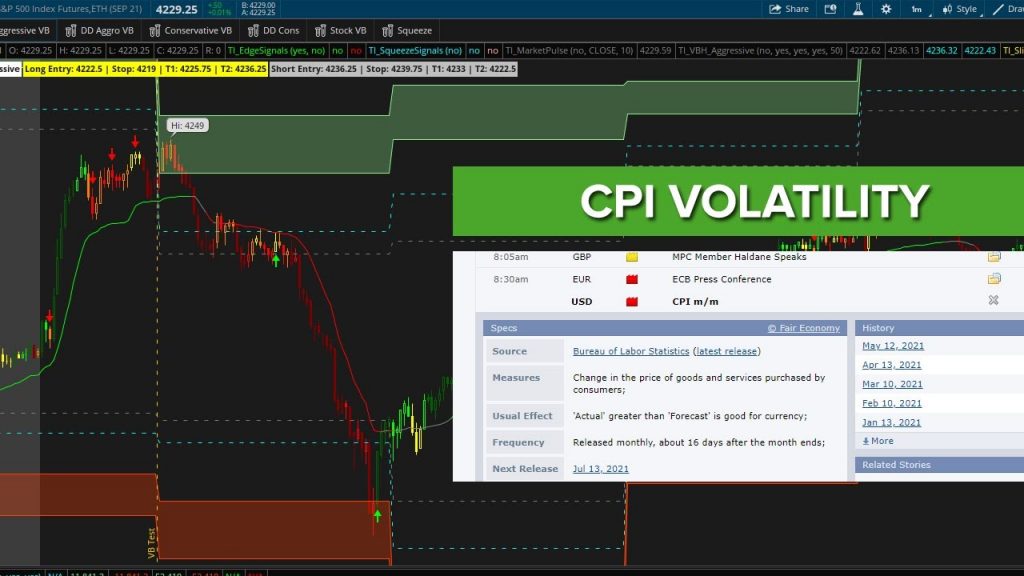

Read MoreConsumer Price Index Volatility – Day and Swing Trading Setups (Jun. 2021)

A step-by-step guide on how to take advantage of CPI headlines and volatility that comes with it.

Read MoreVolatility Framework for Stocks & Futures – Examples

Learn how to take advantage and profit from planned volatility catalyst events in Crude Oil, using the Inventories Report.

Read More/ES and /YM Volatility – Live Commentary

Live commentary, walking through two different volatility trade setups in the /ES and /YM futures markets.

Read MoreVolatility Reversal Setup Walkthrough

This is a longer form, detailed walkthrough for Futures Volatility Box members, recapping all fade setups from May 10, 2021’s trading activity.

Read More