Posts Tagged ‘swing trades’

Bearish Trade Setup – NTNX

I’ll walk through a bearish setup in NTNX, that stems from an overall bearish trend line, bearish stacked moving averages and a bearish squeeze that is forming.

Read MoreA Trend Reversal Setup for 2022 in Zoom (ZM)

After an incredible run in 2020, Zoom saw a correction for much of 2021. In today’s video, I’ll share the signs I’m monitoring for yet another trend switch in Zoom.

Read MoreTTM Squeeze Trade Setup in AMAT That Hasn’t Lost in 20 Years

In this video, I’ll discuss a daily and weekly timeframe setup in AMAT that has won all 6 of the times it has triggered in the past.

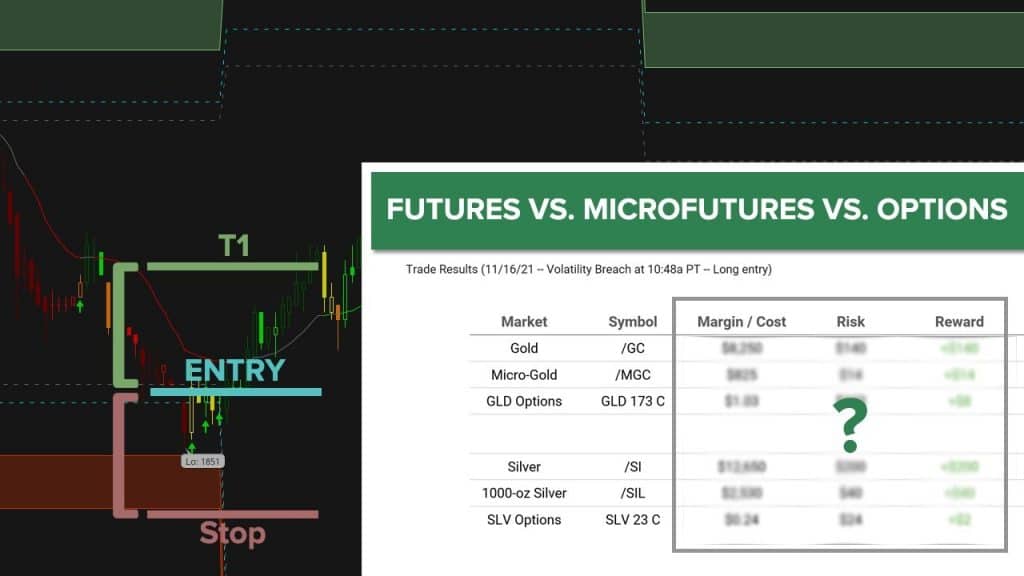

Read MoreFutures vs. Microfutures vs. ETF Options – Gold/Silver Trade Comparison

A side-by-side comparison between futures, microfutures, and ETFs for two key metals (Gold and Silver).

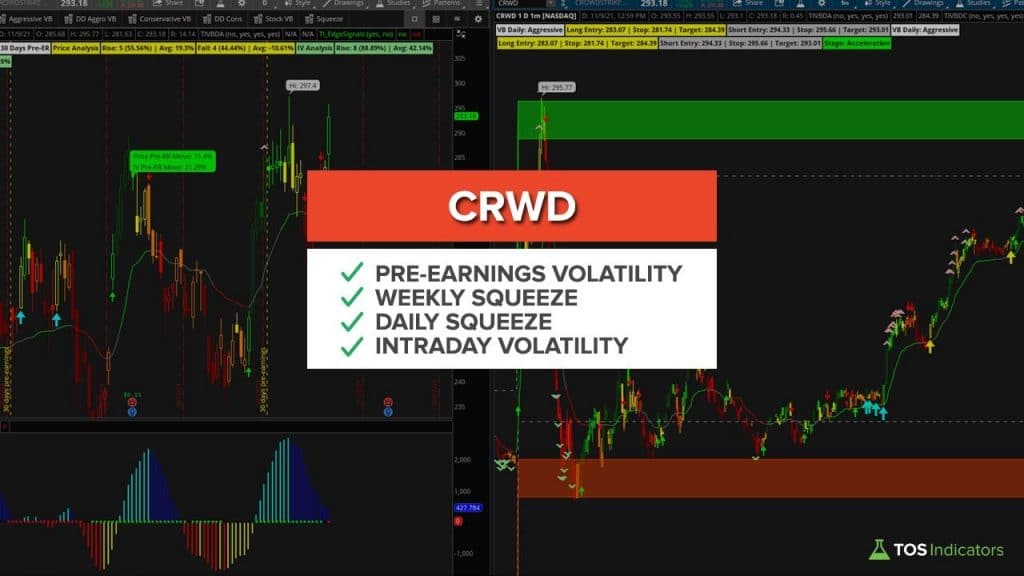

Read MoreCrowdStrike (CRWD) – Pre Earnings Volatility and Multiple Squeezes

Let’s break down a trifecta of setups inside of CrowdStrike (CRWD), where we have pre-earnings volatility, multiple squeezes forming, and intraday reversal opportunities.

Read MoreTTM Squeeze Trade Setup in AMZN That Hasn’t Lost in 20 Years

In this video, I’ll discuss a weekly timeframe setup in Amazon that has triggered 8 times in the last 20 years, and has been a winner all 8 of those times.

Read MoreAre the Markets Too Extended?

A step-by-step guide on how to determine if a market is extended, and likely to revert back to its mean.

Read MoreCoinbase (COIN) Breakout Above Previous Resistance with High Volume

In today’s video, I’ll walk through a breakout that has triggered inside of Coinbase stock (COIN), along with break down a futures reversal trade setup inside of Gold futures (/GC).

Read MoreUtility Labels Indicator for ThinkOrSwim – Quick Sector Overview

Let’s walk through an example of how to use our free Utility Labels indicator, available for ThinkOrSwim.

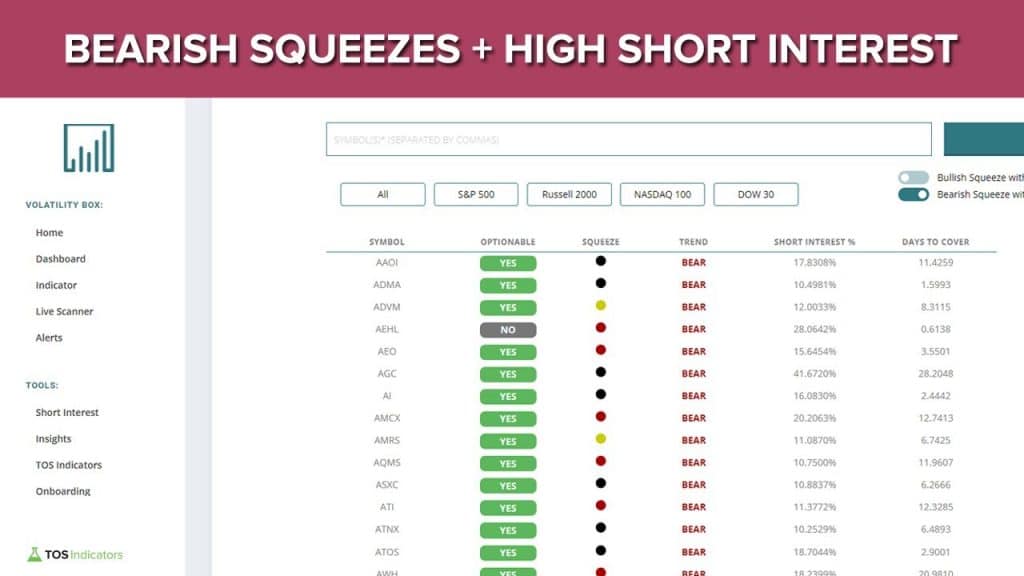

Read More3 Stocks with Bearish Squeezes and High Short Interest

With the market continuing its plummet downwards, we will find opportunities inside of the S&P 500 that have bearish stacked moving averages, with a squeeze forming, and greater than 10% short interest.

Read More