Posts Tagged ‘swing trades’

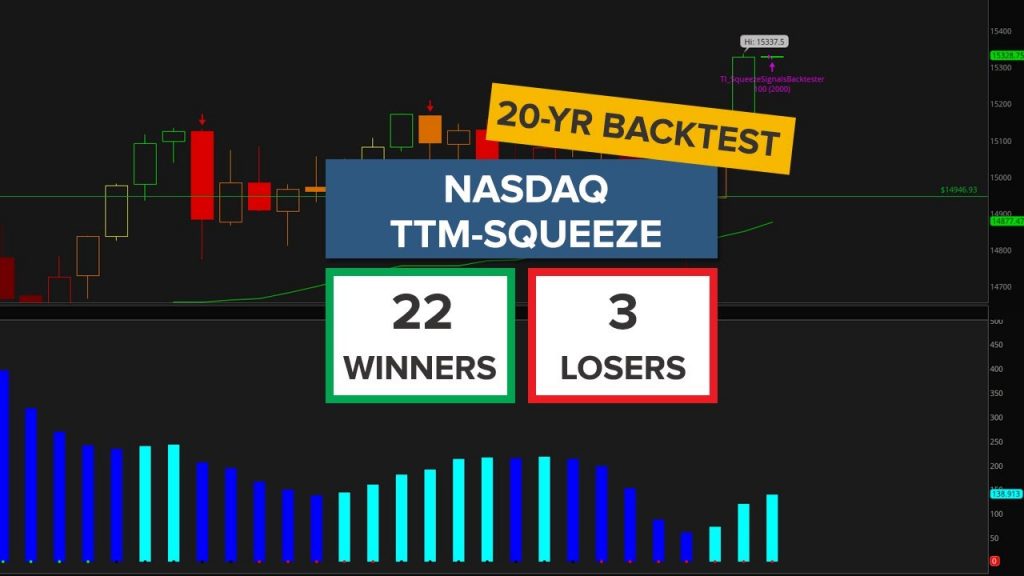

TTM Squeeze Trade Setup in Nasdaq (with 20 Year Backtest)

Over the past 20 years, we’ve had the Nasdaq trigger 25 times using our bullish Squeeze Signals indicator. The signal has been a winner 22 out of those 22 times.

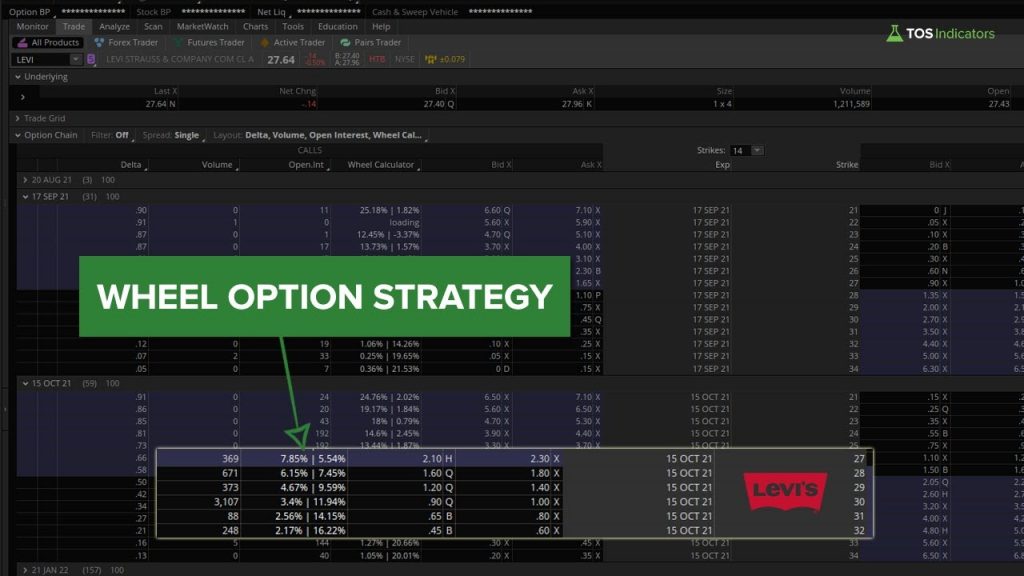

Read MoreWheel Options Strategy in LEVI (Swing Trade)

We’ll build out a trade setup in LEVI, running the Wheel Option Strategy to generate consistent income (~2-4% per month).

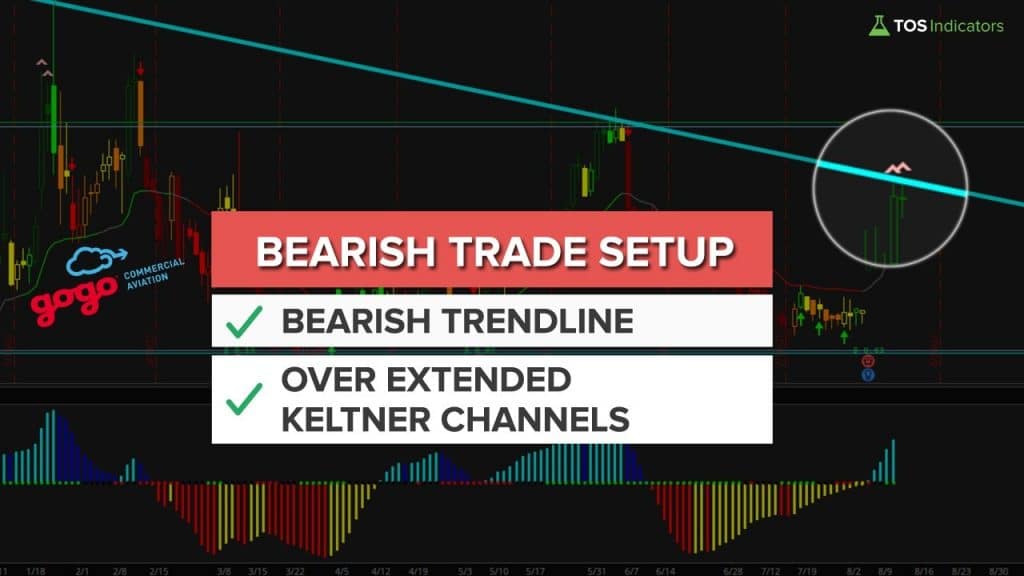

Read MoreGOGO – Bearish Trade Setup

I’ll walk through a bearish setup in GOGO, that stems from an overall bearish trend line, along with price action being in the 3 Keltner Channel factor territory.

Read MoreVisa and MasterCard – August Seasonality Patterns and Fibonacci Extensions

Visa and MasterCard are two stocks in which we have 5 and 10-YR bullish seasonality patterns for the month of August, near key Fibonacci Extensions.

Read MoreBitcoin and Ethereum – Short Term Trend Switch From Bearish to Bullish

Bitcoin and Ethereum have signaled a shorter term trend switch, shifting from a predominantly bearish trend to a fresh, bullish trend.

Read MoreWeekly Squeeze – Trade Updates in SHOP, FIVN, ATVI and VG

We will review the weekly (and in some cases, daily) squeezes and trades that we had set up in SHOP, FIVN, ATVI and VG.

Read More6 Options Trade Ideas for the Daily Squeeze in Activision (ATVI)

A step-by-step guide on playing the daily time frame squeeze in Activision, which is building momentum.

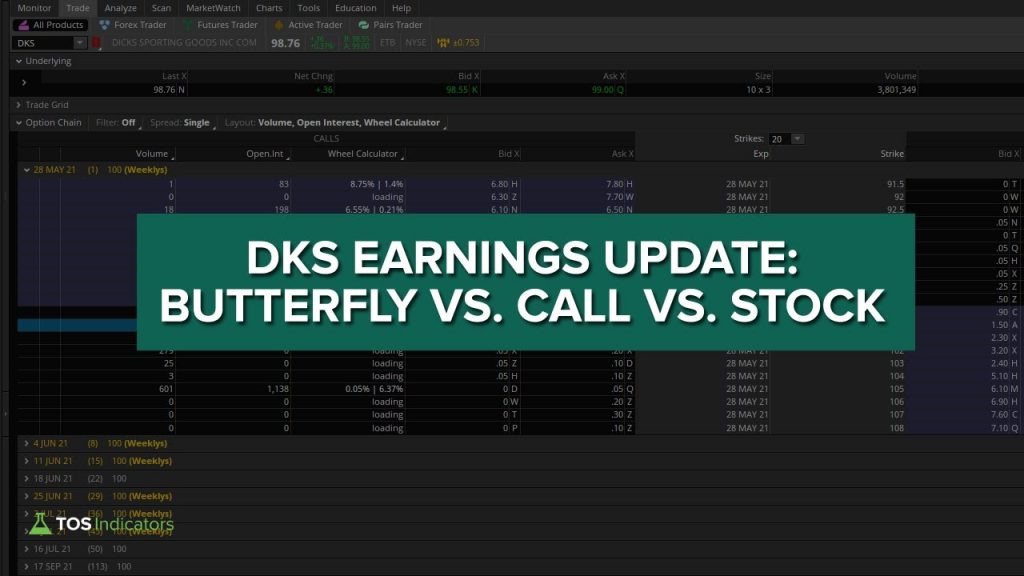

Read MoreEarnings Trade Update in DKS – Butterfly vs. Calls vs. Stock

Revisiting the earnings trade we set up in DKS, comparing an options butterfly vs. call vs stock.

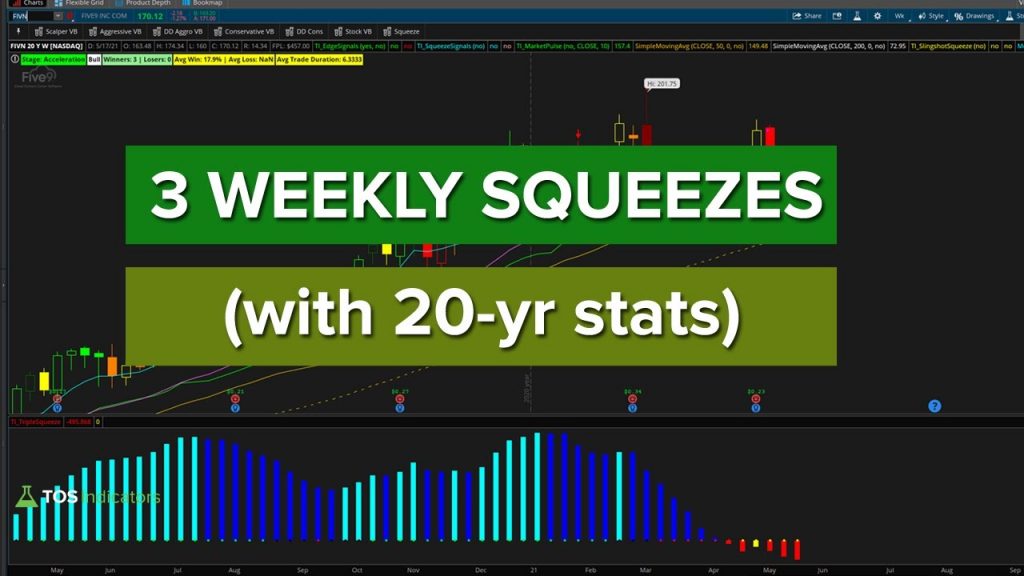

Read More3 Weekly Squeezes with Winning Stats Over 20 Years

With the recent volatility in the market place, we have some lucrative longer-time frame squeezes setting up in 3 particular stocks.

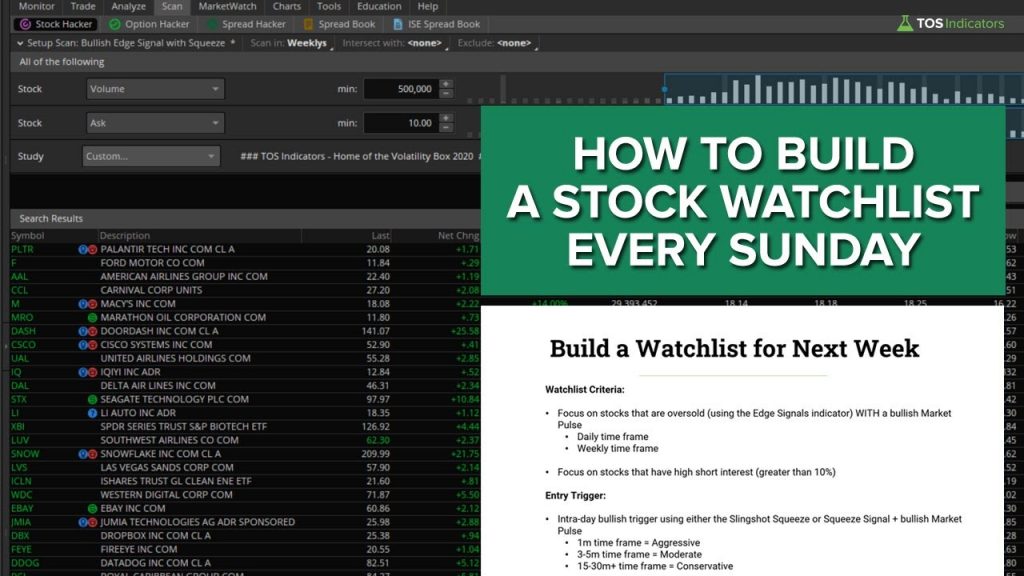

Read MoreHow to Build a Stock Watchlist Every Sunday

In less than 10 minutes, I’ll walk through a simple process that you can follow every Sunday to build a watchlist of stocks you’d like to focus on day trading, for the upcoming week.

Read More