Anchored VWAP Scan

Build a scan to identify pullbacks to the Anchored VWAP from previous pivot points.

Introduction

Welcome to another thinkScript tutorial!

We’re going to take our Anchored Volume Weighted Average Price (Anchored VWAP) Indicator and turn that into a scan.

If you don’t already have the Anchored VWAP indicator, you can download it here. You’ll need it to follow along, and it’s completely free.

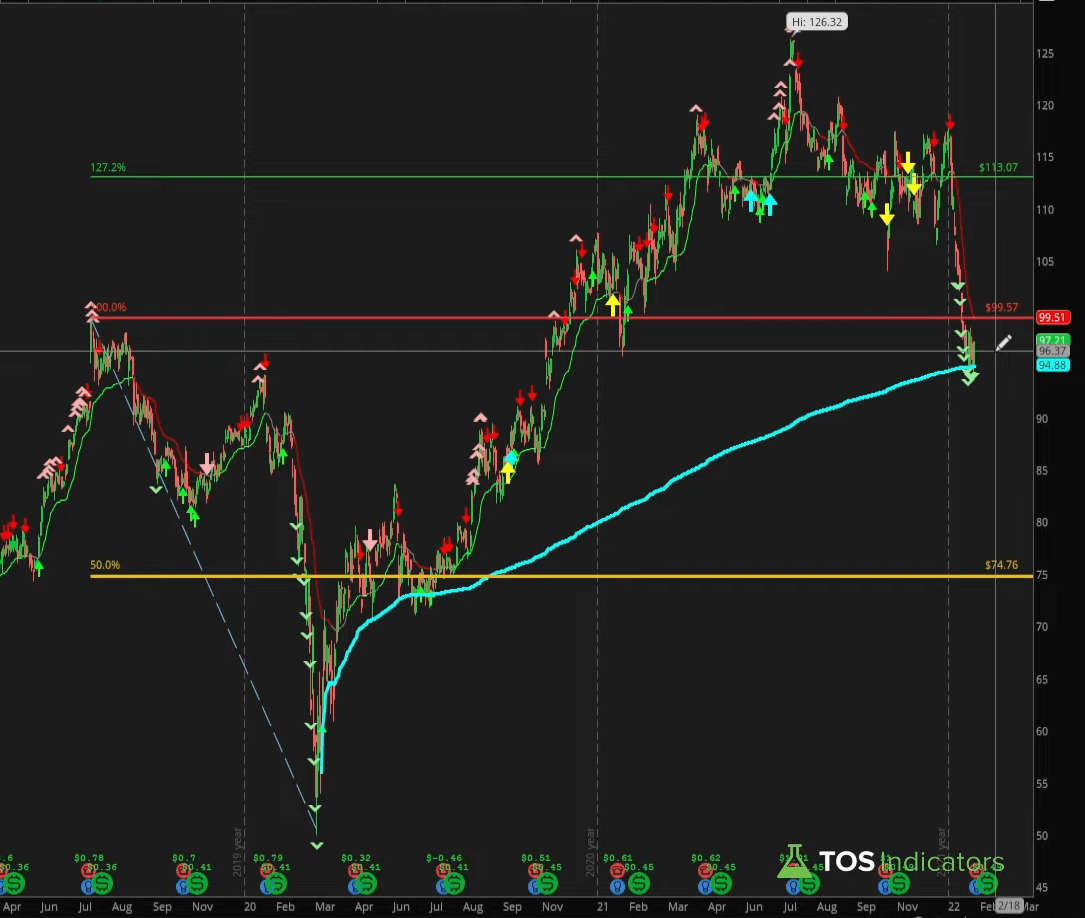

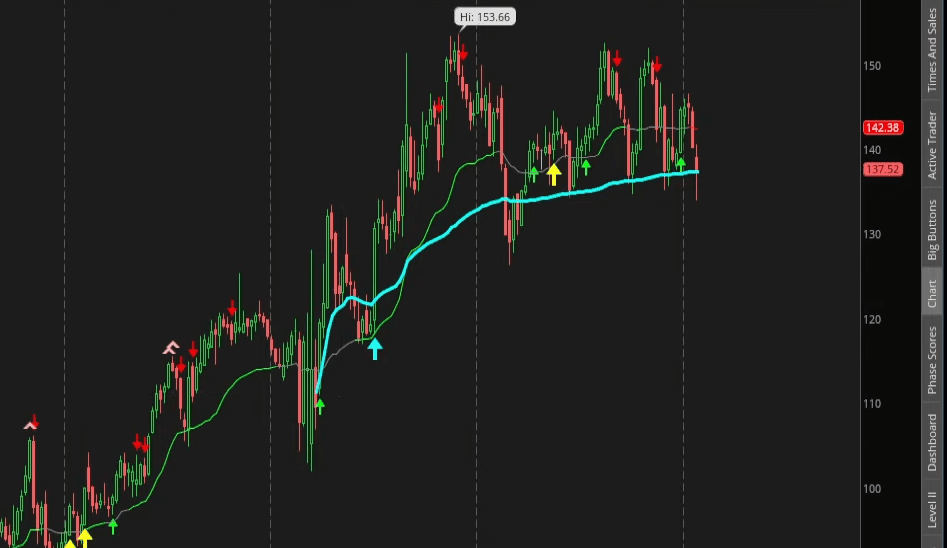

Here is a chart to give you an idea of what we’re trying to find with this scan.

SBUX example chart:

We have anchored the VWAP to the March lows. You can see the first candle going up after the March lows, on a weekly time frame chart.

Notice the different pullbacks to the Anchored VWAP line, and how the VWAP acts as a support for a shorter term bounce.

I’ve noticed this type of idea works a little better on stocks that most people are looking at. There’s more liquidity, think the largest blue-chip stocks you can think of…, your S&P-100 stocks.

Of course, the scan works on every type of market, but we’ll focus on the best of the best for this exercise.

Volatility Box Invite

We are TOS Indicators.com, home of the Volatility Box.

The Volatility Box is our secret tool, to help us consistently profit from the market place. We’re a small team, and we spend hours every day, after the market close, doing nothing but studying thousands of data points to keep improving and perfecting the Volatility Box price ranges.

We have two different Volatility Boxes - a Futures Volatility Box and a Stock Volatility Box.

Futures Volatility Box - Trade Major Markets With an Edge

Designed For: Futures, Micro-Futures and Index Market Traders

Supported Models: Hourly Volatility Box models

Supported Markets: 10 Major Futures Markets

The Futures Volatility Box comes with:

- 5 Volatility Models for each market

- Support for 10 Futures Markets (/ES, /NQ, /YM, /RTY, /CL, /GC, /SI, /ZB, /HG, /NG)

- Video Setup Guide

- Trade Plan

- Access to all members-only resources, including Squeeze Course

Learn More About the Futures Volatility Box

Trade futures and micro futures with a consistent volatility edge

Building the Scan

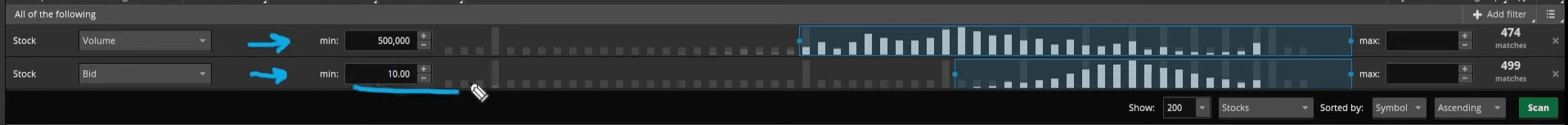

Click the scan tab, and we’ll start with two basic filters:

- Volume filter - looking for stocks that have an average trade volume of x per day

- Price filter - looking for stocks that are greater than $x

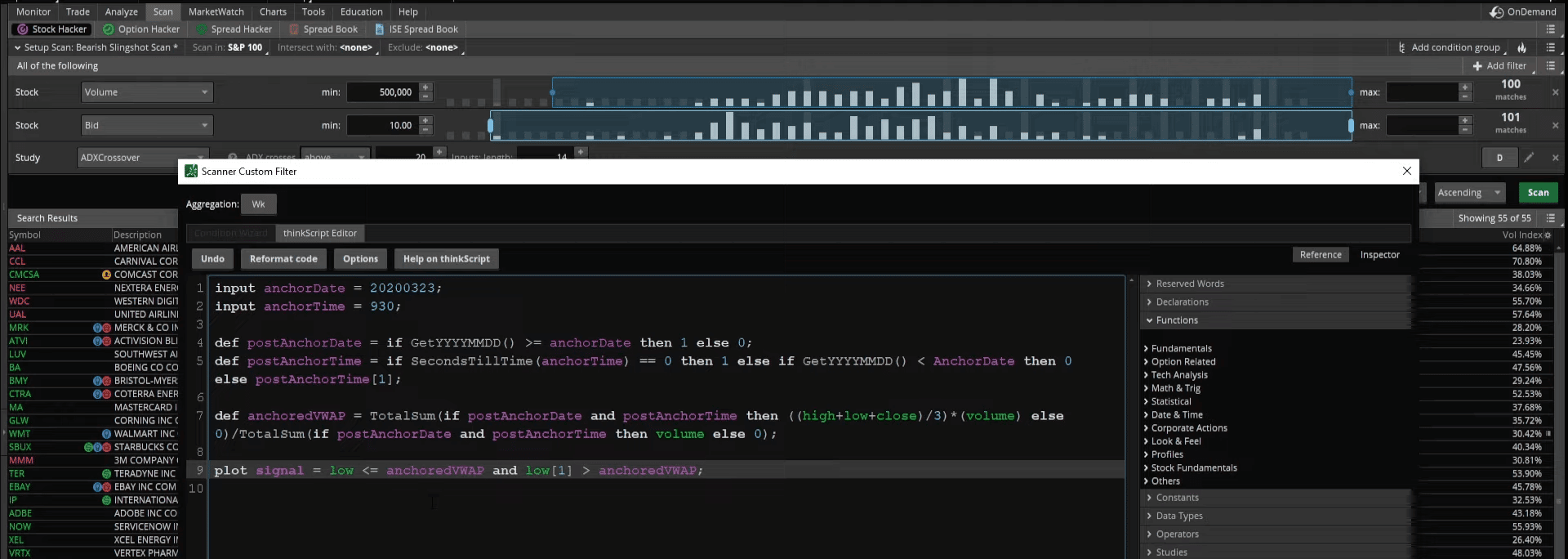

Click add filter, go to the drop-down where it says ADXCrossover and choose custom. This is where we can add our Anchored VWAP code.

Note: Custom study filters only work on live money. If you’re in paper trading, you will not be able to follow along with this.

Click the tab that says “thinkScript Editor” and paste the Anchored VWAP code.

We need to make 3 changes in the code in order to scan what we’re looking for

- Change the Aggregation Period – ThinkOrSwim will make the time period daily by default, and we need to adjust that to weekly. The weekly time frame allows us access to more historical data, which may be necessary for a date further back than 1 year.

- Change the Anchor Date – Pick a new anchor dateClean Code – Remove all the formatting code, as we won’t need it for the scan.

- Update Plot Variables - change the plot variables to def variables so that we can create our own custom, scan condition

After making the changes, this is what the Anchored VWAP scan code looks like:

And this is our plot variable (aka scan condition):

plot signal = low <= anchoredVWAP and low[1] > anchoredVWAP;

Run the scan and see if the results line up with what you would expect. In the video tutorial, we'll test this on Starbucks, which we know is currently an example of our "picture perfect" setup.

Examples

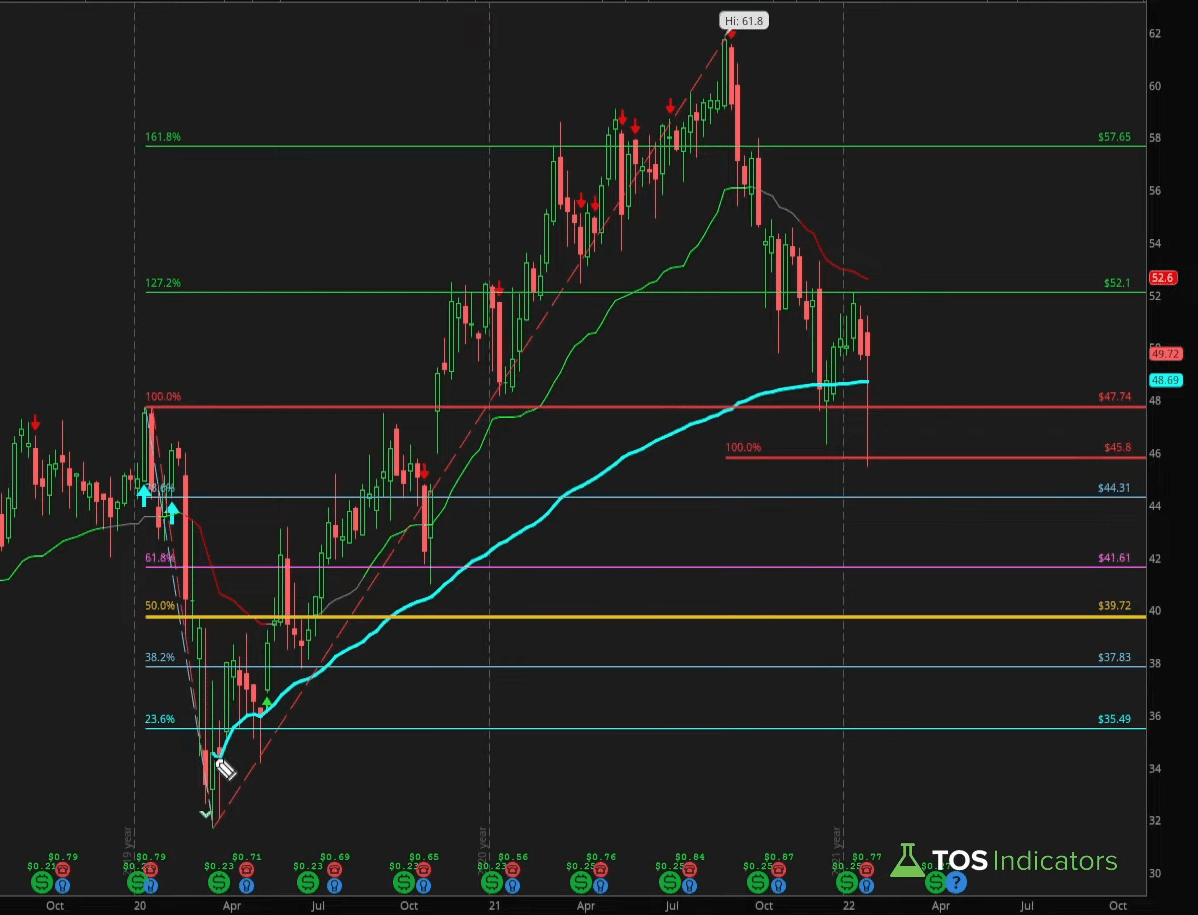

COMCAST (CMCSA)

Let’s look at Comcast to see if it fits the criteria that we already have. So, change the chart tab to CMCSA.

We see that Comcast is pulling back towards the Anchored VWAP line, and on our previous week, we were above the VWAP. As for this week, our low was below the VWAP, and we also closed above the VWAP price.

So the scan worked!

CMCSA does have an active pullback to the VWAP anchored to March lows, and we were able to find it easily. Let’s try another example.

Walmart (WMT)

In Walmart, we see something similar, a little bit less drastic in terms of that March to Feb decline, but still meeting our conditions:

Boeing (BA)

Unlike Walmart or Starbucks, Boeing has never really made much of a move, so it looks a little bit unattractive on the decline, but it is still on the same line of the VWAP extrapolated from those lows.

All of these meet the same scan criteria that we are looking for.

Pro Tip: For Volatility Box members, try using the Edge Signals indicator to confirm bounces away from the Anchored VWAP line.

You can also narrow down your timeframe to zoom in and see overbought/oversold confirmations on a more granular basis.

Conclusion

To summarize, we started with a weekly time frame scan to scan for markets currently pulling back to the Anchored Volume Weighted Average Price. If you’d like to see more granular data, try narrowing down the time frame to smaller values like daily, or hour basis, whatever fits your bill. Use that to see confirmation of moves away from VWAP level that we’re looking at.

A couple indicators that indicates that the trend is changing

- Edge Signal indicator – our overbought/oversold confirmation.

- Market Pulse (Free) - our trend indicator

I hope this video was helpful to the Anchored VWAP traders, or even investors looking to build a list of stocks that you think might be long overdue for a shorter term bounce.

It can also help to find a list of stocks fairly quickly that has basis using previous lows.

You can download and import these scans into your ThinkOrSwim platform for your trading.

Take care everyone, and good luck trading.

Stock Volatility Box - Powerful Web Based Volatility Platform

Designed For: Stock and Options Traders

Supported Models: Hourly and Daily Volatility Box models

Supported Markets: 10,000+ Stocks and ETFs (new markets added frequently)

A Stock Volatility Box membership includes access to:

- Live Scanner - A powerful scanner we've built from scratch, to scan 10,000 symbols every 2 seconds for new volatility breaches

- Dashboard - A quick and easy way to view daily volatility model levels online

- Short Interest Scanner - Short interest, Squeeze, and EMA data to find short squeezes

- Squeeze Course - All of our proprietary squeeze tools, including robust backtesters

- All Members Only Indicators - We don't nickel and dime you. Everything really is included.

- And much more!

Learn More About the Stock Volatility Box

Trade stocks and options with a consistent volatility edge