Posts Tagged ‘pillar’

2 Ways to Identify Trending Markets

We have two easy ways to discover likely trending markets, using data-driven tools that we’ve created. In today’s video, we’ll discuss both of those methods and break them down with some examples.

Our first method of identify trending markets is built inside of the Volatility Box. We’ve used data here to identify specific price action clues in the first few hours of the market being open, to determine whether the market is likely to trend.

Today, we had Copper give us the indication that we sh

Read MoreMorning Volatility Clues for ES, YM and RTY

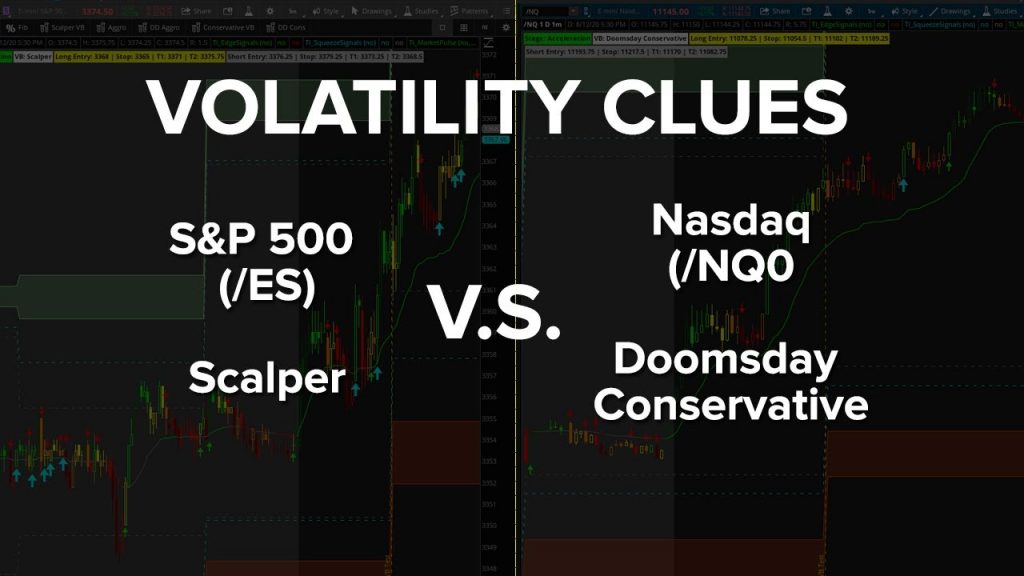

In today’s video, we’re going to use our first hour Volatility Box test to find clues around what to expect for the rest of the day.

Today, we saw that the 30-YR Bond Futures (/ZB) and the Nasdaq Futures (/NQ) both gave us clues to expect more volatility as the day progresses. We’ll review whether or not the clues were accurate, and what actually happened as the day progressed.

In the Nasdaq, we were on our Doomsday Conservative models (which are the most conservative models we have), compare

Read MoreHow to Easily Identify a Trending Day (Before It Sets Up)

Trending days are some of the most powerful ones, if you know the signs for which to look out.

Unfortunately, more times than not, keeping track of things like the market internals ($TICK, $ADSPD, $PCVA, etc.) can be overwhelming, and lead to analysis paralysis with no real action.

The Volatility Box makes identifying a Trending Day super easy – a chart bubble pops up notifying you to expect a likely trending day. It’s that easy. In the case of the /ES futures, we had the heads up at 7 AM PT

Read More