Posts Tagged ‘s&p 500’

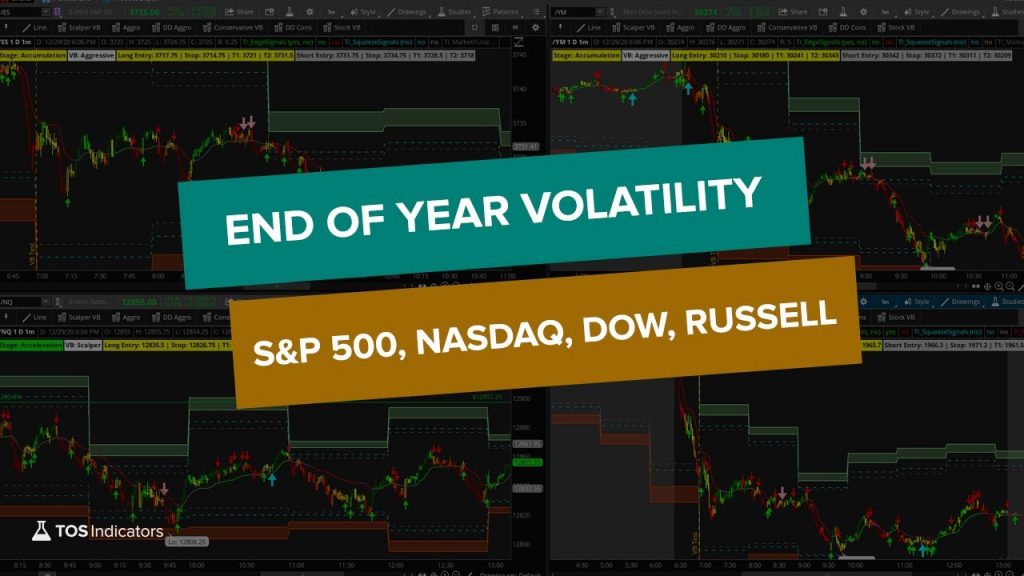

End of the Year Volatility – S&P, DOW, Nasdaq and Russell

In this video, we’ll take a look at the end of year volatility that we’re seeing in the S&P, DOW, Nasdaq and Russell.

Read MoreComparing Volatility in 10 Futures Markets Post-Selloff

We’ll use the Volatility Box models as a structure, to easily rank the markets.

Read MoreSwing Trade in DDOG and Day Trades in S&P 500

We’ll discuss a swing trade setup in DataDog (DDOG), along with breaking down some of the day trades in the S&P 500 (along with one setup for tomorrow).

Starting off with DDOG, we have a pullback on the weekly time frame chart to our bullish Market Pulse line. In addition, we also have a bullish Edge Signal (oversold) confirmation signal on the daily time frame chart.

Here’s the trade parameters for the extensions discussed in the video, along with 4 potential targets depending on how long y

Read MoreScalp Setup on S&P 500 Futures

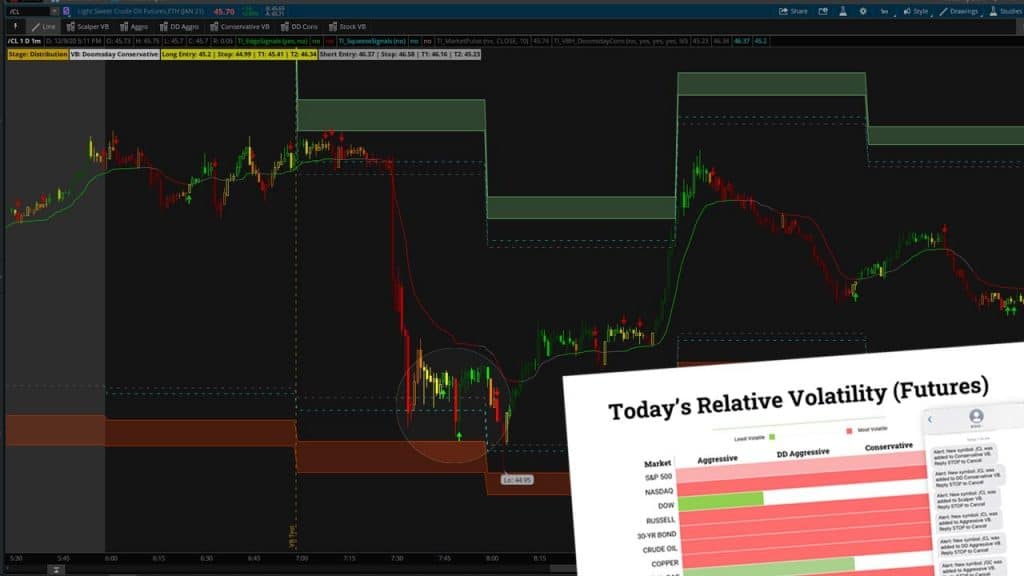

By 7 AM PT, the Volatility Box allowed us to get a quick measure of ranking of volatility within the 4 major indices markets.

Today, that ranking was the following (in order from least to most volatile):

1. ES

2. NQ and YM

3. RTY

The S&P 500 was the least volatile market, still respecting our Scalper Volatility Box. Meanwhile, the DOW and Nasdaq had both broken outside of the scalping models, suggesting more volatility than its peer.

The Russell 2000 was the most volatile, having breached ou

Read MorePost-Election Volatility Trading

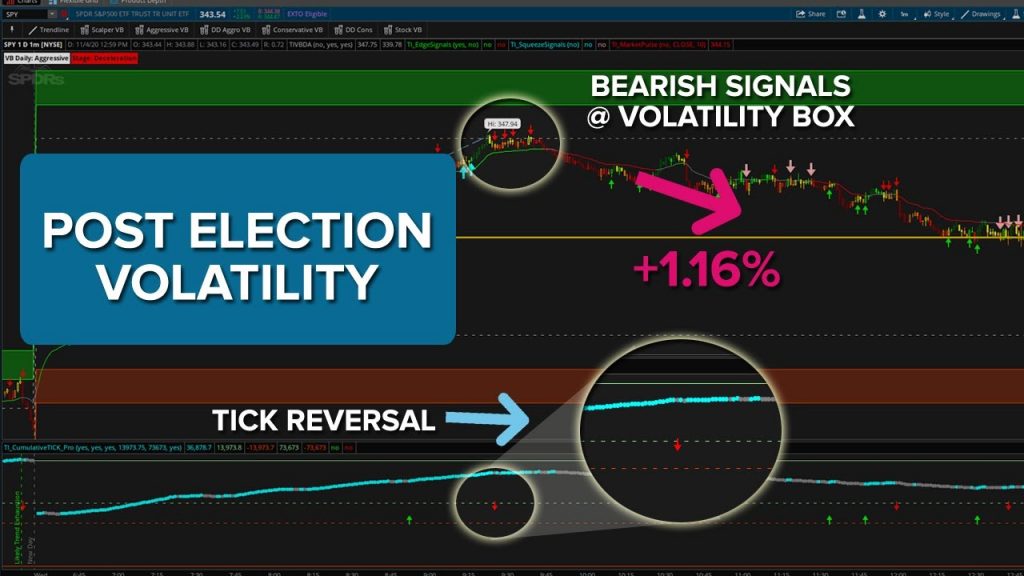

With the election being a close race, we had a good deal of uncertainty that translated into volatility for our 4 major index markets.

During the after hours activity as the election results were slowly trickling out, we saw the S&P, Nasdaq, DOW and Russell futures all moving wildly (with the NQ up 3.5%+ in after hours). This same volatility continued into the market place today.

As a result of this volatility, we had a variety of different trading opportunities set up, which we’ll discuss in

Read MorePre-Election Volatility in the S&P 500

With the election tomorrow night, we’re starting to see some of the “funkiness” that we would expect from pre-election night volatility in the S&P 500.

Specifically today, we had the market internals suggest to us to expect more buying pressure as the day progressed. We also saw a steady rise in the Cumulative TICK indicator, suggesting more buying than selling pressure.

However, when you contrast that with what price action actually did, we’ll see a much different story. Instead of price go

Read MorePullback Levels on S&P and Nasdaq

With today’s selling pressure, supported by high volume, we’ll take a look at potential pullback zones in the S&P 500 (SPY) and Nasdaq (QQQ).

Using Fibonacci, we see in the Nasdaq that we’ve hit the 1.618 extension, and are now pulling back. With the S&P, we have open gaps below us, which look like they are likely to be filled.

In case you’re interested, you can also replicate the same process that we use in tonight’s video on the DOW and Russell as well, for pullback zones.

After discuss

Read MorePre-Election Volatility in Index Markets

With the election right around the corner, we’ve had a good amount of volatility enter our 4 major index markets.

In today’s video, we’ll break down the trade setups that we had in the S&P, Nasdaq, DOW and Russell futures markets. If you don’t trade the full size futures, you can also use the micro-futures equivalents, or even the ETF options.

With today’s chop, we had the S&P and DOW really chopping back and forth in between our Futures Volatility Box entry lines.

We triggered both long an

Read MoreHourly and Daily Volatility Levels – SPY, QQQ, DIA, IWM

As volatility traders, the 2020 election has led to an increase in not only volatility, but also trade opportunities in many of the major markets.

In today’s video, we’ll contrast our Hourly Volatility Box levels with the Daily Volatility Box levels in the 4 major indices. We’ll take a look at ES vs. SPY, NQ vs. QQQ, DIA vs. YM, and IWM vs. RTY.

We’ll also highlight the “Likely Trending Down” heads up that we received with the Cumulative TICK Pro indicator, and how to trade using market inte

Read MoreStimulus Volatility – Futures and Stock Trades

We had stimulus volatility act as a catalyst, leading to some nice trade setups in both futures and stocks.

In today’s video, we’ll cover trades in the 4 major index market futures, along with some stock setups in Pinterest (PINS), FarFetch (FTCH), Baidu (BIDU) and DOW Inc. (DOW).

The first half of the video will focus on the indices trades, where similar to this week, we had 3 winners and 1 loser. We had some nice gains in the /ES, /YM and /RTY futures, while the /NQ was a loser.

With sto

Read More