Posts Tagged ‘TSLA’

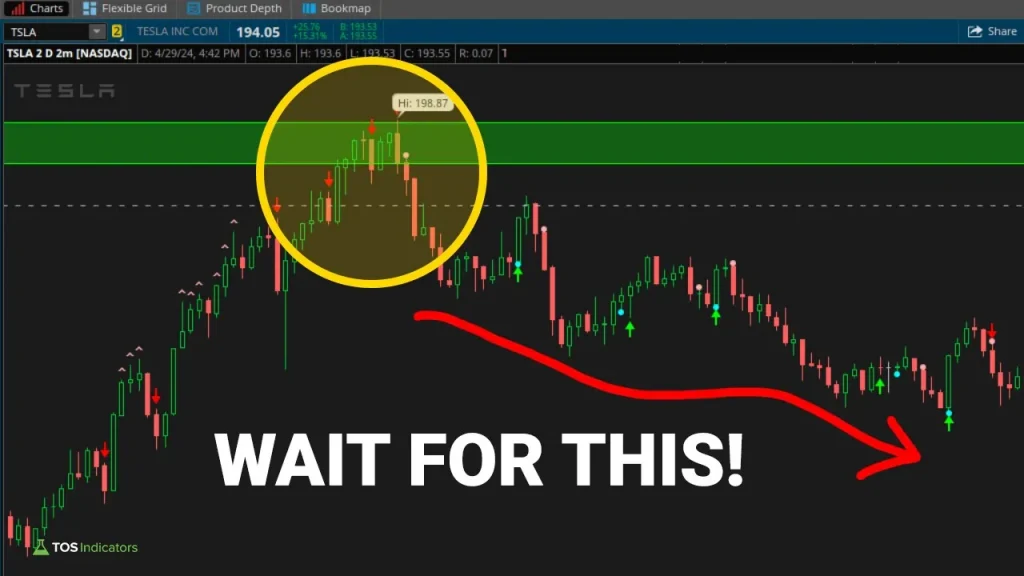

Take Advantage of TSLA’s Post-Earnings Volatility

Here’s a simple way to take advantage of these intraday levels in TSLA, as post-earnings volatility continues to increase.

Read MoreDIA and JNJ Trade Triggers (and DDOG/TSLA recap)

We’ll do a review of the swing trades in DDOG and TSLA which have hit their first set of targets, along with set up a new trade in DIA.

A reminder as to the idea behind DDOG: https://youtu.be/ZStu8iHr46E

-We had a pullback on the weekly time frame chart to DDOG’s Market Pulse line.

-We also had a bullish Edge Signal (oversold) confirmation signal on the daily time frame chart.

ENTRY: $91.04 (Filled)

TARGET 1: $94.62 (Hit T1)

TARGET 2: $100 (Open)

TARGET 3: $115.30 (Open)

TARGET 4: $125-$1

TSLA, RTY and YM Trades

We’ll do a quick update to our TSLA Broken Wing Butterfly trade, along with discuss two futures trades in the Russell and DOW markets.

Starting off with the TSLA broken wing butterfly, we were looking for a pin near the $550 price point, and had built a 530/550/560 broken wing butterfly for $1.55. Today, that same butterfly is currently selling for ~$3.90.

To manage the trade, I’d be looking at a pullback here in TSLA, which would actually be healthy, and help erode some of the theta premium

Read MoreTSLA Broken Wing Butterfly Trade Idea

With the news of Tesla (TSLA) being added to the S&P 500, we have a catalyst to support a bullish trade idea looking for a move to the 1.272% Fibonacci extension.

We have a squeeze that has been gaining momentum, leading to the idea that it will fire long. To play this move in a relatively “expensive” ticker, we’re going to build a broken wing butterfly.

The broken wing butterfly gives us 2 inherent benefits:

1. No upside risk

2. Reduced cost compared to owning the shares outright, or buyi

Preparing for MSFT and TSLA Post-Earnings Moves

With earnings season started, we’re going to use the free Smarter Earnings indicator to show you how you can plan and prepare for likely post-earnings moves.

Download Smarter Earnings indicator (free): https://www.tosindicators.com/indicators/smarter-earnings

Starting with the Futures Volatility Box, we had two trade setups today in Gold. The first setup was a stop-out, which cost us 4.5 points per contract, and had us switch from our Aggressive Volatility Box models to our Doomsday Aggres

Read MoreDay Trading TSLA, NFLX and 8 Other Stocks

We’re going to talk about 10 day trading setups that we had today via the Stock Volatility Box platform (including TSLA and NFLX).

Imagine outsourcing all of the work of finding trades to a machine, and then getting to pick and choose your favorite symbols? Well, with the Stock Volatility Box platform, we’ve built a powerful Live Scanner, which is constantly scanning the market every 15 to 20 seconds, to look for Volatility Box edge entries.

Using the Live Scanner, we had 117 total trades th

Read More