Posts Tagged ‘futures walkthrough’

SPY vs SPX Options for Buying the Dip

In today’s video, we’ll compare using SPY vs SPX 0 DTE options to trade our volatility levels on the S&P 500 index market.

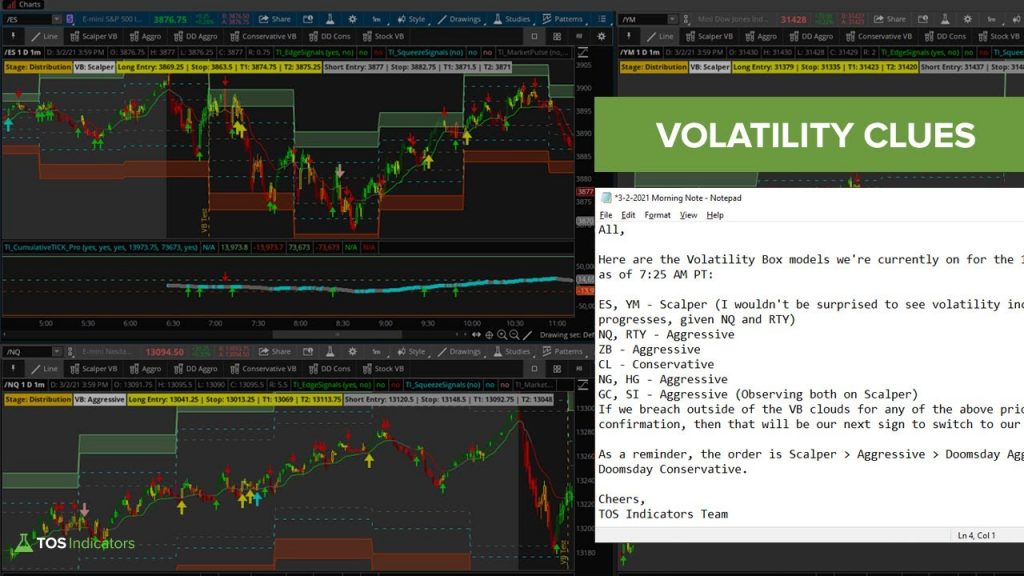

Read MoreWalking Through the Morning Volatility Note

Morning volatility can be a very useful source of information around what to expect for the day, as long as you can read it.

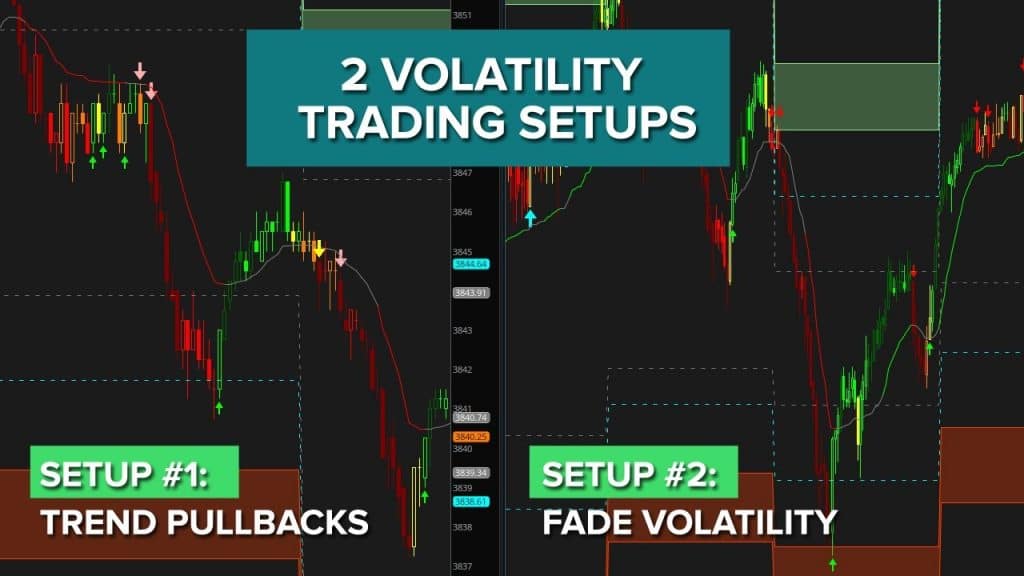

Read More2 Volatility Setups to Trade Futures

2 different setups to take advantage of and profit from volatility, using the Volatility Box.

Read MoreRTY Futures Day Trade Walkthrough

We’ll walk through a “picture perfect” setup in the Russell Futures (RTY), which set up today in the 9-10am PT hour.

During the middle of the east coast lunch time, we had the Russell hit our dashboard, when price action reached our Volatility Box entry lines. This gave us an opportunity to get short, once we had the Edge Signal confirmation.

In today’s case, we had several different components which supported the short:

1. We had multiple Edge Signal confirmations (our oversold / overbought c

Cumulative TICK and Volatility Ranges – Day Trading /ES Futures

We had both trend and fade opportunities that set up in the S&P 500 futures (/ES), for high probability trades.

With the morning gap down lower, we had the TICKs consistently signaling selling action. This was easy to see via the Cumulative TICK indicator, with the pro version signaling that we should expect to see a likely trending down move.

Shortly after the notification at 7:00am PT, we had a pullback to our Market Pulse line, giving us a better place to start building a position with ETF

Read More