Volatility Box Trade Examples

Volatility models to help you trade stocks and futures like a seasoned professional

A Simple Way to Trade Earnings With Reduced Risk

Earnings volatility led to a sector to trigger a ‘Buy the Dip’ setup early in the morning. This was a high-probability setup, with both a volatility and price edge. Let’s break this setup down in more detail in today’s video.

ES Futures vs. Micro ES Futures vs. SPX Volatility

Compare and contrast the volatility in the S&P 500 across 3 different asset classes: /ES, /MES, and SPX.

The Difference Between Morning vs. Afternoon Volatility

The morning volatility was much different from the afternoon’s volatility today. Let’s review the differences between each, and take a look at 4 examples of stocks that triggered in each volatility regime.

COSTCO’s Unusual Volatility (COST Stock)

COST stock stood out in the morning, as one of the few long setups that hit our Live Scanner. Let’s dive deeper into COST, and compare the volatility to other stocks that hit the scanner.

Day Trading Volatility Comparison – TSLA vs. ORCL

Compare and contrast the volatility in Tesla (TSLA) vs. Oracle (ORCL) today. Both presented a volatility edge, but with different setups. We’ll break down each market in today’s video, and dive deeper into the trades.

Will Next Friday’s Volatility Be a Repeat?

After the lunch time hour, volatility picked up in the S&P 500, DOW, Nasdaq and Russell. Let’s break down this volatility, and analyze the ‘buy the dip’ fade setup which presented itself.

Gold’s September Seasonality (10 Year Analysis)

I’ll share 5, 10 and 20 year stats for this repeating pattern in Gold, and share day trading and swing trading setups to take advantage of this move.

Avoid Breakout Traps in This Tricky Hour

Either avoid this hour, or learn how to trade with a contrarian mindset. The obvious setups are usually the ones with a lower probability during this hour.

The Difference Between Yesterday and Today’s Volatility

The morning volatility landscape was much different today, compared to yesterday. I’ll show you how to quickly spot these differences, and use them for your benefit.

This is Why the DOW Stood Out Today

Today’s sell-off triggered a long-side volatility setup in the S&P 500, DOW and Nasdaq. The DOW very clearly stood out – it gave us an edge for this long entry, good for +62 points.

The Closing Bell Selloff Inside the DOW Futures

Let’s walk through an example of a day trading setup in the DOW futures, during the final hour of the market. The setup was a long side entry, as price fell into our Volatility Box zones.

Friday Volatility in the Index Markets

We had a volatile close to end this trading week, something we aren’t typically used to seeing. Let’s dig deeper to see how a volatile Friday translates into day trading setups.

Volatility Comparison – NASDAQ vs. META Stock vs. NVDA Stock

Compare and contrast the volatility in the Nasdaq futures market, with the volatility inside of two large cap stocks (META and NVDA).

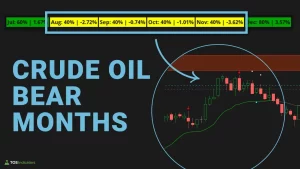

Crude Oil Seasonality Idea Update

This video is a brief update on the 4 month seasonal pattern in Crude Oil. You can find Part 1 of this video here: https://www.youtube.com/watch?v=v17ftfs5voc

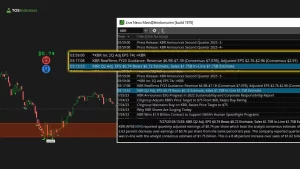

Earnings as a Volatility Catalyst

Earnings season provides us with the gift of volatility. In today’s video, we’ll review two companies that reported earnings, and how their results translated to intraday volatility.

Earnings Volatility – How to Find Mismatched Opportunities

Let’s dive into two companies, which reported earnings today, but with VERY different results.

Exploit Rallies in Companies Reporting Poor Earnings

Poor earnings report, but stock still up? I’ll show you how to take advantage of setups like these, with an example using DOW Inc’s earnings report.

Trade Reversals in NVDA With This Simple Setup

Leverage a simple 4-step setup, which you can use to trade reversals in your favorite markets (with an example in NVDA).

Sector Volatility vs. Stock Volatility (XLU)

We’ll compare and contrast the volatility of a specific sector, XLU, with that of 3 top utility stocks within the ETF

PEP Stock vs. NASDAQ Futures

Compare and contrast the volatility in the Nasdaq futures market, with the volatility inside of two large cap stocks (INTC and PEP).

Futures vs. Stock Volatility Models (NQ vs. QQQ)

I’ll show you the differences between the Futures Volatility Box and Stock Volatility Box models and levels.