Posts Tagged ‘crude oil’

Why the $76.50 Level is Key for Crude Oil

We’ll walk through a key level in Crude Oil, and setups from the monthly, weekly and daily time frame charts of /CL.

Read MoreCrude Oil Trade Update and S&P Sector ETF Pullbacks

Let’s review our recent trade in USO / Crude Oil Futures, along with find new pullback opportunities in key sector ETFs.

Read MoreCrude Oil Swing Trade Setup

In today’s video, we’ll take a look at a setup that is forming on the daily time frame chart in Crude Oil (via both, the /CL futures market and the USO market).

The video is organized in two different parts, for futures and stock/options traders.

In the first part, we’ll take a look at the /CL futures market, putting into perspective where price is currently at in the broader scope. We have a pullback to the Market Pulse in what could be the beginning of a new bullish trend, but our trend st

Read MoreTrading Daily and Hourly Volatility Levels on Indices

After 3 days of breaking outside of our most conservative models, we saw price action start to stabilize just a bit.

In today’s video, we’ll layer on both our hourly and daily volatility ranges to look and trade the indices. We sent out the daily volatility ranges, part of the Stock Volatility Box platform, to all of our Futures VB members as well, which ended up triggering for some nice trades across the board.

Via our Futures VB levels, we had a total of 7 trades, with a net P/L of +$1,410,

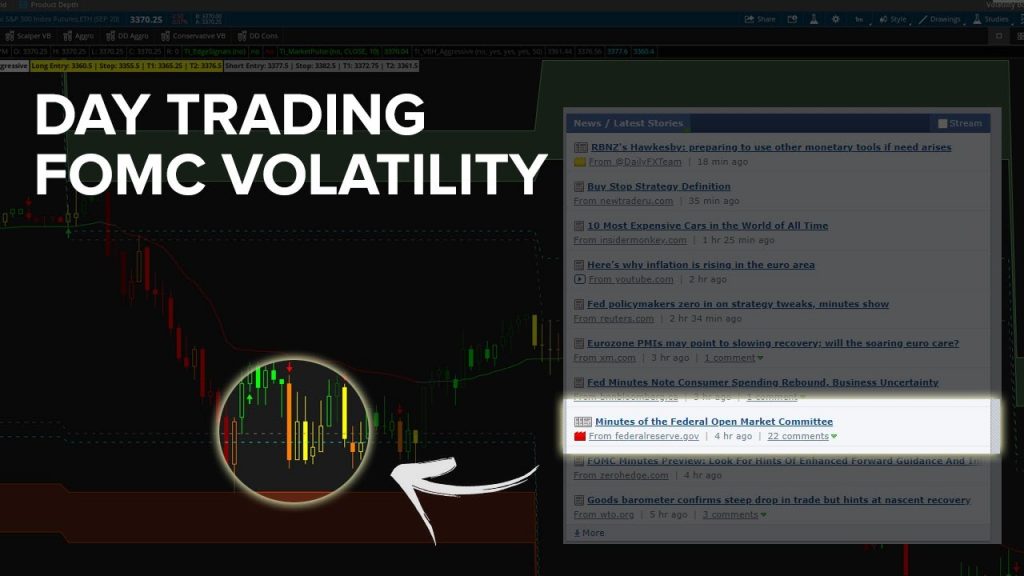

Read MoreDay Trading Futures Through FOMC Minutes Volatility

The release of the FOMC Minutes served as our catalyst for volatility in the futures market place today, leading to 7 futures day trades.

In today’s video, we’ll discuss all 7 of those trades, walking through all of the breaches and setups. Most of our trades today came in the 11-12p PT hour (when the FOMC minutes were released), which led to a burst of volatility in the marketplace.

Outside of the indices and 30-YR bond, we also had futures volatility trades that set up in markets like Crud

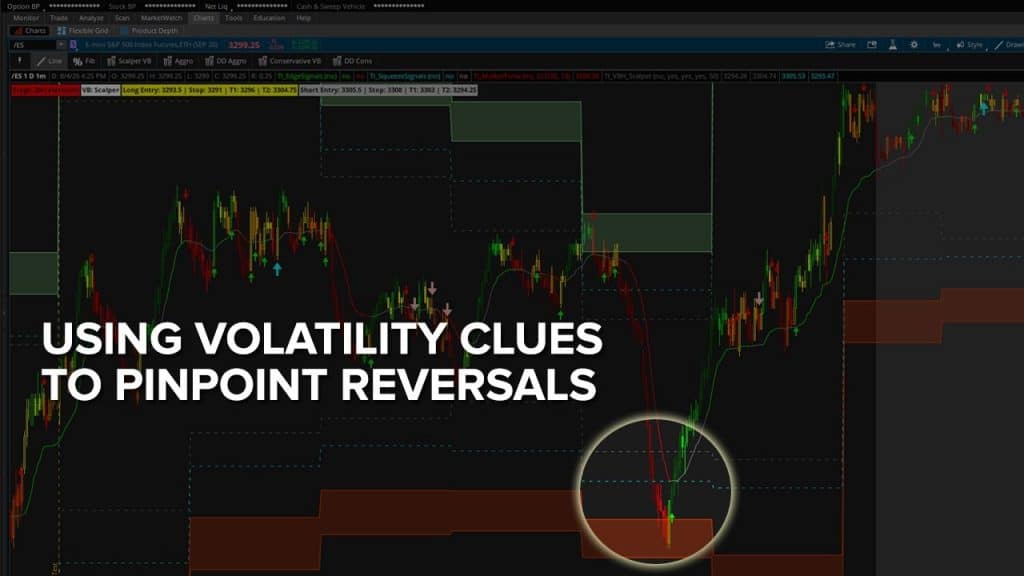

Read MoreUsing Volatility Clues to Day Trade Futures

We had our early morning volatility test give us some clues as to what to “expect” for the rest of the day.

Using our Volatility Box models, we had the 30-YR Bond (/ZB) signal to us that we should be using the Doomsday Aggressive models, while our indices all signaled that we could continue to scalp via the Scalper Volatility Box.

That was a clue – with the bonds giving us an early heads up to expect some sort of volatility in the broader markets (which we saw, in the 11-12 PM PT hour in the

Read MoreWalking Through 10 Volatility Breaches in Futures Markets

We had more Volatility Box breaches today, than we’re typically used to seeing. Today, we had 8 out of the 10 markets we look at breach, giving us a total of 10 trade setups.

In today’s video, we’ll go through each of those 10 trade setups in slightly greater detail. While the indices all presented us with losing trades, we had other markets like Gold and Silver help make up for some of those losses.

If we had to extract 2 “takeaways” from today’s trading, those would be:

1. If you have to

Expecting a Trending Down Day in Nasdaq 30 Mins After the Open

We had an early heads up to expect a trending day in the Nasdaq (/NQ), Copper (/HG) and Crude Oil (/CL) futures markets.

The Nasdaq was the clear winner for the day, but all 3 markets made moves in their respective trending directions. We had our notification at 7am PT that we should expect a likely trending day in the NQ futures.

At that point, the Nasdaq was trading closer to 10,100. By the end of the day, the Nasdaq had traded down to 9,927.25. That’s a move of ~1.7%+, which had significa

Read More