Posts Tagged ‘s&p 500’

Are the Markets Too Extended?

A step-by-step guide on how to determine if a market is extended, and likely to revert back to its mean.

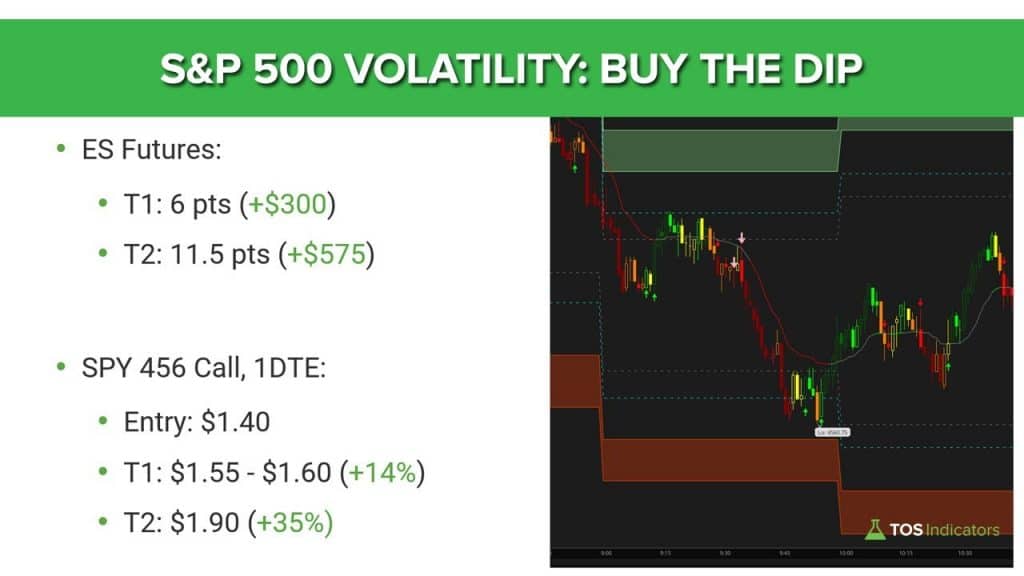

Read MoreS&P 500 Volatility – ES Futures vs. SPY Call Options

In today’s video, we’ll break down the S&P 500 in particular, focusing in on the “Buy the Dip” setup that triggered in between the 9-10am PT hour.

Read More10-Minute Process to Analyze Market Volatility Every Morning

I’ll walk through a 10-minute process that you can follow every morning, in order to determine and analyze volatility in key markets.

Read MoreFutures Day Trading – NQ & RTY vs. ES & YM (Volatility Comparison)

Spot volatility clues easily in major index markets using this simple trick.

Read More/ES and /YM Volatility – Live Commentary

Live commentary, walking through two different volatility trade setups in the /ES and /YM futures markets.

Read MoreVolatility Reversal Setup Walkthrough

This is a longer form, detailed walkthrough for Futures Volatility Box members, recapping all fade setups from May 10, 2021’s trading activity.

Read MoreSPY vs SPX Options for Buying the Dip

In today’s video, we’ll compare using SPY vs SPX 0 DTE options to trade our volatility levels on the S&P 500 index market.

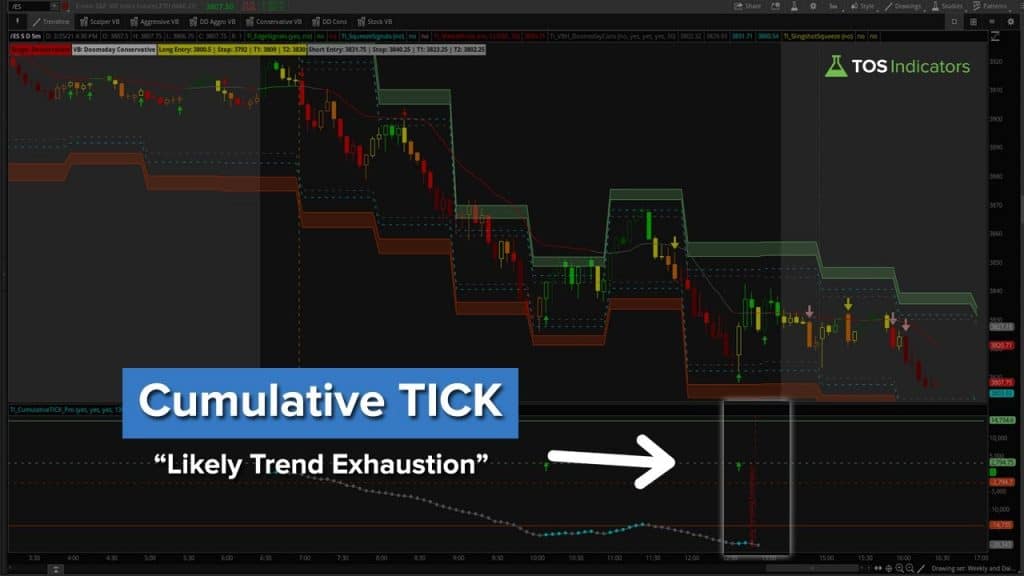

Read MoreCumulative TICK Signal for a 0 DTE Options Trade in SPY

The Cumulative TICKs signaled that we were at a point of likely trend exhaustion on Thursday, headed into Friday. Let’s use this information to set up a 0 DTE option trade.

Read MoreChop vs. Trend Trades in ES, YM, NQ and RTY

Let’s look at visual examples of chop vs. trend trade setups, using the Volatility Box.

Read MoreS&P, DOW and Nasdaq After the First Week of Trading in 2021

With the first full week of trading completed in 2021, we’ll review where the major markets ended in relation to technical levels.

Specifically, we’ll focus in on 6 markets:

1. S&P 500

2. DOW

3. Nasdaq

4. Russell 2K

5. Gold

6. Bonds

In the 4 major indices, we’ve tagged major Fibonacci extensions. While the S&P and Russell has hit its 1.272% extension, the Nasdaq has tagged its 2.00% extension. The DOW, on the other hand, has yet to hit any major extension from the Feb-March 2020 swing.

For

Read More