Volatility Box Trade Examples

Volatility models to help you trade stocks and futures like a seasoned professional

A Simple Setup to Profit From Opening Range Volatility

Learn a simple setup that you can use to capitalize on morning volatility, and take advantage of sharp reversals in the markets.

Volatility Breakdown – First Trading Day of 2023

An in-depth volatility review of 10 major futures markets, reviewing their volatility profile on the first trading day of 2023.

SPY Resumes Down Trend – New Resistance Zones and Targets

A quick review as SPY resumes the down trend, and set up new resistance areas for short side trade setups, along with target zones.

Options Volatility Day Trading Setups in MSFT and SBUX

Learn how to use volatility to your edge, when day trading liquid options contracts. I’ll show you two examples in MSFT and SBUX options, profiting from their volatility.

Double Calendar Spread to Profit If Stock Goes Up or Down

Explore double calendar spreads and their unique advantages in this example. The position is designed to profit if the stock goes slightly up, stays flat, or goes down.

Options Scalping vs. Underlying Price Movement – Same Setup Comparison

Compare options scalping versus trading the underlying, for the same setup. Find just how much leverage and risk shorter dated options carry.

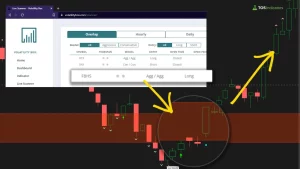

Stock Volatility Scanner – Hourly and Daily Volatility Models Breaching

In today’s video, we’ll use the Stock Volatility Box Live Scanner to have a machine find high-probability, volatility trade setups for us.

Volatility Day Trading – Stocks and Futures Recap

Let’s review futures and stock volatility trade setups for day trading today’s event-driven day.

MSFT Earnings – Options Trade Idea

Pre-earnings patterns and tendencies inside of MSFT, 7 days prior to earnings. Options trade idea included.

TSLA Pre-Earnings Patterns

Pre-earnings patterns and tendencies inside of TSLA, 3 days prior to earnings.

3 Price Channels to Help You Trade AMZN Stock

In this video, I’ll show you the 3 different price channels that Amazon is currently trading within. We’ll discuss how to trade within these channels, and longer term targets if the trendlines break.

Why the $76.50 Level is Key for Crude Oil

We’ll walk through a key level in Crude Oil, and setups from the monthly, weekly and daily time frame charts of /CL.

Options Pricing and Volatility Reversals – NET, UNH and CROX

We’ll walk through 3 different stocks that appeared on the Live Scanner’s Overlap tab. We’ll track options pricing and volatility in each one of these 3 markets.

Hourly and Daily Volatility Trades On the “Overlap” Tab

In today’s video, we’ll spend some time looking at the new Live Scanner — specifically the “Overlap” tab. The overlap tab looks for hourly and daily Volatility Box breaches, occurring at the same time.

Stock Volatility Box Live Scanner – New Hourly, Daily and Overlap Tabs

Our newest update to the Stock Volatility Box is now LIVE, making it easier than ever to find volatility setups in stocks and ETFs.

September Seasonal Patterns

We’ll explore the seasonality tendencies in the month of September, for the 4 major index markets, going back 20 years.

TTM Squeezes in SPY Sectors

I’ll share two sectors which have weekly TTM Squeezes setting up, with a momentum signal to the downside. Both have a Squeeze Signal that is plotting, along with bearish momentum.

3 Stocks That Stood Out Today

With a volatile morning in the broader indices, 3 stocks stood out with our setup rules being met. We’ll spend extra time on one stock, which had both hourly and daily volatility models being breached.

Volatility Trade Setups in 4 Index Futures

Let’s recap of all of the Futures Volatility Box trade setups, inside of the 4 major index futures. Towards the end of the video, we’ll also evaluate where the S&P 500 is, in relation to its longer term downtrending channel.

Jackson Hole Summit Day 1 – SPY Rallies in Final Hour

We’ll do a recap of day 1 of the Jackson Hole Symposium, and how it affected the S&P 500. Towards the end of the video, we’ll also find the weakest sector in this rally, for short side positions.

Volatility Catalysts For This Week

Lets review the economic calendar for this week, discussing the various volatility catalysts, including the Jackson Hole Symposium. We’ll review Crude Oil and the S&P 500 markets.