Posts Tagged ‘day trades’

Preparing for MSFT and TSLA Post-Earnings Moves

With earnings season started, we’re going to use the free Smarter Earnings indicator to show you how you can plan and prepare for likely post-earnings moves.

Download Smarter Earnings indicator (free): https://www.tosindicators.com/indicators/smarter-earnings

Starting with the Futures Volatility Box, we had two trade setups today in Gold. The first setup was a stop-out, which cost us 4.5 points per contract, and had us switch from our Aggressive Volatility Box models to our Doomsday Aggres

Read MorePost-Earnings Volatility Box Setup

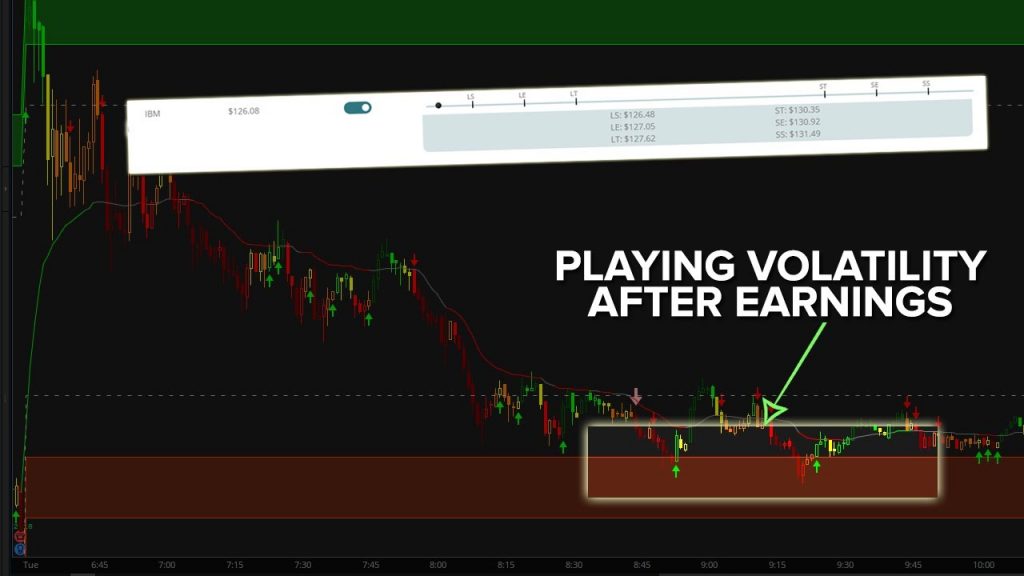

With earnings activity starting to pick back up, we’ll talk about a fairly simple, yet effective setup to play post-earnings moves in your favorite stocks.

For today’s example, we’re going to use IBM, which reported before the market open (and had an earnings beat). On the beat, IBM gapped up higher, but then continued to fill its gap and trend lower for the rest of the day.

The setup comes in looking to “buy the dip” or “fade the rip” and using earnings as a catalyst for a high volatility ev

Read MoreFibonacci Levels – SPY, QQQ, IWM, DIA, MSFT, NFLX and CSCO

Once again, we have a nice pullback setting up in the markets, giving us some new opportunities to enter on a trend pullback.

In this video, we’re going to start by reviewing what the SPY, QQQ, DIA AND IWM are telling us, by using price action, volume and Fibs. While QQQ currently offers us the most Fibonacci-support, it’s also the most extended (duh), having reached its 1.272% extension of the Feb-March swing high to low.

We’re going to use that to dive deeper into some stocks in the Nasdaq,

Read MoreAdapting to Changing Volatility Conditions

If you’re looking to trade volatility, it’s critical to have tools to very easily, but reliably measure and rank the volatility across markets, and adapt.

Today, with the Volatility Box, we had the luxury of adapting to each index market’s respective volatility — and we saw that differ across the 4 major markets.

For example, today, here were the rankings of the 9 futures markets that we look at, with their respective Volatility Box models:

ES, RTY – Scalper

NQ – Aggressive

YM – Doomsda

How to Use Shorter Dated Options to Skew R/R in Your Favor

We’re going to compare 1 vs. 8 days to expiration (DTE) options, to see what the delta looks like, in terms of the returns of each strategy.

We had over 90 setups that hit our Live Scanner today, with a focus on “Buying the Dip” — this means Aggressive VB Long and Conservative VB Long setups.

Of those 90, we’re going to focus on 6 in particular that met the following conditions:

1. Hit the Volatility Box edge

2. Got an Edge Signal

3. Opportunity to enter at the VB clouds or better, before

Day Trading the Nasdaq Futures

We have a systematic process that we follow every single day, for day trading with the Volatility Box.

Using the note we sent out at 7:30 am PT to all of our members, we’ll cover the Nasdaq and Copper futures markets, where we had trade opportunities set up today.

Specifically on the Nasdaq futures (NQ), we had 3 different setups that met our Trade Plan rules, and triggered. All 3 of these were winners, for a net P/L of +$1,560.

On the Copper futures (HG), we had one trade setup which took

Read MoreDay Trading TSLA, NFLX and 8 Other Stocks

We’re going to talk about 10 day trading setups that we had today via the Stock Volatility Box platform (including TSLA and NFLX).

Imagine outsourcing all of the work of finding trades to a machine, and then getting to pick and choose your favorite symbols? Well, with the Stock Volatility Box platform, we’ve built a powerful Live Scanner, which is constantly scanning the market every 15 to 20 seconds, to look for Volatility Box edge entries.

Using the Live Scanner, we had 117 total trades th

Read MoreFades in the YM, RTY and NG Futures

We had three markets in which we had Volatility Box breaches today – the DOW, Natural Gas and Russell futures markets.

In the morning, we sent out a note to all of our members with a list of all 9 futures markets we look at, along with the Volatility Box models we were using for the day. These models are selected based on the First Hour test, and we let price action dictate to us if and when we should switch.

We had a total of four trades that set up today:

1. A long fade in Natural Gas (win

SPY, QQQ, DIA and IWM Buy Zones and Triggers

We saw a broader sell off in the indices with Friday’s trading, leading many top weighted holdings to start to pull back to entry zones.

In this video, we’re going to use a few different perspectives (and indicators) to create a game plan, with specific levels that I’m interested in buying as support on the SPY, QQQ, DIA, and IWM.

We’re going to use the following tools for the analysis:

1. Put Call Ratio in the Utility Labels

2. Market Pulse Line

3. Fibonacci Retracements and Extensions

4.

Expecting a Trending Down Day in Nasdaq 30 Mins After the Open

We had an early heads up to expect a trending day in the Nasdaq (/NQ), Copper (/HG) and Crude Oil (/CL) futures markets.

The Nasdaq was the clear winner for the day, but all 3 markets made moves in their respective trending directions. We had our notification at 7am PT that we should expect a likely trending day in the NQ futures.

At that point, the Nasdaq was trading closer to 10,100. By the end of the day, the Nasdaq had traded down to 9,927.25. That’s a move of ~1.7%+, which had significa

Read More