Posts Tagged ‘s&p 500’

S&P 500, Nasdaq and DOW – Major Levels (September 2024)

These are the major levels to pay attention to in the S&P 500, Nasdaq, and DOW Jones as the markets flirt with a new all time high.

Read MoreS&P 500 and Nasdaq – Fibonacci Levels (August 2024)

The S&P 500 stock is giving you a RARE opportunity to buy the dip, after a steep sell-off. Profit from this volatility with the exact Fibonacci extensions levels.

Read MoreIs Costco Stock (COST) STILL A Buy After Falling 12%?

This S&P 100 stock is giving you a RARE opportunity to buy the dip, after a nearly 12% sell-off. Profit from this volatility with the exact Fibonacci extensions levels.

Read MoreS&P 500 and Nasdaq – Fibonacci Levels (July 2024)

Here’s a detailed overview of all of the key levels to look for in SPY, QQQ, VGT, and VOO.

Read MoreTake Advantage of FOMC Volatility in SPY

Here is a simple way to take advantage of FOMC related volatility in the S&P 500, using SPY.

Read MoreBuy the Dip in SPY at $500?

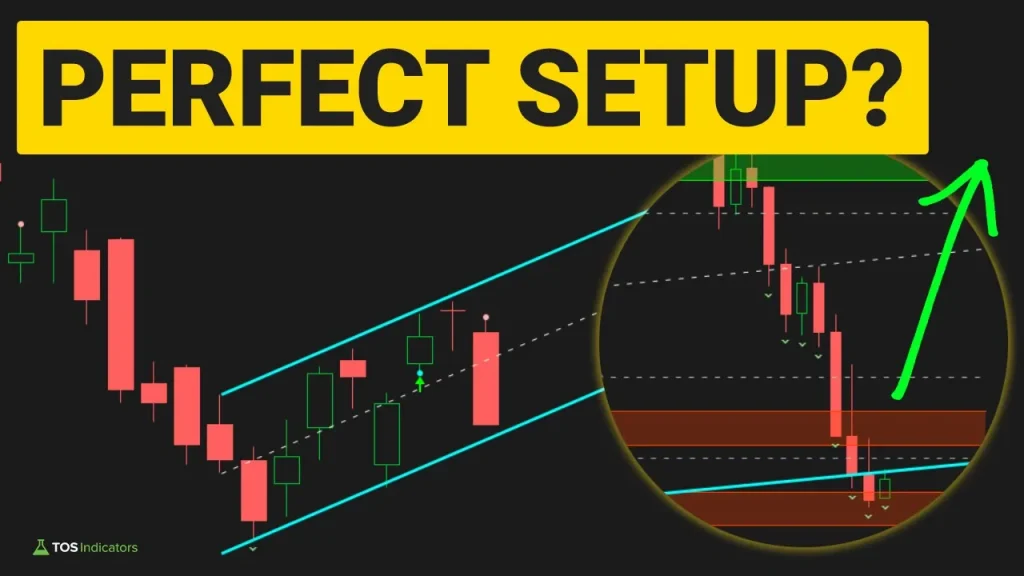

Is the S&P 500 a buy at these key levels? Here’s a simple way to use volatility and price channels for a comprehensive look.

Read MoreUsing the VVIX to Trade SPY

Here’s a simple clue to look for in the VVIX, when trading the S&P 500. We’ll take a look at three market internals, and what each was telling us.

Read MoreS&P 500 – Fibonacci Levels (Jun. 2023)

Let’s review the updated Fibonacci levels in the S&P 500, taking a look at 3 different major swings from 2020, 2022, 2023.

Read MoreS&P 500 – Fibonacci Levels Update

A quick update on the S&P 500 Fibonacci Levels that we have been tracking in this most recent sell-off, along with a game plan of what we need to see for our bias to reverse.

Read MoreHow Low Can the S&P 500 Fall?

We’ll use Fibonacci extensions in our current bear market to project downside levels, if the S&P 500 continues to keep falling.

Read More