Posts Tagged ‘day trades’

Trading Psychology – S&P vs. Nasdaq Futures (Winner vs. Loser)

Trading psychology, and managing emotions throughout a day, is often times the difference maker between a good and bad day.

As traders, our job is to follow our Trade Plan rules and execute trades that meet conditions in which we have a probabilistic edge. However, this is usually much easier said than done, as emotions and human nature to avoid loss / rejection starts to take over.

Mark Douglas’s Trading in the Zone is one of the best books on trading psychology, and truly training the mind

Read More2 Setups in the 30-YR Bond and Weekend Trade Updates

Our Trade Plan rules typically keep us on the right side of the market. In today’s case, we ended up being TOO cautious with our rules, at the expense of missing multiple setups in the 4 major indices markets, almost all of which worked.

However, our rules usually do keep us out of trouble — which was proven in our 2 setups in the 30 Year Bond futures market (/ZB). In our first setup, we hit both our first and second target, giving us a nice win.

The second setup was a little different, tho

Read MoreHow to Easily Identify a Trending Day (Before It Sets Up)

Trending days are some of the most powerful ones, if you know the signs for which to look out.

Unfortunately, more times than not, keeping track of things like the market internals ($TICK, $ADSPD, $PCVA, etc.) can be overwhelming, and lead to analysis paralysis with no real action.

The Volatility Box makes identifying a Trending Day super easy – a chart bubble pops up notifying you to expect a likely trending day. It’s that easy. In the case of the /ES futures, we had the heads up at 7 AM PT

Read MoreTrading FSLY, ZS and JNJ On a Down Day

On a day in which the S&P was down 5.43%, we still found a way to be profitable with both long AND short setups using the Volatility Box.

In today’s video, we’re going to revisit the 6 takeaways that we had discovered in the “Analyzing Friday’s Stock Market Flow” video (linked below):

https://www.youtube.com/watch?v=hhzAhWK8zKs

We’ll go through a handful of trades using the takeaways and observations that we’ve been discussing in these Trade Report videos. For example, we discovered that 6:3

Read MoreRanking Volatility in ES, YM, NQ and RTY Futures

We show you how to rank the 4 major index markets and their respective volatility, in just a few minutes.

As part of our Volatility Box Trade Plan, we have our first hour test, which helps us determine and adapt to the day’s volatility. In today’s case, what we noticed was the DOW and Russell futures giving us signs of being the more volatile markets, while the Nasdaq was on the opposite end of that spectrum.

We perform the First Hour Test for our indices at 7 AM PT, less than 30 minutes into

Read MoreAnalyzing Friday’s Stock Market Flow

We’re going to use all 231 Volatility Box trade setups to chart out Friday’s stock market flow, to see if there are any interesting patterns that stand out.

We’ll compare things like the Aggressive vs. Conservative Volatility Box models, along with answering some common questions, such as “Is there a specific time of day that’s better for trading stocks than others?”

There are 6 different dimensions that we’ll use for this analysis:

1. Aggressive vs. Conservative

2. Long vs. Short

3. Combine

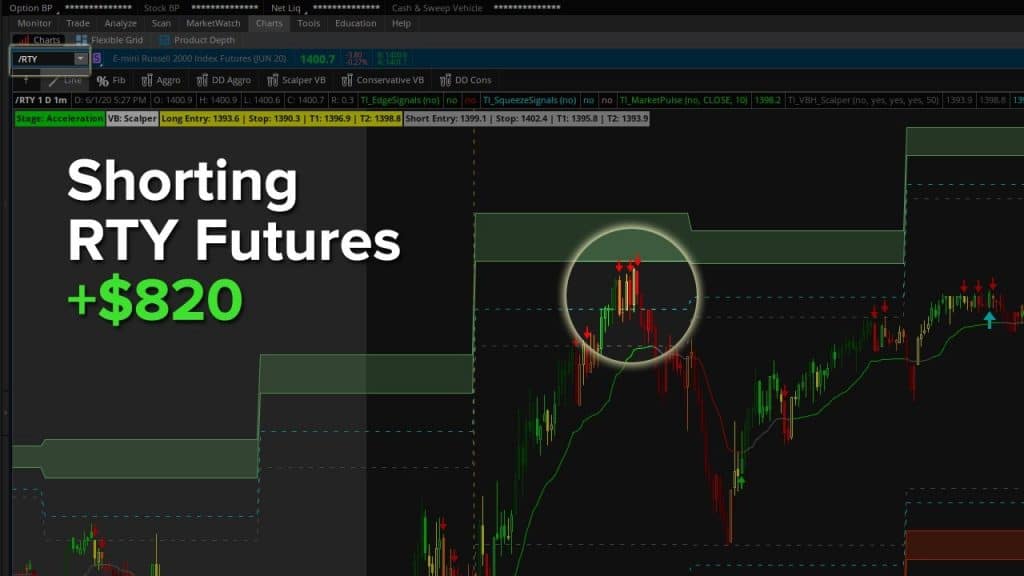

Short Entry in the Russell Futures +$820

We had one entry in the Russell 2K (/RTY) futures today, at 7:40 AM PT, which led to a nice winner of +$820 across both contracts.

The short came in the RTY as price slammed into our Volatility Box, levels giving us an opportunity to try and scalp the markets. Our risk was 4.8 points, to try and make 4.8 points on the first contract, and 11.6 points on the second contract (with a break-even stop).

Once we got our Edge Signal confirmation, that was the green light to enter the trade, with a s

Read MoreVolatility Returns and Swing Trade Setups in TDOC and GD

Start trading with an edge, at the edge, and sign up for the Volatility Box today

Read MoreNG Futures and Swing Trade in Cloudflare

Start trading with an edge, at the edge, and sign up for the Volatility Box today

Read More