Volatility Box Trade Examples

Volatility models to help you trade stocks and futures like a seasoned professional

SPY – 4 Reasons to Still Be Bearish

I’ll share 4 reasons why I still have a bearish bias in the S&P 500 market, after last week’s price action.

Power Hour Stocks – Which Outperformed SPY?

We’ll use our free Relative Performance indicator to find a list of stocks which outperformed SPY in the final hour of the markets.

SPY Market Pulse Update – August 2022

Let’s review the Market Pulse update in the S&P 500 for August 2022.

One Sector ETF That Stood Out After the Opening Bell

There was one sector that stood out shortly after the open today. While other sectors were chopping around sideways, this sector had sellers kicking in full gear.

Futures Volatility Box – Index Markets (ES, YM, NQ, RTY)

I’ll walk through each of the 4 index markets, talking through the different setups that triggered throughout the day.

FOMC Trading – S&P 500 (Fed Raises Rates – July 2022)

The Fed raised rates, which led to an increase in volatility in the markets. We’ll take a look at how the “FOMC Model” played out today, with volatility trading in the S&P 500.

How to Trade Earnings – UPS and MSFT

With UPS and MSFT reporting earnings tomorrow, let’s analyze each company, and determine what their earnings personality has historically been.

Pre-Earnings Patterns – MSFT, BA, and More

We’ll find pre-earnings patterns and tendencies inside of four stocks, and review both price and volatility tendencies.

S&P 500 Futures – Fed Volatility Trade Setup

A complete breakdown of a volatility setup inside of the S&P 500 futures, setting up as a result of Fed’s Waller comments earlier in the day.

Two Stocks That Stood Out Today

With a volatile week underway, two stocks stood out early in the week. I’ll break down the volatility in those two stocks in today’s video.

Economic and Earnings Volatility Catalysts – July 2022

Let’s break down economic and earnings volatility catalysts, which could influence shorter-term volatility in the major markets.

FOMC Volatility – S&P 500 (July 2022)

We’ll compare and contrast July 2022’s FOMC volatility to that of past FOMC Meeting Minutes.

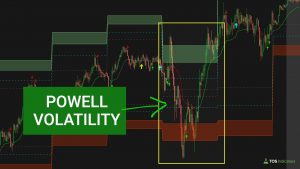

Powell Volatility – Volatility in S&P 500, Sectors, and Individual Stocks

The volatility after Fed Chair Powell’s testimony from this morning provided an opportunity and edge to trade reversals.

SPY Falls Further – Downside Bear Market Targets and Intraday Volatility

The S&P 500 hit the downside target that we’ve been monitoring for nearly 4 months. Where does the S&P go from here? Do we bounce higher, or do we continue falling to our next downside target?

FOMC Volatility – S&P 500 (June 2022)

In today’s video, we’ll compare and contrast June 2022’s FOMC volatility to that of past FOMC Meeting Minutes.

SPY Lotto Butterfly Idea – Downside Target of $400

In today’s video, I’ll share a lotto trade idea in SPY, which is targeting a break of the trendline to the downside (targeting $400).

The Key Trend Line in the S&P 500 (June 2022)

In today’s video, I’ll share the trend line that I’m monitoring inside of the S&P 500 (and all major markets), as we wait for the bear market relief rally to snap.

AMD Stock – Highest Sizzle Index and Volatility Models

AMD had the highest sizzle index score to lead this morning’s market activity. Let’s review how this volatility shaped up, and trades that set up.

Energy Sector – Market Update (May 2022)

A big picture comparison of the energy sector, comparing 3 ETFs, and a handful of top holdings, to find relative strength and a volatility edge.

FOMC Volatility – S&P 500 (May 2022)

In this video, we’ll see how the markets moved, once Fed chair Powell took the stand and gave his statement.

Power Hour Volatility – SPY, SBUX, COST, CSCO

In today’s video, we’ll take a look at leveraging the volatility in the final hour of the market, after a volatile day in which the S&P 500 was down nearly -3.5%.