Posts Tagged ‘s&p 500’

Opening Range Breakout (ORB) Strategy Backtest – SPY vs. QQQ vs. AAPL

Is the ORB strategy working in any market consistently, during this volatility? Let’s put it to the test with our ORB backtester, comparing SPY vs. QQQ vs. AAPL.

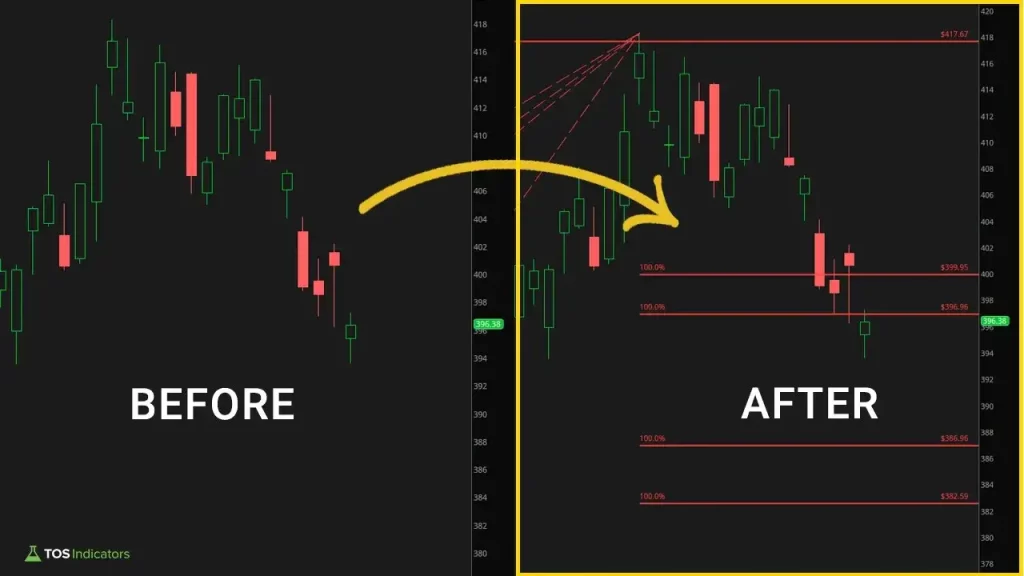

Read MoreS&P 500 Fibonacci Retracement Levels (Feb. 2023)

Start with a blank chart of the S&P 500, and learn how to mark it up from scratch using a Fibonacci Retracements and price channels.

Read MoreSPY Lotto Butterfly Idea

In today’s video, I’ll share a lotto trade idea in SPY, which is targeting a move to the Market Pulse line, and a bounce from the shorter term trend channel.

Read MoreMarket Volatility and Impact on Individual Index Markets

We’ll review the overall market’s volatility from this morning, when we had the S&P 500, DOW, Nasdaq, and Russell all break key volatility zones.

Read MoreFutures Day Trading – S&P and NASDAQ – 2 Different Setups

The S&P 500 (/ES) and NASDAQ (/NQ) futures both presented multiple day trading setups today. We’ll review two different kinds of setups, for both trend following traders and trend reversal traders.

Read MoreA Simple Setup to Profit From Opening Range Volatility

Learn a simple setup that you can use to capitalize on morning volatility, and take advantage of sharp reversals in the markets.

Read MoreVolatility Breakdown – First Trading Day of 2023

An in-depth volatility review of 10 major futures markets, reviewing their volatility profile on the first trading day of 2023.

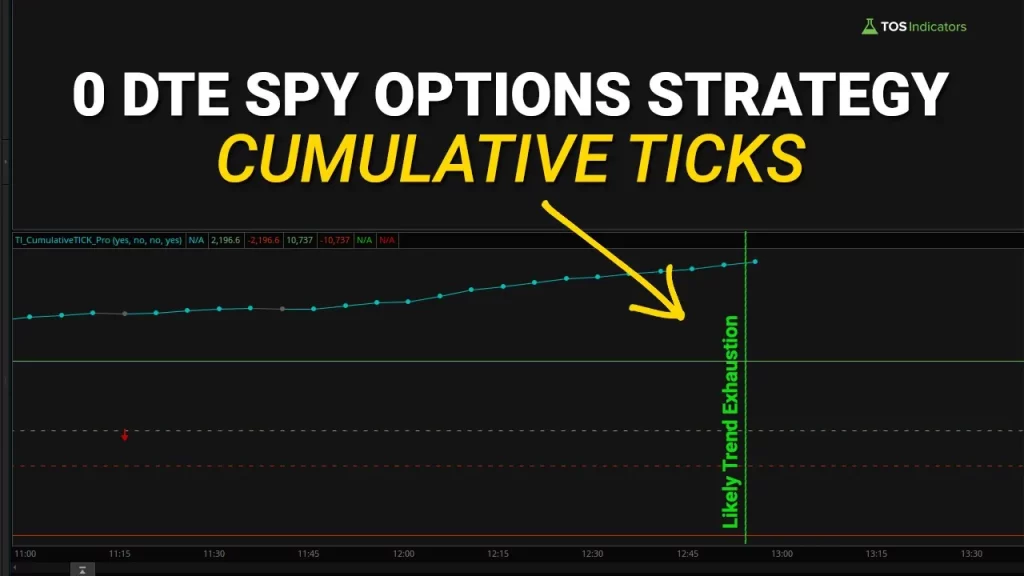

Read MoreWhat Market Internals are Telling Us About Tomorrow

With today’s rally, the Cumulative TICKs are telling us to expect a likely trend exhaustion tomorrow. I’ll share the exact day trading and swing trading triggers that I’m waiting for, in order to take advantage of this setup.

Read MoreVolatility Day Trading – Stocks and Futures Recap

Let’s review futures and stock volatility trade setups for day trading today’s event-driven day.

Read MoreSeptember Seasonal Patterns

We’ll explore the seasonality tendencies in the month of September, for the 4 major index markets, going back 20 years.

Read More