Posts Tagged ‘s&p 500’

Cumulative TICK Indicator with Volatility Ranges

Over the weekend, we released our 21st episode of the “How to thinkScript” series, which includes both a free and pro version (which is available for Volatility Box members).

In today’s video, we’re going to use the Cumulative TICK Pro indicator, alongside our updated Volatility Box models to take a look at price action in the indices.

Across the board in the ES, YM, and NQ, we had breaches of our Volatility Box in the 10-11AM PT hour that hit our Volatility Box zones, almost to perfection.

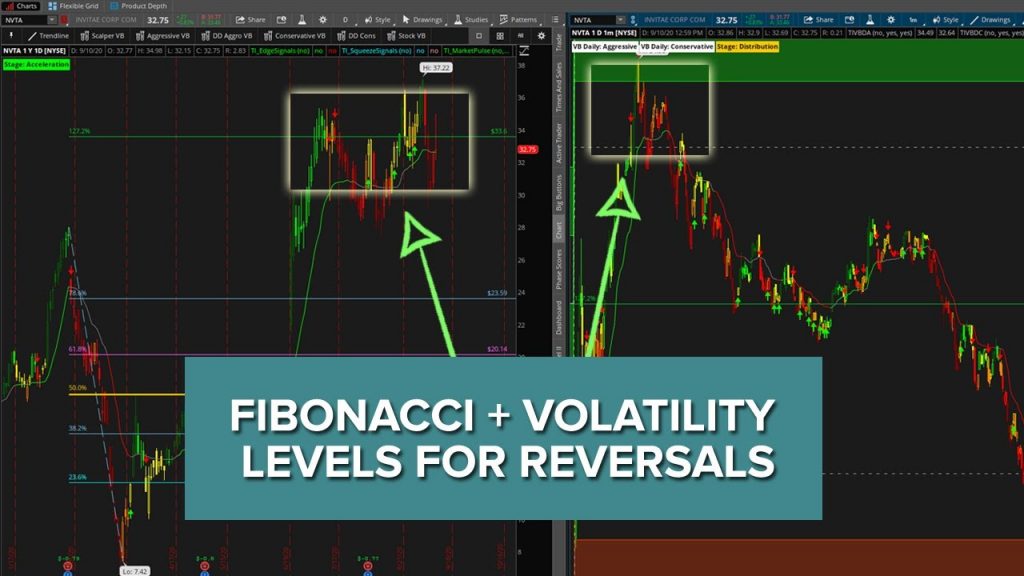

Read MoreStock Volatility Trades in NVTA, SPY and QQQ

In this video, we’ll review the Stock Volatility Box’s performance for today, as well as dive deeper into the charts of NVTA, SPY and QQQ to look at 3 specific setups.

With the recent burst of volatility, we’ve seen more stocks hit our Live Scanner compared to usual. The Live Scanner is a “machine” that we’ve built, whose job is to update every 15 seconds with new trades that breach our Volatility Box edges.

Today, we had more than 229 trades that hit our Live Scanner over the course of the

Read MoreTrading Daily and Hourly Volatility Levels on Indices

After 3 days of breaking outside of our most conservative models, we saw price action start to stabilize just a bit.

In today’s video, we’ll layer on both our hourly and daily volatility ranges to look and trade the indices. We sent out the daily volatility ranges, part of the Stock Volatility Box platform, to all of our Futures VB members as well, which ended up triggering for some nice trades across the board.

Via our Futures VB levels, we had a total of 7 trades, with a net P/L of +$1,410,

Read MoreSell Off in the Markets – Trigger Zones to Monitor

We had a relatively sharp sell off in the markets today, with many markets breaking outside of even our most conservative volatility models in the 7-8am PT and the subsequent hour.

We had all of our major indices markets break outside of our Doomsday Conservative Volatility Box clouds (ES, YM, NQ, and RTY), along with markets such as the 30-YR Bond, Gold, and Silver (ZB, GC, and SI). While that led to a challenging day in day trading the futures, it’s important to also take a step back and asse

Read MoreVolatility Trades in Tech Stocks and Futures (Sept. 2, 2020)

We had the Nasdaq futures break outside of our Doomsday Conservative (our most conservative) volatility models within the first 30 minute after market open. With that same downfall, we had a group of tech stocks all hit our Stock Volatility Box Live Scanner, giving us plenty of opportunities to look for fade trade setups.

In today’s video, we’ll discuss both stock and futures trades, along with ways to overlap the Stock and Futures Volatility Boxes to work in congruence. With Nasdaq breaking ou

Read MoreDay Trading Futures Through FOMC Minutes Volatility

The release of the FOMC Minutes served as our catalyst for volatility in the futures market place today, leading to 7 futures day trades.

In today’s video, we’ll discuss all 7 of those trades, walking through all of the breaches and setups. Most of our trades today came in the 11-12p PT hour (when the FOMC minutes were released), which led to a burst of volatility in the marketplace.

Outside of the indices and 30-YR bond, we also had futures volatility trades that set up in markets like Crud

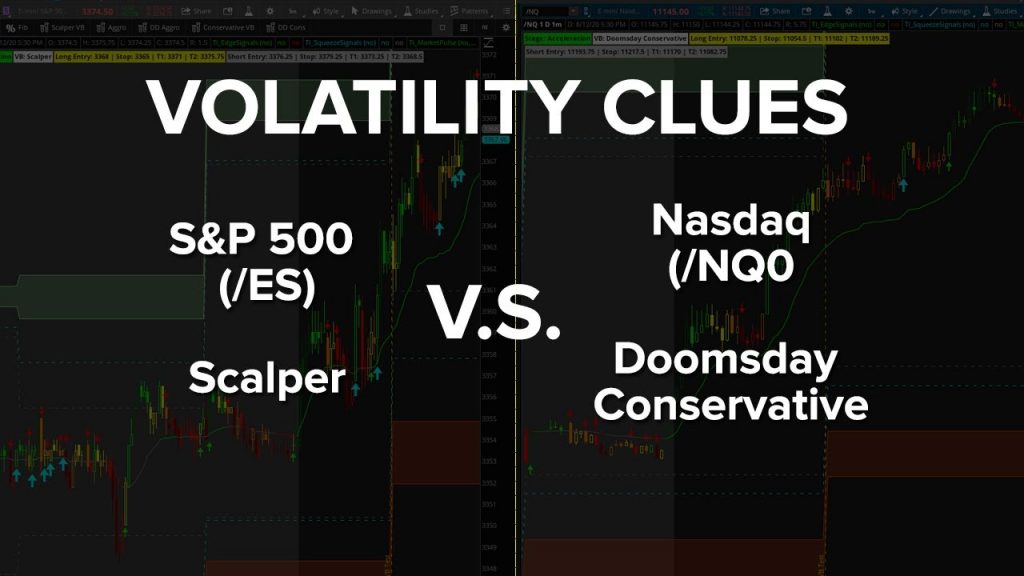

Read MoreMorning Volatility Clues for ES, YM and RTY

In today’s video, we’re going to use our first hour Volatility Box test to find clues around what to expect for the rest of the day.

Today, we saw that the 30-YR Bond Futures (/ZB) and the Nasdaq Futures (/NQ) both gave us clues to expect more volatility as the day progresses. We’ll review whether or not the clues were accurate, and what actually happened as the day progressed.

In the Nasdaq, we were on our Doomsday Conservative models (which are the most conservative models we have), compare

Read MoreReviewing 3 Losers in ES, NQ and ZB for Takeaways

In today’s video, we’re going to take a look at three futures trades that were losses, to see if there are any takeaways.

We had setups in the S&P 500 (/ES), Nasdaq (/NQ) and 30-YR Bond (/ZB). However, neither of these setups worked today, which was atypical. Normally, we have an opportunity to earn back some of our losses, even on our net red days. Today, we didn’t have any such cases.

We’ll do a deeper dive into each of the three markets, and review the breach, along with the subsequent pr

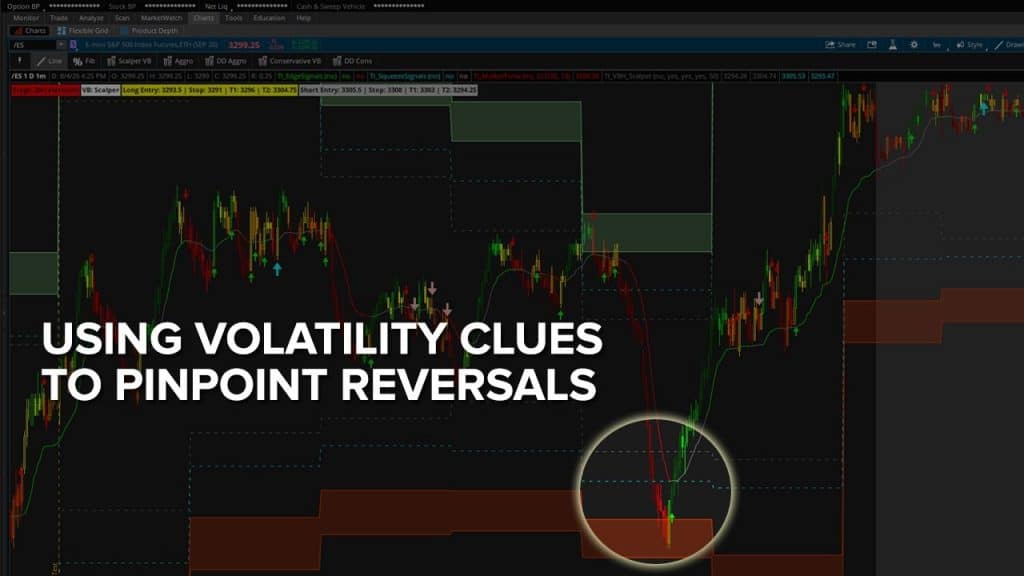

Read MoreUsing Volatility Clues to Day Trade Futures

We had our early morning volatility test give us some clues as to what to “expect” for the rest of the day.

Using our Volatility Box models, we had the 30-YR Bond (/ZB) signal to us that we should be using the Doomsday Aggressive models, while our indices all signaled that we could continue to scalp via the Scalper Volatility Box.

That was a clue – with the bonds giving us an early heads up to expect some sort of volatility in the broader markets (which we saw, in the 11-12 PM PT hour in the

Read MoreTrading FOMC Volatility – Futures & Stock Setups

With the FOMC event today, we saw a burst of volatility in our futures markets leading to a series of breaches in /ES, /NQ, /GC and /HG.

The S&P 500, Nasdaq and Copper futures trades were all winners, while the Gold trade was a loser. In today’s video, we’ll do a recap of all 5 of the trade setups that we had today, for a net P/L of +$805.

Outside of that, we’ll also talk about some swing trade setups that are still active and valid. With Powell’s remarks, we can look to take advantage of ar

Read More