Posts Tagged ‘squeeze trades’

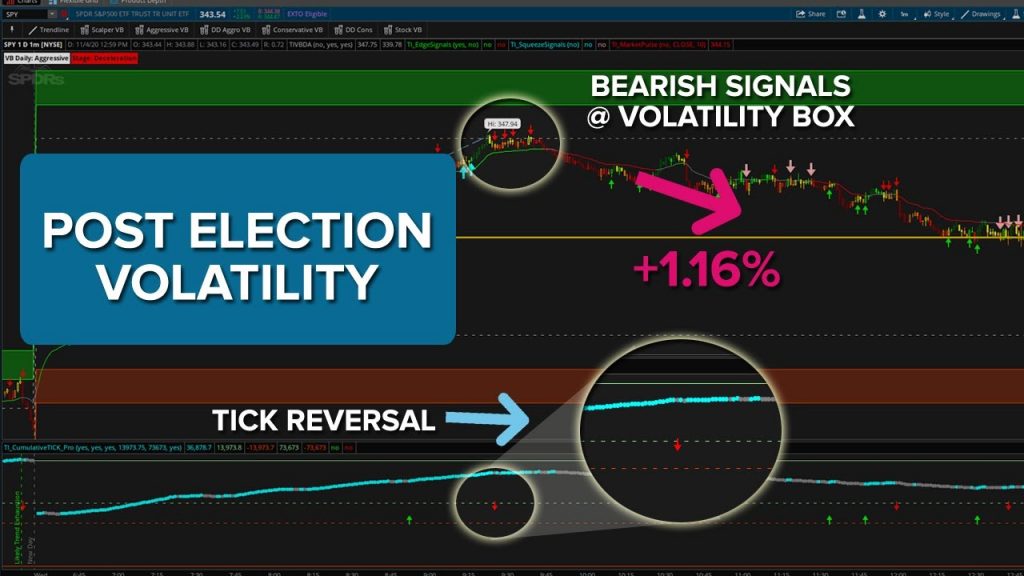

Post-Election Volatility Trading

With the election being a close race, we had a good deal of uncertainty that translated into volatility for our 4 major index markets.

During the after hours activity as the election results were slowly trickling out, we saw the S&P, Nasdaq, DOW and Russell futures all moving wildly (with the NQ up 3.5%+ in after hours). This same volatility continued into the market place today.

As a result of this volatility, we had a variety of different trading opportunities set up, which we’ll discuss in

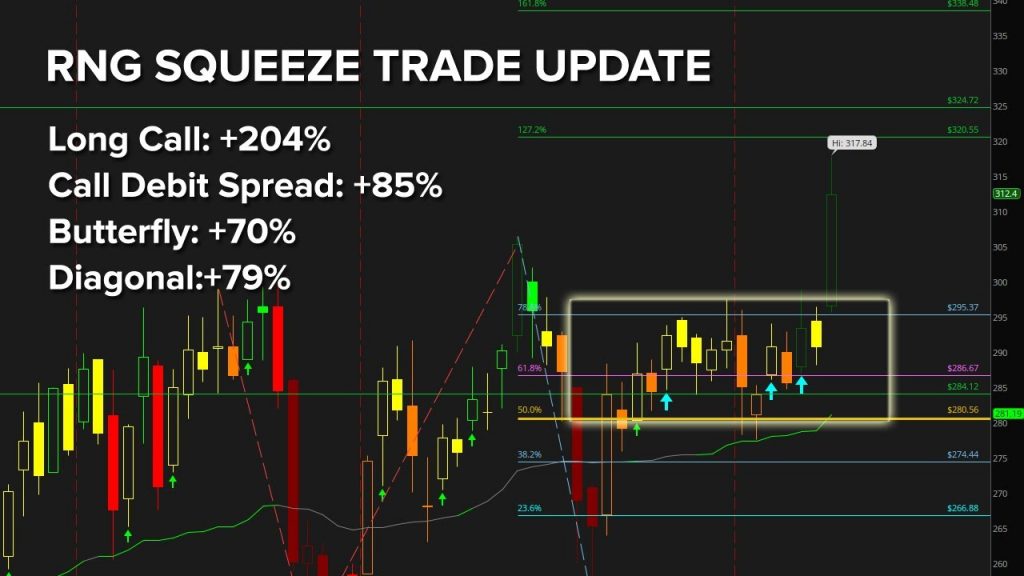

Read MoreRNG Options Trades Winner Follow Up (Stock Up +9%)

On August 30, 2020, we set up 4 different options trades in Ring Central (RNG), looking for a bullish move to $320.

We were looking at the September series options with 19 DTE, but got the move much sooner in less than 2 days. In today’s video, we’ll do a follow up on picking smart targets, along with an update to the option’s pricing to gauge which strategy was most effective.

The 4 trades that we had set up were:

1 – Long Call ($4.90 now worth $14.90)

2 – Long Call Debit Spread ($3.00 now w

4 Options Trade Ideas in Ring Central (RNG)

In today’s video, I’d like to focus on one stock, which I think has some trade opportunities setting up. We’ll spend some time evaluating the stock chart on a daily time frame, along with its option’s chain.

The stock that we’ll be taking a look at is Ring Central — they started by making the video doorbell, and have expanded their line of offering to a suite of security, and some even non-security applications now.

That’s to say – their product line has been gradually expanding, and I woul

Read More3 Real Estate ETFs Ripe for Momentum Moves

In today’s video, we’ll spend some time going through the Squeeze Signals scan results, to try and find clusters of stocks/ETFs in the same sector.

The Squeeze Signals indicator is an indicator which helps us to combine the power of the Triple Pro Squeeze, along with patterns that usually tend to lead to some nice momentum-burst type movements. We build this indicator as part of the Triple Squeeze Course (free for Volatility Box members): https://www.tosindicators.com/squeeze-course

With toda

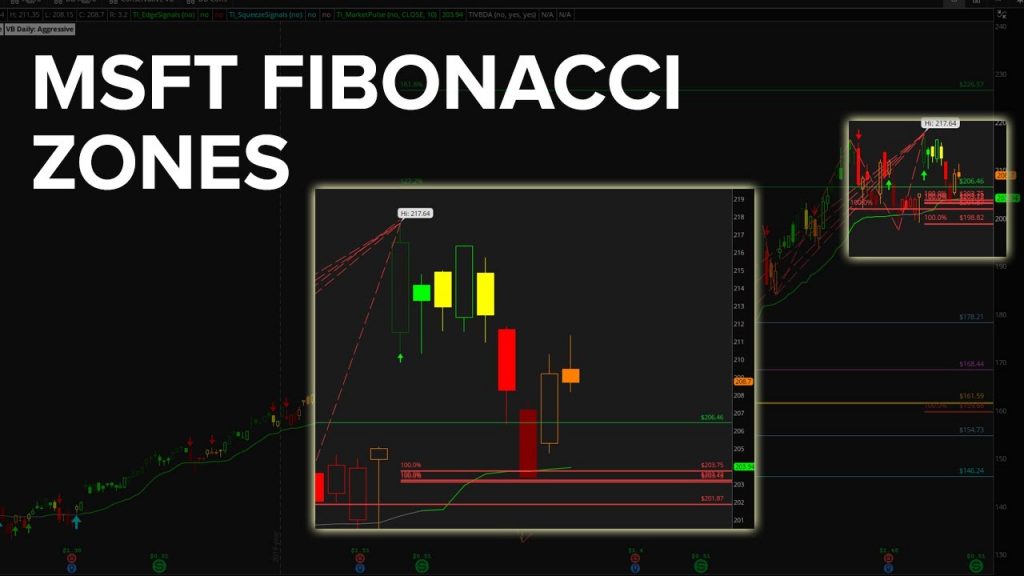

Read MoreMSFT Fibonacci Levels and Stock Volatility Trades

We’re going to talk about 3 different stock topics in this video:

1 – Microsoft (MSFT) fib zones update, with new levels for entry, along with potential target zones

2 – Bullish short squeeze trade opportunity in PAGS

3 – Review of 3 Stock Volatility Box trades in ADSK, DDOG and GMAB

With MSFT, we’ve seen a pullback into the Fibonacci levels on this entire recovery move up, and we’re looking for a similar continuation of trend to the 1.618% extension.

In PAGS, we have a squeeze that looks l

Read MoreFibonacci Levels – SPY, QQQ, IWM, DIA, MSFT, NFLX and CSCO

Once again, we have a nice pullback setting up in the markets, giving us some new opportunities to enter on a trend pullback.

In this video, we’re going to start by reviewing what the SPY, QQQ, DIA AND IWM are telling us, by using price action, volume and Fibs. While QQQ currently offers us the most Fibonacci-support, it’s also the most extended (duh), having reached its 1.272% extension of the Feb-March swing high to low.

We’re going to use that to dive deeper into some stocks in the Nasdaq,

Read MoreHigh Short Interest and Bullish Squeeze in Lumentum (LITE)

In less than 5 minutes, we’re going to scan through 60 stocks to find high short interest trade opportunities (using the weekly time frame).

The scan that we use in today’s video is our Edge Signals scan, looking to find places where we had the signal print bullish with last week’s close. We also overlaid a squeeze condition on top, looking for a squeeze likely to fire long.

Using that list, we have these 4 stocks, that looked interesting and had relatively high short interest:

IFF,

VCTY,

T

High Short Interest Update in CHWY and PETS

Over the weekend, we set up trades in CHWY and PETS, with the help of our new short interest scanner.

Both CHWY and PETS had high short interest, but we also had some key executives selling their shares. This gave us a reason to be cautious, and set up more of a hedge-type trade, as opposed to an outright directional play.

Our final trade was looking for a bullish move in CHWY, with a bearish hedge in PETS, which was the weaker of the two charts.

Since making the video, CHWY has increased +1

Read MoreUpdate to Swing Trade in CloudFlare (Taking +18% Profits)

Start trading with an edge, at the edge, and sign up for the Volatility Box today

Read MoreBullish and Bearish Swing Trade Setups (April 2020)

An overview of bullish and bearish TTM Squeeze setups with high probabilities.

Read More