CVNA Stock Falls Perfectly Into Our Volatility Box Levels

In tonight’s update, we’ll take a deeper look into our trade on CVNA stock, using the Volatility Box.

The Volatility Box helped us capture a CVNA stock move of +2.13%, while the options were closer to a ~30% gain, depending on the point of entry.

This is where our new “Edge Signals” (name TBD) indicator helped us determine when and where we wanted to get in.

Additionally, XLF started to roll over today, as discussed in yesterday’s trade update. That was partially due to the volatility that rocked the markets after 10:33pm, when the tariff news hit the market.

China Tariffs Staying Until Election

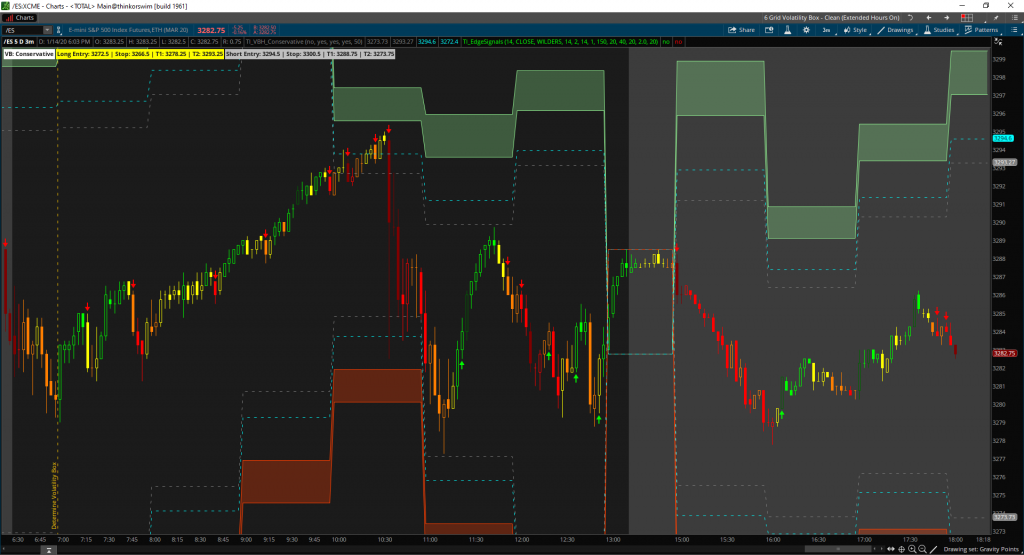

Volatility picked up in full gear as soon as the tariff news hit the market. The overall indices immediately plummeted. If you had your orders parked on the Aggressive Volatility Box like us, you were stopped out.

However, if you do not park your orders ahead of time, you had the luxury of time and more information today. If you were looking to trade, the Conservative Volatility Box (per our rules) gave you an entry and target.

If the rapid price action caused you to sit on your hands, then you had the luxury of watching the beauty of the markets unfold. That too, without needing to risk your own capital.

Here’s a chart of /ES futures from today’s news activity, with the Conservative Volatility Box:

We pierced down below even the clouds in the Volatility Box, before ripping the market up higher. We have seen this happen a couple times in the past few weeks – the market sinks lower on news, digests it, and rips right back up.

Unfortunate for us, parking our orders today cost us money, in an attempt at not missing any trades.

CVNA Stock: Using the Volatility Box For a Reversal

We’ll focus on a long entry in Carvana (CVNA stock symbol) for today’s update, as it offers great liquidity for stock and options traders alike.

CVNA stock hit our first scan at 7:05 AM PT, putting it on our Volatility Box radar. Using our Stock Volatility Box Tool, we had our volatility levels ready to go, looking for an entry at $84.80.

Once we had our Edge Signal confirmation at 7:30 AM PT, our Volatility Box clouds were in full effect. Our entry came as price action fell into our Volatility Box clouds, giving us an opportunity to go long.

While we used CVNA stock, the options chain on CVNA shows decent liquidity. The 80 strike had the highest OI at the time of entry, for an ITM option. For those looking to play with OTM options, the 90 strike was the best.

With our entries in place, it was time to now manage the position. Our stop was outside of the Volatility Box at $82.90. Our first target was using our gray dashed target line, at $86.66.

Let’s summarize the trade parameters before continuing:

- Entry: $84.80

- Stop: $82.90

- Target: $86.66

CVNA stock did go on to hit our target close to 10:30 AM PT, before being pulled down lower as part of the bigger tariff news. However, it was quick to bounce back from the same levels (retest is not a valid trade for us).

Carvana’s chart is a great example of something we like to see:

- Our fall down into the Volatility Box was gradual and controlled, not a sharp spike in one direction

- Once we crossed our first Volatility Box edge zone, the candles changed from red to yellow/green

- We had an Edge Signal plot prior to even hitting our Volatility Box clouds

- Price action bounced from the clouds, without giving us much heat on the trade

With earnings season around the corner, volatility should pick up in the markets. We can use that volatility to find similar entries to CVNA stock, and fade price action.

Likely Trending List – Jan 15, 2020

Using our new Stock Volatility Box Tool, we have a few different symbols that are on our “Trend Trending” list for Wednesday (January 15, 2020). Below is a sample list of just a few of those symbols.

Each of these symbols closed outside of our Volatility Box edge, and we look for them to continue to trending into tomorrow’s session, if they breach our clouds.

- Alcoa (AA)

- Ally (ALLY)

- American Express (AXP)

- UPS (UPS)

- Toll Bros (TOL)

For all of our Volatility Box members with access to the tool, you can use the list above to create a game plan for tomorrow’s trading.

The key will be to look for price to breach above either the Aggressive or Conservative Volatility Box cloud edge in the first 15 minutes of market open.

Here is a comma-delineated list of the tickers above, that you can input directly into the Stock Volatility Box Tool:

[su_note note_color=”#000″ text_color=”#FFF” radius=”3″ class=””] AA, ALLY, AXP, UPS, TOL [/su_note]

If we breach above each of those respective levels, then we’ll be looking at those symbols as likely trending candidates for the day.

However, if we do not breach those levels within the first 15 minutes, then we skip the symbol and focus on areas where we have breached.

Conclusion:

XLF earnings holds our attention this week. We look at them not only as trade opportunities using our Smarter Earnings and Stock Volatility Box, but also as a domino falling.

XLU has already rolled over from our last update. A transition in XLF from from acceleration to accumulation would support a pullback in the S&P. This would also help us confirm our put call ratio hypothesis.

Nothing is guaranteed though. Financials could crush earnings, and rip the market higher. This would lead the 10-day put call ratio SMA to remain below our 0.85 threshold for much longer.

Start trading with an edge, at the edge, and sign up for the Volatility Box today